Medicare Proposes 2022 Payment and Quality Reporting Changes

Recently, the Centers for Medicare and Medicaid services released a new proposal of the Medicare physician fee schedule for 2022; this may mean big changes to all requirements for 2022. The final ruling is expected to be set by November 1st of this year. This new proposal is expected to make a more easily accessible and inclusive health care system.

This proposal includes changes to the Merit-based Incentive Payment System, more commonly known as MIPS. MIPS is a program that allows eligible clinicians to receive a bonus in payments, or a penalty on their payments, based on their performance score. The performance model’s threshold will be set at 75 points, while the threshold for exceptional performance will be placed at 89 points. Changes proposed may also include the options for participation for the Alternative Payment Model, APM for short. APM is a way to incentivize affordable quality care. There could be potential changes in payment rates using a conversion factor, that would decrease just under 4% from 2021 rates.

Another change to note would be the delay of the payment penalty phase of the Appropriate Use Criteria (AUC) until 2023, or until the end of COVID-19 health emergency – whichever comes later. AUC is a criterion in which procedures can be determined if they are suitable for the patient or not, expecting that the medical gains significantly outweigh the medical risks. With reference to COVID-19, these changes will allow the continuation of audio-only visits for mental health services. This proposal is hoping to extend the CMS web interface in order to allow collections and submissions.

One final topic to note is the setting of 2023 as the first year that will follow the new MIPS Value Pathways (MVPs). MVPs are predetermined measures and activities that allow eligible clinicians to meet the MIPS requirements with guidance. With this change, in 2023, it will allow more to participate in the program; i.e. clinical social workers and certified nurse midwives. The list continues as they plan to include these select clinical topics: rheumatology, stroke care and prevention, heart disease, chronic disease management, emergency medicine, lower extremity joint repair, and anesthesia. As of now there is no policy in place on how to remove activities that raise possible safety concerns for patients, so in addition to adding to the list of approved activities, this proposal allows some to be removed. There is already a program in place to reweight to MIPS eligible clinicians, and along with allowing more clinicians to register for the program, they plan to apply automatic reweighting for them as well. Currently, smaller practices with 15 or fewer eligible clinicians, can apply for an exemption for hardship, that way the reweighting can be applied to a different performance category.

Changes to quality reporting are going to continuously grow in ways that allow more medical affiliates to report. Currently, Care Compare allows quality reporting to be displayed for hospital affiliations, which then links the corresponding office to that report. Moving forward, this proposal expects to add more facility types, including but not limited to: inpatient rehab centers, hospice, and skilled nursing facilities. In addition to those joining the program, there are also reporting requirement additions to note. Reports under the foundational layer will need to include population health measures and promotions of the interoperability performance category. Under the quality performance category, MVP participants will need to select 4 quality measures, which would have to include an outcome measure; this can be measured by CMS through administrative claims (if available). Additionally, the improvement activities performance category requires participants to choose 2 medium-weighted improvement activities, or one high-weighted activity of the same nature. Furthermore, another area of reporting comes from the cost performance category. CMS calculates a facility’s performance solely on the cost measures that are apart of the MVP administrative claims data. For specifics on how CMS will score these categories, please follow the link below. For a quick look at reporting requirements, registration deadlines, and the information required when registering, please read over the tables below provided by CMS.

View Table 1 | View Table 2 | View Table 3

For more information regarding this proposal, please direct your attention to the following links.

QPP Fact Sheet | PFS Fact Sheet | Proposal Article

“Medicare Proposes 2022 Payment and Quality Reporting Changes.” MGMA,

pages.mgma.com/index.php/email/emailWebview?md_id=6605.

The Occupational Safety and Health Administration (OSHA) issued a COVID-19 emergency temporary standard (ETS) with which healthcare employers will be required to comply. This ETS includes an outline and description for an effective COVID-19 plan designed to reduce injuries and illnesses in healthcare workplaces. A COVID-19 plan is essential to responding to COVID-19 hazards in an effective manner. These safety and health programs must proactively and constantly identify and mitigate hazards before employees develop illness or injury in order to be truly effective. In the case of COVID-19 hazards in healthcare settings, this includes identifying employees at risk of exposure to the virus and developing ways to protect them. This type of approach helps employers meet their obligation to provide a safe workplace under the OSH Act. The ETS requires a COVID-19 plan that contains the main components of this kind of safety and health program. According to the ETS OSHA released, there are studies showing that these programs are positively impacting the safety, health, and performance of healthcare workers.

OSHA has identified seven core elements of a successful safety and health program. These are:

- Management Leadership – establish a safety plan, communicate it to all employees and assign a coordinator to track the progress.

- Worker Participation – train employees to recognize hazards and develop open communication to use their expertise and insight to identify and address hazards. This is the most important.

- Hazard Identification & Assessment – use a team approach to identify hazards. Observe work habits and evaluate employee input from surveys or meetings to determine if, where, and how workers could be exposed and if there are safeguards in place to reduce those risks.

