Yeo & Yeo Named Among the Best of the Best CPA Firms by INSIDE Public Accounting

Yeo & Yeo, a leading Michigan-based accounting and advisory firm, has been recognized by INSIDE Public Accounting (IPA) as a Best of the Best CPA Firm. This prestigious honor reflects Yeo & Yeo’s excellence within the industry.

Each year, IPA names 75 of the Best of the Best firms, applying a proprietary scoring formula of over 35 metrics to the 600+ firms that participate in the IPA Practice Management Survey. The report provides a clear picture of the best-managed firms based on performance in key areas of management, growth, and strategic vision.

“Being named among the ‘Best of the Best’ firms in the nation is a powerful affirmation of our core values. It proves that by prioritizing our people’s growth and well-being, we’ve created a firm that not only attracts top talent but also delivers outstanding results for our clients,” said Yeo & Yeo President & CEO Dave Youngstrom.

Yeo & Yeo’s success is rooted in the dedication of its talented professionals, who prioritize a client-centric approach by actively listening, responding genuinely, and addressing clients’ needs with expertise, experience, and empathy. “I am especially proud of the dedication of our people whose contributions made this possible,” said Youngstrom.

In addition to being named an IPA Best of the Best firm, Yeo & Yeo was recently ranked among IPA’s Top 200 accounting firms in the nation, demonstrating the firm’s ability to thrive in a dynamic industry. These honors are a testament to the firm’s commitment to its strategic initiatives, which include enhancing professional development and training, expanding benefits, streamlining operations, investing in new technologies, and broadening services to include HR advisory solutions. Most recently, Yeo & Yeo merged in Berger, Ghersi & LaDuke PLC, continuing its growth and expanding presence in Southeast Michigan.

“Adapting to the changing landscape of the accounting profession and succeeding at it takes passion, persistence, and patience,” added Youngstrom. “Through our strategic plan initiatives and the work of our internal development teams, we are continuously evolving in ways that best support our people and meet our client’s growing needs, without sacrificing our dedication to excellence.”

Youngstrom concluded, “This accolade not only affirms our current strategies but also inspires us to keep growing and advancing. We are honored and deeply thankful to our dedicated team, valued clients, and supportive partners for their shared commitment to our collective success.”

When drafting partnership and LLC operating agreements, various tax issues must be addressed. This is also true of multi-member LLCs that are treated as partnerships for tax purposes. Here are some critical issues to include in your agreement so your business remains in compliance with federal tax law.

Identify and describe guaranteed payments to partners

For income tax purposes, a guaranteed payment is one made by a partnership that’s: 1) to the partner acting in the capacity of a partner, 2) in exchange for services performed for the partnership or for the use of capital by the partnership, and 3) not dependent on partnership income.

Because special income tax rules apply to guaranteed payments, they should be identified and described in a partnership agreement. For instance:

- The partnership generally deducts guaranteed payments under its accounting method at the time they’re paid or accrued.

- If an individual partner receives a guaranteed payment, it’s treated as ordinary income — currently subject to a maximum income tax rate of 37%. The recipient partner must recognize a guaranteed payment as income in the partner’s tax year that includes the end of the partnership tax year in which the partnership deducted the payment. This is true even if the partner doesn’t receive the payment until after the end of his or her tax year.

Account for the tax basis from partnership liabilities

Under the partnership income taxation regime, a partner receives additional tax basis in his or her partnership interest from that partner’s share of the entity’s liabilities. This is a significant tax advantage because it allows a partner to deduct passed-through losses in excess of the partner’s actual investment in the partnership interest (subject to various income tax limitations such as the passive loss rules).

Different rules apply to recourse and nonrecourse liabilities to determine a partner’s share of the entity’s liabilities. Provisions in the partnership agreement can affect the classification of partnership liabilities as recourse or nonrecourse. It’s important to take this fact into account when drafting a partnership agreement.

Clarify how payments to retired partners are classified

Special income tax rules also apply to payments made in liquidation of a retired partner’s interest in a partnership. This includes any partner who exited the partnership for any reason.

In general, payments made in exchange for the retired partner’s share of partnership property are treated as ordinary partnership distributions. To the extent these payments exceed the partner’s tax basis in the partnership interest, the excess triggers taxable gain for the recipient partner.

All other payments made in liquidating a retired partner’s interest are either: 1) guaranteed payments if the amounts don’t depend on partnership income, or 2) ordinary distributive shares of partnership income if the amounts do depend on partnership income. These payments are generally subject to self-employment tax.