- Hazard Prevention & Controls – assess if hazards can be eliminated (e.g. work from home) and when they cannot be, consider how the risks may be reduced (e.g. disinfecting, social distancing, physical barriers, ventilation).

- Evaluation and Improvement – evaluate regularly to make sure the plan is implemented as intended, continue to identify new hazards, and make improvements where necessary.

- Coordination & Communication at Multi-Employer Sites – in some settings, employees may travel from one site to another, possibly exposing employees of a different location. Communicate with all affiliated employers to review your plans and to share information on reported hazards and illness.

- Education & Training – ensure that all employees are able to recognize hazards and know the procedures for addressing them. Establish ways for employees to contribute to the safety and health plan.

In addition to the COVID-19 plan, the ETS also requires that covered employees:

- Clean and disinfect the workplace.

- Screen employees for symptoms of COVID-19 and follow requirements for removing potential infected employees from the workplace.

- Ensure social distancing.

- Screen patients upon arrival.

- Report COVID-19 hospitalizations and fatalities.

- Provide reasonable time off and paid leave for COVID-19 vaccinations.

View the full ETS document here. Here is a list of Frequently Asked Questions.

Works Cited

Occupational Exposure to COVID-19; Emergency Temporary Standard, 29 C.F.R. §1910.502. (June 21, 2021).

On June 11, 2021, the U.S. Department of Health and Human Services (HHS) released a revision to the reporting requirements for practices that received Provider Relief Fund (PRF) payments. This revision supersedes the previous update from January of this year. The deadlines for spending the PRF money and for reporting the spending have been extended to relieve some of the burden experienced by smaller practices. The PRF Reporting Portal will be open on July 1, 2021 for providers to begin submitting information. Providers can register for PRF Reporting Portal accounts now.

The revisions apply to those providers who received one or more payments of over $10,000 during a single Payment Received Period (including General, Targeted, Skilled Nursing Facility, and Nursing Home Infection Control distributions). These reporting requirements do not apply to Rural Health Clinic COVID-19 Testing Program, HRSA COVID-19 Uninsured Program or the HRSA COVID-19 Coverage Assistance Fund. Rather than require all payments be used by June 30, 2021, the availability of the funds is dependent on the date the payment was received. The funds received must only be used for expenses within the period of availability. Practices that received one or more payments over, in total, $10,000 must report for each applicable Payment Received Period (rather than $10,000 total across all PRF payment periods). The previous 30-day reporting period has been extended to 90 days. Practices must complete the reporting by the last day of the reporting period or be subject to recoupment. The table below outlines specific dates for both spending and reporting in each period.

|

|

Payment Received Period |

Deadline to Use Funds |

Reporting Time Period |

|

Period 1 |

April 10, 2020 – June 30, 2020 |

June 30, 2021 |

July 1 – September 30, 2021 |

|

Period 2 |

July 1, 2020 – December 31, 2020 |

December 31, 2021 |

January 1 – March 31, 2022 |

|

Period 3 |

January 1, 2021 – June 30, 2021 |

June 30, 2022 |

July 1 – September 30, 2022 |

|

Period 4 |

July 1, 2021 – December 31, 2021 |

December 31, 2022 |

January 1 – March 31, 2023 |

According to the HHS notice, the Reporting Entity is that which registers its Tax Identification Number (TIN) and reports on the payments received by that TIN and/or its subsidiaries. The following table outlines types of PRF recipients.

|

Type of PRF Recipient |

Definition |

|

General Distribution recipient that received payment in Phase 1 only |

Entity that received Phase 1 General Distribution payment totaling more than $10,000 in a Payment Received Period |

|

General Distribution recipient with no parent organization or subsidiaries except PRF recipients that received Phase 1 General Distribution only |

Entity (TIN level) that received one or more General Distribution payments totaling more than $10,000 in a Payment Received Period |

|

General Distribution recipient with one or more subsidiaries that received payments in Phase 1 to 3 |

Entity that meets these 3 criteria: 1. Is the parent of one or more subsidiary billing TINs that received General Distribution payments in Phase 1 to 3 2. Has associated providers that were providing diagnoses, testing, or treatment for individuals with possible or actual cases of COVID-19 on or after January 31, 2020 3. Can otherwise attest to the Terms and Conditions |

|

Targeted Distribution recipient (including Nursing Home Infection Control Distribution) |

Entity (TIN level) that received Targeted Distribution payments totaling more than $10,000 in a Payment Received Period |

Parent entities can report on their subsidiaries’ General Distribution payments whether the subsidiaries received the payments directly or the money was transferred to them by the parent company. The parent entity can report on the General Distribution payments no matter which entity, the parent or subsidiary, agreed to the Terms and Conditions. However, for Targeted Distribution payments, the original recipient is always the Reporting Entity. Parent entities may not report on their subsidiaries’ Targeted Distribution payments regardless of whether the original recipient transferred the payment. A subsidiary Reporting Entity must note the amount of the Targeted Distributions received that were transferred to or by the parent entity. Transferred Targeted Distribution payments are more likely to be audited by HRSA.