The partnership agreement should clarify how payments to retired partners are classified so the proper tax rules can be applied by both the partnership and recipient retired partners.

Consider other partnership agreement provisions

Since your partnership may have multiple partners, various issues can come into play. You’ll need a carefully drafted partnership agreement to handle potential issues even if you don’t expect them to arise. For instance, you may want to include:

- A partnership interest buy-sell agreement to cover partner exits.

- A noncompete agreement.

- How the partnership will handle the divorce, bankruptcy, or death of a partner. For instance, will the partnership buy out an interest that’s acquired by a partner’s ex-spouse in a divorce proceeding or inherited after a partner’s death? If so, how will the buyout payments be calculated and when will they be paid?

Minimize potential liabilities

Tax issues must be addressed when putting together a partnership deal. Contact us to be involved in the process.

© 2024

Public companies are required to evaluate and report on internal controls over financial reporting using a recognized control framework under rules set forth by the Securities and Exchange Commission (SEC). However, private companies also need checks and balances to help ensure their financial statements are correct and reduce the risk of fraud. Additionally, transparent reporting about the control system can give lenders, investors and other stakeholders greater confidence in a business’s financial results.

Develop an auditor’s mindset

The American Institute of Certified Public Accountants (AICPA) defines control activities as “steps put in place by the entity to ensure that the financial transactions are correctly recorded and reported.” AICPA auditing standards also require external auditors to evaluate their client’s internal controls as part of their audit risk assessment procedures. They routinely monitor the following three control features:

1. Physical restrictions. Employees should have access to only those assets necessary to perform their jobs. Locks and alarms are examples of ways to protect valuable tangible assets, including petty cash, inventory and equipment. But intangible assets — such as customer lists, lease agreements, patents and financial data — also require protection using passwords, access logs and appropriate legal paperwork.

2. Account reconciliation. Management should regularly analyze and confirm account balances. For example, bank statements should be reconciled monthly and inventory should be counted regularly.

Interim financial reports, such as weekly operating scorecards and quarterly financial statements, also keep management informed. However, reports are useful only if management finds time to review them and investigate anomalies. Supervisory oversight takes on many forms, including observation, test counts, inquiry and task replication.

3. Job descriptions. Another essential control is to have detailed job descriptions. Company policies should also call for job segregation, job duplication and mandatory vacations. For example, the person who receives customer payments should not also approve write-offs (job segregation). And two signatures should be required for checks above a prescribed dollar amount (job duplication).

Private company auditors tailor audit programs for potential risks of material misstatement. Still, they aren’t required to specifically perform procedures to identify control deficiencies unless they’re hired to perform a separate internal control study.

Disclosures about the control system

Audited financial statements may include footnote disclosures that describe the control environment, including policies and procedures for risk management, compliance and governance. These disclosures help build trust with stakeholders by providing insights into the company’s control environment and its effectiveness in ensuring accurate financial reporting.

Reporting on internal controls is an ongoing process, not a one-time assessment. Even if you’re not required to follow the SEC’s rules on evaluating internal controls, a thorough system of checks and balances will help your company achieve its goals.

We can help

Company insiders sometimes need more experience or objectivity to assess internal controls. Our auditors have seen the best — and worst — control systems and can help evaluate whether your controls are effective. Contact us for more information.

© 2024

Tax planning is only a small component of estate planning — and usually not even the most important one for most people. The primary goal of estate planning is to protect your family, and saving taxes is just one of many strategies you can use to provide for your family’s financial security. Another equally important strategy is asset protection. And a spendthrift trust can be an invaluable tool for preserving wealth for your heirs.

Spendthrift trust defined

A spendthrift trust prohibits a beneficiary from directly tapping its funds or transferring its rights to someone else. The trust can also deny access to creditors or a beneficiary’s ex-spouse.

Instead, the trust beneficiary relies on the trustee to provide payments based on the trust’s terms. These could be in the form of regular periodic payouts or on an “as needed” basis. The trust document will spell out the nature and frequency, if any, of the payments. Once a payment has been made to a beneficiary, the money becomes fair game to any creditors.

Be aware that a spendthrift trust isn’t designed primarily for tax-reduction purposes. Typically, this trust type is most beneficial when you want to leave money or property to a family member but worry that he or she may squander the inheritance.

For example, you might think that the beneficiary doesn’t handle money well based on experience, or that he or she could easily be defrauded, has had prior run-ins with creditors or suffers from an addiction that may result in a substantial loss of funds.

If any of these scenarios are possible, a spendthrift trust can provide asset protection. It enables the designated trustee to make funds available for the beneficiary without the risk of misuse or overspending. But that brings up another critical issue.

The trustee plays a major role

Depending on the trust’s terms, the trustee may be responsible for making scheduled payments or have wide discretion as to whether funds should be paid, how much and when. The trustee may even decide if there should be any payment at all.

Or perhaps someone will direct the trustee to pay a specified percentage of the trust’s assets depending on investment performance, so the payouts fluctuate. Similarly, the trustee may be authorized to withhold payment upon the occurrence of certain events (for example, if the beneficiary exceeds a debt threshold or declares bankruptcy).

The designation of the trustee can take on even greater significance if you expect to provide this person with broad discretion. Frequently, the trustee will be a CPA, attorney, financial planner or investment advisor, or someone else with the requisite experience and financial know-how. You should also name a successor trustee in the event the designated trustee passes away before the term ends or otherwise becomes incapable of handling the duties.

Other considerations

Be aware that the protection offered by a spendthrift trust isn’t absolute. Depending on applicable law, government agencies may be able to access the trust’s assets — for example, to satisfy a tax obligation.

It’s also essential to establish how and when the trust should terminate. It could be set up for a term of years or for termination to occur upon a stated event, such as a child reaching the age of majority.

Contact us if you have questions regarding a spendthrift trust.

© 2024

To help ensure continued stability and profitability, businesses need to engage in some form of strategic planning. A recent survey by insurance giant Travelers drives home this point.

In its 2024 CFO Study: A Travelers Special Report, the insurer surveyed 610 chief financial officers (CFOs) from companies with 500 or more employees in various industries. One of the questions posed was: What are the most valuable skills needed by today’s CFOs?

One might assume their answers would relate to being able to crunch numbers or understand complex regulations. But the top skill, coming from 62% of respondents, was “Strategic planning for future company success and resiliency.”

5 critical skills

Along with being somewhat surprising, the survey result begs the question: Which leadership skills, specifically, are essential to strategic planning? Among the five most important are the ability to:

1. View the company realistically and aspirationally. Strategic planning starts with a grounded view of where the company currently stands and a shared vision for where it should go. You and your leadership team need accurate information — including properly prepared financial statements, tax returns and sales reports — to establish a common perception of the state of the business. And from there, you need to be able to reach a mutually agreed-upon vision for the future.

2. Analyze the industry and market — and foresee impending changes. Everyone should be up to speed on the state of your industry and market from the pertinent perspective. Your CFO, for example, needs to be able to report on key performance indicators that place your company’s financial status in the context of industry averages and explain how those metrics compare to competitors in your market.

What’s more, everyone needs to develop the ability to make reasonable, fact-based predictions on where the industry and market are headed. Not every prediction will come true, but you’ve got to be able to forecast effectively as a team.

3. Understand customers and anticipate their needs. Again, from every member’s distinctive perspective, your leadership team needs to know who your customers truly are. This is where your marketing executive can come into play, laying out all the key features and demographics of those who buy your products or services.

Then you’ve got to put in the teamwork to determine what your customers want now and, even more important, what they will want in the future. That latter point is perhaps the biggest challenge of strategic planning.

4. Recognize the capabilities and resources of the business. Your company can operate only within realistic limits. These include the size of its workforce, the skill level of employees, and the availability of resources such as liquidity, physical assets and up-to-date technology.

Every member of your leadership team needs to be on the same page about what your business can realistically do before you decide where you can realistically go. Having a balanced collective of voices — financial, operational and technological — is critical.

5. Communicate effectively. Many companies struggle with strategic planning, not because of a shortage of ideas, but because of a failure to communicate. Leaders who tend to “silo” themselves and the knowledge of their respective departments can be particularly inhibitive. There are also those whose behavior or communication style is simply counterproductive. Continually work on improving how you and your leadership team communicate.

Confident growth

So, does your leadership team have all the requisite skills to succeed at strategic planning? If not, there are certainly ways to upskill your key players through training and performance management. We can help your business gather the financial information it needs to plan for the future confidently and decisively.