For more information regarding the steps for reporting on the use of the PRF payments, see pages 4 through 11 of the HHS publication, “Provider Relief Fund General and Targeted Distribution Post-Payment Notice of Reporting Requirements,” linked here.

Works Cited

“HHS Issues Revised Notice of Reporting Requirements and Reporting Timeline for Recipients of Provider Relief Fund Payments.” HHS.gov, U.S. Department of Health & Human Services, 11 June 2021, www.hhs.gov/about/news/2021/06/11/hhs-issues-revised-reporting-requirements-timeline-for-provider-relief-fund-recipients.html?mkt_tok=MTQ0LUFNSi02MzkAAAF9uNPWCB3NbbYhyumTBHK6pfIynjAWdjpGChnfxH4n8K9-TuAevbeYoIoEuSWc6lGpI24iL_kXpC2LNO1TGbDnziySn24OslezAzeFPUdj.

According to a recent alert issued by Blue Cross Blue Shield, value-based reimbursement will be applied to the new codes for COVID-19 vaccine administration. This change is effective July 1, 2021 and applies to primary care providers (PCPs) and specialists receiving value-based reimbursement. Currently, value-based reimbursement for PCPs is applied to select E&M, preventative health, telehealth, and care management codes. The procedure codes that will now receive value-based reimbursement under this change are:

|

|

|

|

|

|

|

Additionally, value-based reimbursement for PCPs will be applied to six other vaccine administration codes, effective July 1, 2021. These codes are:

|

|

|

|

|

|

Works Cited

“We’re Applying Value‑Based Reimbursement to Procedure Codes for COVID‑19 Vaccine, Other Immunizations.” The Record, Blue Cross Blue Shield of Michigan, May 2021, www.bcbsm.com/content/dam/microsites/corpcomm/provider/the_record/2021/may/Record_0521i.shtml.

Yeo & Yeo Medical Billing & Consulting is pleased to announce that Denise Garrett has earned the Certified Outpatient Clinical Appeals Specialist (COCASSM) credential. The COCAS credential formally recognizes Garrett’s expertise in medical insurance claims, denials and appeals.

“I continue to stay current with new developments in medical billing and gain knowledge in all areas of revenue cycle management, so I am armed with the tools necessary to help our healthcare clients,” Garrett said. “When it comes to medical insurance appeals, if the documentation supports the billing and the insurance company policy, I will fight to ensure that the practice’s denied claims are paid.”

“I continue to stay current with new developments in medical billing and gain knowledge in all areas of revenue cycle management, so I am armed with the tools necessary to help our healthcare clients,” Garrett said. “When it comes to medical insurance appeals, if the documentation supports the billing and the insurance company policy, I will fight to ensure that the practice’s denied claims are paid.”

To earn the credential, Garrett passed the American Institute of Healthcare Compliance’s COCAS exam, which encompasses four main topics:

- Appeals and revenue cycle management

- Auditing before the appeal and understanding medical necessity

- Medicare and ERISA appeals processes

- How to create an effective appeals program to avoid unnecessary investigations and probes

Garrett is an account manager with more than 20 years of medical billing and coding experience. She is a Certified Healthcare Auditor (CHA), Certified Professional Coder (CPC), Certified Physician Practice Manager (CPPM®), Certified Professional Compliance Officer (CPCO™), Certified Professional Medical Auditor (CPMA®), and a Certified Foot & Ankle Surgical Coder (CFASC), with expertise in the coding of diagnoses, services, and procedures for physician practices. Garrett serves on the national board of directors of the American Academy of Professional Coders Chapter Association (AAPCCA). She is also a member of the American Medical Billers Association and the American Institute of Healthcare Compliance.

Since 2012, Medicare payments to medical practices have been subject to a -2% sequestration in an effort by Congress to address the debt ceiling crisis. The Coronavirus Aid, Relief, and Economic Security (CARES) Act temporarily suspended that sequestration in May of 2020, meaning that physicians have seen a 2% increase in their payments on Medicare claims. The expiration of this suspension – previously extended from December 21, 2020 to March 31, 2021 – has again been extended through the end of 2021. On April 13, 2021, Congress passed legislation approving this extension and President Biden is expected to sign the bill into law soon.

Back at the end of March, the Centers for Medicare & Medicaid Services (CMS) instructed Medicare Administrative Contractors (MACs) to hold claims with dates of service on or after April 1 without affecting the practitioners’ cash flow. They recommended this hold until this legislation was passed to avoid having to reprocess the claims. Now that the legislation is passed, these claims will be processed. The expense of this suspension is expected to be recouped by extending the sequester through the end of the 2030 budget year.

Works Cited

Coronavirus Aid, Relief, and Economic Security Act of 2020, Pub. L. 116-136, §3709, 134 Stat. 421 (2020).

To prevent across-the-board direct spending cuts, and for other purposes., Pub. L. 117-7, §1 (2021).

The Medicare Accelerated and Advance Payment Program (AAP) were expanded on March 28, 2020. The Centers for Medicare & Medicaid Services (CMS) made the program available to most Medicare physicians and group practices. The AAP provided loans to medical practices suffering financial distress or disruption due to COVID-19. The loans were determined based on the practice’s history of Medicare billing. Originally, providers were to begin payments on these loans in August of 2020. However, the repayment was delayed until one year after the payment was issued to the practice. This means that repayment could begin as early as April 2021 for some providers.

Group practices that have received AAP loans have two repayment options, automatic claims recoupment and lump sum repayment. The automatic claims recoupment is the default method and involves automatically reducing the Medicare payments owed to providers to gradually recoup the amount of the loan. Beginning one year after the loan disbursement, Medicare Administrative Contractors (MACs) will reduce the payments owed to the provider by 25% for 11 months. If the loan has not been paid in full after the 11-month period, the Medicare payments will be reduced by 50% for 6 more months. Any balance remaining after that is due within 30 days or it will accrue 4% interest until it is payed off. Loans paid off before this time will not accrue interest. Providers may also repay their AAP loans by making a lump sum payment(s) to their MAC. If a group practice is interested in making lump sum payments, they should consult their MAC for details and forms to accompany the payments.

The CMS has not issued further details on the repayment process. They have not yet stated exactly when recoupment will begin. Questions should be directed to providers’ MACs at this time.

Works Cited: Continuing Appropriations Act, 2021 & Other Extensions Act, 5 U.S.C. §2501 (2020).

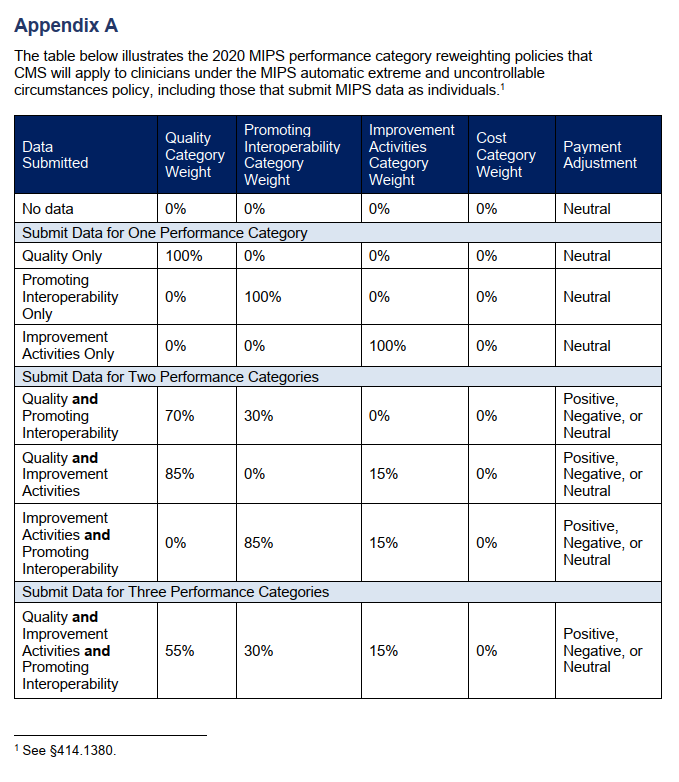

Due to the COVID-19 public health emergency, the Centers for Medicare & Medicaid Services (CMS) will be applying the MIPS extreme and uncontrollable circumstances (EUC) policy automatically for all eligible clinicians for the 2020 performance period. This policy applies to providers that are unable to submit sufficient MIPS data for the 2020 reporting year during the submission period. MIPS eligible individual providers will not be required to submit an application to reweight the MIPS performance categories.

However, the enforcement of the EUC policy does not automatically apply to groups or virtual groups. Groups, virtual groups, and Alternative Payment Model entities wishing to request reweighting of any or all of the MIPS performance categories due to COVID-19 must submit an EUC exception application by the extended deadline of March 31, 2021. Groups that do not apply for EUC will be scored by the existing MIPS scoring policies. The individual clinicians in the group will receive the payment adjustment associated with the group’s final score unless their individual participation score is higher. Virtual groups will be scored according to the existing MIPS scoring policies regardless of data submission and the eligible clinicians in the group will receive the payment adjustment associated with the group’s final score.