© 2024

Having proper policies and procedures in place over procurement and suspension and debarment is essential for organizations receiving federal financial assistance. This article discusses the common issues nonfederal entities encounter with procurement and suspension and debarment, and best practices for ensuring their processes and controls are properly designed to promote compliance with the requirements of Title 2 U.S. Code of Federal Regulations (CFR) Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance). The guidelines discussed and referenced in this article are those in effect prior to October 1, 2024.

Background

The Uniform Guidance addresses procurement standards for nonfederal entities other than states, including those operating federal programs as subrecipients of states, in 2 CFR sections 200.318 through 200.326. Requirements for suspension and debarment are found in 2 CFR Part 180. Nonfederal entities must follow their own documented procurement procedures, which reflect applicable state and local laws and regulations, provided such procedures conform to applicable federal requirements.

Common Issues

Below are some of the most common issues noted concerning compliance by nonfederal entities, and the relevant requirements:

- Lack of documented procurement procedures. 2 CFR 200.318 states nonfederal entities must have and use documented procurement procedures. Such standards must conform with relevant state, local and tribal laws and regulations, as well as the procurement standards identified in 2 CFR 200.317 through 200.327. The nonfederal entity must maintain written standards of conduct covering conflicts of interest and actions of its employees engaged in the selection, award and administration of contracts.

- Inserting restrictions on competition. Procurement transactions are to provide for full and open competition. 2 CFR 200.319 provides examples of inappropriate conditions nonfederal entities will artificially impose to create limitations to competition, such as through placing unreasonable requirements on firms to qualify to do business, requiring unnecessary experience or specifying a “brand name” product. Furthermore, nonfederal entities must avoid use of statutorily or administratively imposed state, local, or tribal geographical preferences except where federal statutes mandate or encourage geographic preference.

- Not retaining evidence of price or rate quotations for small purchases. 2 CFR 200.320(a)(2) describes small purchases as those with an aggregate dollar amount higher than the micro-purchase threshold ($10,000, or $2,000 for acquisitions subject to the Davis-Bacon Act) but less than the simplified acquisition threshold ($250,000, or a lower amount as determined by the nonfederal entity). When small purchase procedures are used, the nonfederal entity must obtain price or rate quotations from an adequate number of qualified sources.

- Inappropriate use of noncompetitive procurement. 2 CFR 200.320(c) limits the use of noncompetitive procurement to specific circumstances which include: (a) the aggregate dollar amount does not exceed the micro-purchase threshold; (b) the item is available only from a single source; (c) a public exigency or emergency does not permit a delay for competitive solicitation; (d) the federal awarding agency or pass-through entity expressly authorized via response to a written request for noncompetitive procurement; and (e) after solicitation of a number of sources, competition is determined inadequate. Nonfederal entities procuring goods or services noncompetitively outside of the specific circumstances listed risk having the related costs disallowed and other negative ramifications due to noncompliance.

- Not checking for suspended or debarred parties. Nonfederal entities are prohibited from contracting with or making subawards under covered transactions to parties that are suspended or debarred. Per 2 CFR 180.220, covered transactions include contracts for goods and services awarded under a nonprocurement transaction (e.g., grant or cooperative agreement) that are expected to equal or exceed $25,000, contracts that require the consent of an official of a federal awarding agency, or contracts for federally required audit services.

Question: Can a nonfederal entity use its history or familiarity with a vendor as criteria for selection?

Answer: No, procurement transactions must be conducted in a manner that provides full and open competition. Relevant technical requirements or the inclusion of minimum essential characteristics or standards may be used for evaluation purposes but must not contain features which unduly restrict competition. “Preferences” are not appropriate criteria for evaluating bids or proposals.

Best Practices

Below are suggested best practices to help ensure compliance with requirements for procurement and suspension and debarment:

- Routine review of documented procurement procedures. Nonfederal entities must have written procedures for procurement and should review these procedures routinely to ensure they are in compliance with relevant laws and regulations, and accurately reflect the actual procurement process.

- Review of terms and conditions. Invitations to bid, requests for proposal and contracts should be reviewed to ensure the terms and conditions are in compliance with recently enacted federal laws and regulations. For example, effective May 14, 2022, the Build America, Buy America Act (BABA) requires a Buy America preference for iron, steel, manufactured projects, and construction materials used in projects.

- Retention of quotes, bids and proposals received. For procurements made under small purchase procedures or formal procurement methods, nonfederal entities should retain copies of the quotes, bids, or proposals received to support compliance for competitive procurement.