The four MIPS performance categories are Quality, Promoting Interoperability, Improvement Activities, and Cost. The MIPS Cost category is calculated automatically based on data from claims and does not require reporting. There are concerns, however, that COVID-19 will have significant effects on the cost measures. For that reason, the cost category will be weighted at zero percent under the automatic EUC policy even if data is submitted for any or all of the other performance categories. If a practice covered under the EUC policy does not submit data for any of the other (3) categories, they will receive a neutral or no payment adjustment for the 2020 MIPS performing year (the 2022 MIPS payment year). If data is submitted for only one of the three categories, that category will be weighed for 100% of the score and the practice will receive a neutral or no payment adjustment under the EUC policy. If data is submitted for two or more of the three performance categories, each category will be weighed according to the table (Appendix A) published by the CMS and a positive, negative, or neutral payment adjustment will be issued for the 2022 MIPS payment year.

If you believe that you qualified for the automatic EUC policy and it does not appear to be reflected in your performance feedback, you can submit a targeted review within 60 days following the release of your 2020 performance feedback.

Works Cited: Scoring, 42 C.F.R. §414.1380. (2021).

According to Alissa Knight, a former hacker, personal health information (PHI) is the most highly valued data on the dark web. She states that the value of a single PHI record is 10 times more the price of a credit card number. Knight partnered with Approov, a mobile security company, to test mobile health apps by hacking them through their application program interfaces (APIs). They tested 30 apps this way to identify threats to said apps and the PHI they contain. Their findings were then published in a report, “All That We Let In.”

Knight and Approov discovered that all 30 of the apps they tested were vulnerable to API attacks. Some even allowed them to access electronic health records such as x-rays, pathology reports, prescriptions, mental health services, etc. Upwards of 20 million mobile heath users are exposed to potential attacks by these tested apps alone. The vast majority of the tested apps had hardcoded API keys. As Approov CEO, David Stewart explains it, APIs are channels of communication between an app and a server or hospital infrastructure. Essentially, they are the keys to a deeper wealth of information. If these API keys are hardcoded into the mobile app, hackers can dig through the programming and find the API keys, thus gaining access to PHI and more. The report by Approov also states that a small percentage of the tested apps had hardcoded usernames and passwords.

Knight hacked a hospital system as part of the test and was able to access health records and additional registration information for a patient’s family members by simply changing the EHR value by one digit. She used a tool that made it appear as though the access was coming from a mobile health app. She sates that, “The traffic looks exactly the same as traffic that’s coming from the actual mobile app, and that gives the hackers so much more flexibility about the things that they can do.” It was also discovered that these apps are susceptible to various other attacks including Broken Object Level Authorization attacks.

API attacks continue to rise in frequency and are on their way to being the most frequently used attack against mobile applications. The current global heath crisis due to COVID-19 has increased the use of mobile health applications and virtual healthcare which is why Alissa Knight and Approov decided to join for this study. Though the names of the applications tested are being kept anonymous, Stewart acknowledges that apps from large healthcare systems and mobile health vendors were among those tested and found to have vulnerabilities. These vulnerabilities put large amounts of PHI at risk which is why it is critical for APIs to be secured.

How to Protect Against API Attacks

Tools such as APIsec are recommended. These tools perform security testing to find vulnerabilities in APIs. Secure mobile and web applications begin with building secure APIs. The controls for these apps should be monitored and adjusted to comply with the Health Insurance Portability and Accountability Act (HIPAA). Additionally, Knight states that security should be implemented from the very beginning when developing and coding new apps because healthcare needs to keep up with the technological advances of the time despite the security threats posed against mobile apps.

Works Cited:

Horowitz, Brian T. “Mobile Health Apps Leak Sensitive Data through APIs, Report Finds.” FierceHealthcare, Questex, 24 Feb. 2021.

Due to the current COVID-19 health emergency, healthcare providers need to schedule vast numbers of appointments for individuals to receive COVID-19 vaccinations. In the interest of ease and efficiency for all parties, they may use apps and other digital scheduling tools to do so.

Covered providers will not be penalized for potential violations of the Health Insurance Portability and Accountability Act (HIPAA) related to use of online scheduling applications for COVID-19 vaccinations. The Office for Civil Rights (OCR) of the U.S. Department of Health and Human Services announced that it will not enforce fines against healthcare providers for use of such apps that may not be fully HIPAA compliant.

This discretion of HIPAA enforcement applies to covered healthcare providers and their associates, including web-based scheduling applications vendors (WBSAs), when these vendors are a) used in good faith and b) limited to the scheduling of COVID-19 vaccination appointments during the nationwide health emergency. This enforcement discretion is retroactively affective to Dec. 11, 2020 and will remain in effect until it is deemed that the public health emergency has ended.

WBSAs offer online or web-based apps that are non-public facing for the purpose of scheduling appointments for COVID-related services on a large scale. According to the OCR, “non- public facing” means that these apps only allow the patient and intended health care provider(s) to access the data created, received, maintained, or transmitted by the app. The OCR encourages the reasonable use of safeguards to protect privacy security of patients’ protected health information (PHI). These safeguards include using only the minimum of necessary data to complete the scheduling as well as encryption technology and enabling all available privacy settings.

Healthcare providers are encouraged to use vendors that state that their WBSAs support HIPAA compliance when seeking additional privacy protection for PHI. Additionally, they can look for vendors that will enter into a business agreement in connection with use of their WBSAs.

Works Cited

Notification of Enforcement Discretion, 45 C.F.R. §§ 160, 164. (2021).

The U.S. Department of Health and Human Services (HHS) will distribute payments up to $20 billion in Phase 3 of the General Distribution of the CARES Act Provider Relief Fund to offer financial relief to providers impacted by COVID-19.

You may be eligible regardless of whether you previously applied for, received, accepted, or rejected payment from prior PRF distributions. You should apply for funding if you experienced expenses and/or lost revenues attributable to COVID-19 that have not been reimbursed by other sources.

Under Phase 3, applicants that have not yet received Provider Relief Fund payments of 2% of patient revenue will receive a payment that, when combined with prior payments, equals 2% of patient care revenue.

Submit your application to the Provider Relief Fund Application and Attestation Portal between October 5, 2020, and November 6, 2020, at 11:59 p.m.

The Phase 3 application is slightly different from the Phase 2 form, requiring additional revenue and expense data. Even if you previously submitted revenue information, you will need to submit a new application. Instructions and a sample application form are available at hhs.gov/providerrelief. The website also includes a step-by-step application guide and FAQs.

HHS will host a webcast on October 15, 2020, at 3:00 p.m. to review the process and answer questions. Register here.

For additional information, please call the Provider Support Line at (866) 569-3522 from 7:00 a.m. to 10:00 p.m. Central Time, Monday through Friday. Reach out to your Yeo & Yeo professional for additional guidance on relief fund assistance for your situation.

The Department of Health & Human Services (HHS) released additional guidance on reporting requirements for certain recipients of Provider Relief Fund payments. Group practices that received more than $10,000 in Provider Relief Fund payments must report how they spent the funds on COVID-related expenses and lost revenue. More detailed reporting is required for those that received $500,000 or more.

The Department of Health & Human Services (HHS) released additional guidance on reporting requirements for certain recipients of Provider Relief Fund payments. Group practices that received more than $10,000 in Provider Relief Fund payments must report how they spent the funds on COVID-related expenses and lost revenue. More detailed reporting is required for those that received $500,000 or more.

PRF funds can be used in the following manner and order:

- Expenses attributable to coronavirus that are not reimbursed or obligated to be reimbursed from other sources

- Lost revenues, as represented by a change in net patient care operating income from 2019 to 2020 (revenue less expenses)

If recipients do not expend PRF funds in full by the end of calendar year 2020, they will have an additional six months in which to use remaining amounts toward expenses attributable to coronavirus but not reimbursed by other sources, or to apply toward lost revenues in an amount not to exceed the 2019 net gain. For example, the reporting period January – June 2021 will be compared to the same period in 2019.

The reporting system will be available in early 2021 rather than in October 2020, as HHS originally stated. Deadlines have changed numerous times, and any dates included in the guidance are still subject to change. To help you comply with the reporting requirements for Provider Relief Funds, please refer to the following:

- Fact sheet – summary of reporting deadlines and required reporting data elements

- Post-Payment Notice of Reporting Requirements for General and Targeted Distributions – more detailed guidance

For the latest information, visit the CARES Act Provider Relief fund website at hhs.gov/providerrelief.

For additional assistance, contact the HHS Provider Support Line at (866) 569-3522 Monday through Friday, 7:00 a.m. to 10:00 p.m. Central Time, or contact Yeo & Yeo.

The U.S. Department of Health and Human Services (HHS) is distributing payments in the Phase 2 General Distribution of the CARES Act Provider Relief Fund as part of ongoing efforts to offer financial relief to providers impacted by COVID-19.

Starting August 10, 2020, HHS began accepting applications from providers who received a payment under the Phase 1 General Distribution to determine if the provider is eligible for an additional payment.

Who is eligible?

You may be eligible for another payment if your organization received a payment under the General Distribution and:

- Missed the June 3 deadline to submit your March and April revenue information; or

- Have not received Phase 1 General Distribution payments totaling approximately 2% of your annual revenue.

As part of the application, HHS is collecting tax forms and revenue data to determine a payment that is approximately 2% of annual revenue from patient care. If a provider has already received a payment that is approximately 2% of their annual revenue from patient care, they will not receive additional payments.

You must initiate an application and the Taxpayer Identification Number (TIN) verification process by Friday, August 28, to be considered for payment.

Application instructions

The application instructions and an application form are available at hhs.gov/providerrelief. The website also includes a step-by-step application guide and FAQs. Download and review all of these documents to help you complete the process through the Provider Relief Fund Application and Attestation Portal.