- Written documentation of noncompetitive procurement. Nonfederal entities should maintain robust documentation as appropriate for their scenario justifying the use of noncompetitive procurement. Such documentation should include:

- Written approval from the federal awarding agency or pass-through entity authorizing noncompetitive procurement, when available.

- Evidence of inadequate competition when solicited, proof that the item is only available from a single source, and the facts and circumstances explaining why a public exigency or emergency required immediate procurement.

- Retention of documentation of the review for suspension and debarment. Nonfederal entities should retain in their procurement files evidence that they verified the entity was not debarred, suspended, or otherwise excluded from federal programs prior to entering a covered transaction. This can include a screenshot of checking the System of Award Management (SAM) Exclusions maintained by the General Services Administration (GSA) available at SAM.gov, collecting a certification from the entity, or adding a clause or condition in the agreement related to the covered transaction.

Question: Are non-federal entities required to have a separate procurement policy for federally funded procurements?

Answer: Nonfederal entities are not required to have separate procurement policies. However, the procurement procedures used when federal funds are involved must conform to applicable federal statutes and the procurement requirements identified in 2 CFR Part 200. Nonfederal entities may opt for more restrictive policies than the requirements in 2 CFR Part 200 if they so choose.

Conclusion

Compliance with the requirements of the Uniform Guidance for procurement and suspension and debarment is essential to continue to receive federal financial assistance. Through adherence to the best practices listed above, nonfederal entities can better position themselves for a successful future.

Note: In April 2024, the Office of Management and Budget released an updated version of the Uniform Guidance. The effective date for the updated version is October 1, 2024. Federal agencies may choose to apply the final guidance to federal awards issued prior to this date but are not required to do so. Nonfederal entities should refer to the updated guidance when applicable.

Written by Sam Thompson. Copyright © 2024 BDO USA, P.C. All rights reserved. www.bdo.com

With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your small business’s taxes for this year and next. The strategy of deferring income and accelerating deductions to minimize taxes can be effective for most businesses, as is the approach of bunching deductible expenses into this year or next to maximize their tax value.

Do you expect to be in a higher tax bracket next year? If so, then opposite strategies may produce better results. For example, you could pull income into 2024 to be taxed at lower rates, and defer deductible expenses until 2025, when they can be claimed to offset higher-taxed income.

Here are some other ideas that may help you save tax dollars if you act soon.

Estimated taxes

Make sure you make the last two estimated tax payments to avoid penalties. The third quarter payment for 2024 is due on September 16, 2024, and the fourth quarter payment is due on January 15, 2025.

QBI deduction

Taxpayers other than corporations may be entitled to a deduction of up to 20% of their qualified business income (QBI). For 2024, if taxable income exceeds $383,900 for married couples filing jointly (half that amount for other taxpayers), the deduction may be limited based on whether the taxpayer is engaged in a service-type business (such as law, health or consulting), the amount of W-2 wages paid by the business, and/or the unadjusted basis of qualified property (such as machinery and equipment) held by the business. The limitations are phased in.

Taxpayers may be able to salvage some or all of the QBI deduction (or be subject to a smaller deduction phaseout) by deferring income or accelerating deductions to keep income under the dollar thresholds. You also may be able increase the deduction by increasing W-2 wages before year end. The rules are complex, so consult us before acting.

Cash vs. accrual accounting

More small businesses are able to use the cash (rather than the accrual) method of accounting for federal tax purposes than were allowed to do so in previous years. To qualify as a small business under current law, a taxpayer must (among other requirements) satisfy a gross receipts test. For 2024, it’s satisfied if, during the three prior tax years, average annual gross receipts don’t exceed $30 million. Cash method taxpayers may find it easier to defer income by holding off on billing until next year, paying bills early or making certain prepayments.

Section 179 deduction

Consider making expenditures that qualify for the Section 179 expensing option. For 2024, the expensing limit is $1.22 million, and the investment ceiling limit is $3.05 million. Expensing is generally available for most depreciable property (other than buildings) including equipment, off-the-shelf computer software, interior improvements to a building, HVAC and security systems.

The high dollar ceilings mean that many small and midsize businesses will be able to currently deduct most or all of their outlays for machinery and equipment. What’s more, the deduction isn’t prorated for the time an asset is in service during the year. Even if you place eligible property in service by the last days of 2024, you can claim a full deduction for the year.

Bonus depreciation

For 2024, businesses also can generally claim a 60% bonus first-year depreciation deduction for qualified improvement property and machinery and equipment bought new or used, if purchased and placed in service this year. As with the Sec. 179 deduction, the write-off is available even if qualifying assets are only in service for a few days in 2024.