The portal has been updated to simplify the required application data fields. Even if you previously submitted revenue information, you will need to resubmit your information in the new portal.

If you are still in consideration for a Phase 1 General Distribution payment, you must receive either a final payment or communication of ineligibility before re-applying in the current portal.

HHS will host a webcast on August 13 at 3:00 p.m. for potential applicants to review the application process and have their questions answered. Register here.

For the latest information on the Provider Relief Fund Program, visit hhs.gov/providerrelief.

For additional assistance, you may contact the HHS Provider Support Line at (866) 569-3522 Monday through Friday, 7:00 a.m. to 10:00 p.m. Central Time.

Today, May 29, physicians and other healthcare providers may resume non-essential medical and dental procedures that were postponed under Governor Whitmer’s Executive Order 2020-17 (postponement of certain non-essential medical procedures and encounters).

Although non-essential medical procedures may resume, under Executive Order 2020-97, outpatient healthcare facilities must comply with new workplace standards.

Notably, one standard is that providers must continue to utilize telehealth to the greatest extent possible. The rules related to social distancing may otherwise limit the number of patients a facility can see in person. Other protocols include using personal protection equipment, special hours for highly vulnerable patients, workplace training for employees, contactless sign-in and a common screening protocol, which could require changes to a practice’s EMR.

These new standards are not optional. The State of Michigan has two routes of enforcement it may pursue against employers who fail to follow the workplace safety rules specified in the Order. As such, it will be necessary for medical practices to monitor for changes to Executive Orders issued by Michigan’s Governor. The Order does not provide an expiration date for the new safety measures.

Michigan State Medical Society (MSMS) provides on its website key aspects of the standards physicians and medical practices must implement to be in compliance and it is regularly updated. You can reference it here.

On April 30, 2020, the Centers for Medicare & Medicaid Services (CMS) issued another round of sweeping regulatory waivers and rule changes to deliver expanded care to the nation’s seniors and provide flexibility to the healthcare system during the COVID-19 pandemic. These changes include CMS’s efforts to expand beneficiaries’ access to telehealth services so that doctors and other providers can deliver a wider range of care to Medicare and Medicaid beneficiaries in their homes.

CMS issued a press release detailing the expansion of telehealth services and highlighting other additional waivers and rule changes.

Please contact YYMBC with any questions and for practice guidance during this pandemic.

The information contained in this post may not reflect the most current developments, as the subject matter is extremely fluid and constantly changing. Please continue to monitor Yeo & Yeo’s COVID-19 Resource Center for ongoing developments. Readers are also cautioned against taking any action based on information contained herein without first seeking professional advice.

A second wave of relief payments totaling $20 billion is on its way to healthcare providers. Take note: To access and keep the relief funds, providers must verify their 2018 payment receipts with the federal government.

The new cash infusion follows the earlier release of $30 billion to healthcare providers that the Department of Health and Human Services (HHS) began distributing in mid-April. Both series of payments are part of the broader $100 billion CARES Act Provider Relief Fund.

This time, however, the funds are targeted to providers across the board, not only those who treat a bulk of the Medicare population. Whereas the initial release of $30 billion was tied to historical Medicare payments, the new funds are based on a percentage of all-payer data.

This second release is part of HHS’ promise to supply funds to providers that may have missed out on large cash receipts from the initial disbursement. In this release, HHS is basing the share of relief payments on the revenue data providers submit in Centers for Medicare & Medicaid Services (CMS) cost reports.

The HHS began distributing payments to providers from this $20 billion on April 24. Payments will go out weekly, as information is validated. Payments are calculated so that a provider’s allocation from the entire $50 billion general distribution will be in proportion to such provider’s 2018 net patient revenue. Total revenues of Medicare facilities and providers in 2018 is estimated to be $2.5 trillion. Providers can estimate their expected general revenue distribution through the following formula:

(Individual Provider 2018 Revenue/$2.5 Trillion) X $50 Billion = Expected General Distribution

- Providers that previously provided CMS with 2018 cost reports will receive their portion of the funds automatically, but they will have to complete an attestation through the HHS Payment Portal and agree to the terms and conditions.

- Providers that have not shared their 2018 revenue information will have to submit that information to HHS through the General Distribution Portal before they will be eligible.

All payments may only be used to prevent, prepare for and respond to coronavirus, and the payment should reimburse the recipient only for healthcare-related expenses or lost revenues that are attributable to the coronavirus. If a recipient does not have lost revenues or increased expenses due to COVID-19 equal to the amount received, the recipient must return the funds.

For more information, read the HHS’ General Distribution Portal FAQs. Call your Yeo & Yeo Medical Billing & Consulting professional for assistance.

The information contained in this post may not reflect the most current developments, as the subject matter is extremely fluid and constantly changing. Please continue to monitor Yeo & Yeo’s COVID-19 Resource Center for ongoing developments. Readers are also cautioned against taking any action based on information contained herein without first seeking professional advice.

The Department of Health and Human Services (HHS) is beginning the delivery of the initial $30 billion in relief funding to providers in support of the national response to COVID-19. This is part of the distribution of the $100 billion Provider Relief Fund provided for in the Coronavirus Aid, Relief, and Economic Security (CARES) Act recently passed by Congress and signed by President Trump.

All facilities and providers that received Medicare fee-for-service (FFS) reimbursements in 2019 are eligible to receive relief funds. Payments will arrive at these providers via direct deposit beginning April 10, 2020. These are payments, not loans, to healthcare providers, and will not need to be repaid.

How Funds Will be Paid

HHS has partnered with UnitedHealth Group (UHG) to provide rapid payment to eligible providers.

- Providers will be paid via Automated Clearing House account information on file with UHG or the Centers for Medicare & Medicaid Services (CMS).

- Automatic payments will come to providers via Optum Bank with “HHSPAYMENT” as the payment description.

- Providers who normally receive a paper check for reimbursement from CMS will receive a paper check in the mail for this payment as well, within the next few weeks.

- All relief payments are made to the billing organization according to its Taxpayer Identification Number (TIN).

- Payments to practices that are part of larger medical groups will be sent to the group’s central billing office.

What You Have to Do

- As a condition to receiving these funds, providers must agree not to seek collection of out-of-pocket payments from a COVID-19 patient that are greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network provider.

- Within 30 days of receiving the payment, providers must sign an attestation confirming receipt of the funds and agreeing to the terms and conditions of payment. The portal for signing the attestation will be open the week of April 13, 2020, and will be linked on the HHS website page: https://www.hhs.gov/provider-relief/index.html.

For more information on the CARES Act Provider Relief Fund, how payments are calculated and how this applies to the various types of providers, visit the HHS website at https://www.hhs.gov/provider-relief/index.html.

Operations will continue as normal as possible for our clients while our team members continue to implement the safety measures Yeo & Yeo has put in place. Many of our team members have been working remotely and more will be asked to work remotely or to rotate schedules to further support social distancing in our office. Your emails and phone calls are being answered as usual (maybe not as quickly), and your YYMBC professionals are working to meet your needs.

Thank you for the continued trust and support you have given us during this time. We understand that all of you are experiencing similar disruption in your service. We are here to help and work together to get through this.

Yeo & Yeo Medical Billing & Consulting is pleased to announce that Denise Garrett has been appointed to the American Academy of Professional Coders Chapter Association (AAPCCA) national board of directors. She will serve for a three-year term.

The AAPCCA is the governing board for local chapters of the American Academy of Professional Coders (AAPC). Garrett will act as a liaison between AAPCCA and the local chapter officers, serving Region 6, the Great Lakes region, including Wisconsin, Minnesota, Illinois, Indiana, Michigan and Ohio. She will also serve on the board’s Chapter Development Committee. Locally, she will also continue to serve as treasurer for the AAPC Bay City chapter during 2020.

The AAPCCA is the governing board for local chapters of the American Academy of Professional Coders (AAPC). Garrett will act as a liaison between AAPCCA and the local chapter officers, serving Region 6, the Great Lakes region, including Wisconsin, Minnesota, Illinois, Indiana, Michigan and Ohio. She will also serve on the board’s Chapter Development Committee. Locally, she will also continue to serve as treasurer for the AAPC Bay City chapter during 2020.

The AAPC elevates the standards of medical coding by providing training, professional certification, ongoing education and networking opportunities for medical coders. The organization has more than 190,000 members worldwide.

Garrett is an account manager with more than 20 years of medical billing and coding experience. She is a Certified Healthcare Auditor (CHA), Certified Professional Coder (CPC), Certified Physician Practice Manager (CPPM®), Certified Professional Compliance Officer (CPCO™), Certified Professional Medical Auditor (CPMA®), and a Certified Foot & Ankle Surgical Coder (CFASC), with expertise in the coding of diagnoses, services, and procedures for physician practices. She is also a member of the American Medical Billers Association and the American Institute of Healthcare Compliance.

Yeo & Yeo Medical Billing & Consulting, an affiliate of Yeo & Yeo CPAs & Business Consultants, is pleased to announce April Nesbitt and Ariel Porath have earned the Certified Professional Coder Apprentice credential from the American Academy of Professional Coders.

Nesbitt is a medical billing representative and is vice president of the American Academy of Professional Coders (AAPC) Bay City Chapter. She also represents Yeo & Yeo Medical Billing & Consulting employees as a member of the Yeo & Yeo Foundation Grants Committee.

Porath is a medical billing and coding specialist and has a Certified Billing and Coding Specialist credential from the National Health Career Association. She also holds an Ophthalmic Coding Specialist credential through the American Academy of Ophthalmology.

The CPC-A credential allows Nesbitt and Porath to serve clients as a certified coder while working toward full certification.