Upcoming tax law changes

These are just some year-end strategies that may help you save taxes. Contact us to customize a plan that works for you. In addition, it’s important to stay informed about any changes that could affect your business’s taxes. In the next couple years, tax laws will be changing. Many tax breaks, including the QBI deduction, are scheduled to expire at the end of 2025. Plus, the outcome of the presidential and congressional elections could result in new or repealed tax breaks.

© 2024

Your business probably has a disaster plan — or a set of procedures for dealing with a fire, natural disaster, terrorist attack or other emergency that could disrupt operations and threaten lives. Although a fraud contingency plan probably isn’t as critical, it’s still important for most companies to have one. Here’s how to draft and put a fraud contingency plan in place.

Where are your weaknesses?

Start by meeting with your senior management team and financial advisors to devise as many fraud scenarios as you can dream up. Consider how your internal controls could be breached — whether the perpetrator is a relatively new hire, an experienced department manager, a high-ranking executive or an outside party.

Next, decide which scenarios are most likely to occur given such factors as your industry and size. For example, retailers are particularly vulnerable to skimming and construction companies are prone to employee/vendor collusion in bid rigging. Small businesses without adequate segregation of duties may be at greater risk for theft in accounts payable.

Also identify the schemes that would be most damaging to your business. Consider them from financial, employee morale and public relations standpoints.

Who will be responsible for what?

As you write your plan, assign responsibilities to specific individuals. When fraud is suspected, one person should lead the investigation and coordinate with staff and any third-party investigators. Put other employees to work where they can be most effective. For example, your IT manager may be tasked with preventing loss of electronic records and your HR head may be responsible for maintaining employee morale.

You’ll also want to define the objectives of any fraud investigation. Some companies want only to fire the person responsible, mitigate the damage and keep news of the incident from leaking. Others may want to seek prosecution of offenders as examples to others or to recover stolen funds. Your fraud contingency plan should include information on who will work with law enforcement and how they’ll do so.

How should you communicate incidents?

Employee communications are particularly important during a fraud investigation. Staff members who don’t know what’s going on will speculate. Although you should consult legal and financial advisors before releasing any information, you probably want to be as honest with your employees as you can. It’s equally important to make your response visible so that employees know you take fraud seriously.

Also designate someone to manage external communications. This person should be prepared to deflect criticism and defend your company’s stability, as well as control the flow of information to the outside world.

Strong internal controls

A fraud contingency plan shouldn’t be your only effort to combat theft and other crimes within your organization. After all, this plan is intended to help you after fraud has occurred. So be sure to establish strong internal controls that can reduce fraud risk. Contact us for help.

© 2024

Is your company planning to hire a new CFO? A recent survey found that hiring managers look for more than financial acumen when vetting CFO candidates. In fact, only 38.5% of CFOs at Fortune 500 and S&P 500 companies were licensed CPAs in 2023, according to executive recruiting firm Crist Kolder. What other skills may be needed to fill these shoes?

Financial know-how opens doors

The Pennsylvania Institute of Certified Public Accountants recently surveyed over 320 hiring executives about what skills matter most for the CFO role. Not surprisingly, “2024 Corporate Finance Report: CPAs in the C-Suite” found that the top must-have for CFO candidates is the ability to manage the company’s finances effectively.

The top 10 financial skills identified in the survey include:

- Capital management and strategy,

- Financial forecasting,

- Operations and financial reporting,

- Critical thinking,

- Financial reporting compliance,

- Strategy creation,

- Industry/product forecast and outlook,

- Tax compliance,

- Accounts receivable, and

- Networking and industry relationships.

The survey draws two key findings. First, CPAs who aspire to become CFOs will need to expand their skill sets beyond traditional accounting to include strategic planning, risk management and technology oversight. Second, today’s CFOs must “strategize for growth and stability, not just report past results.”

Nonfinancial skills seal the deal

Today’s hiring managers are looking for more than finance and accounting skills when filling CFO positions. They prefer candidates with the following general competencies, listed in order of importance:

- Leadership/strategic aptitude to develop high-performing teams and strategic goals,

- Compliance and regulatory expertise to ensure organizational adherence to laws, regulations and internal policies,

- Technology and analytical proficiency to make data-driven decisions and use cutting-edge tools,

- Industry-specific knowledge to understand market conditions and how they influence the organization, and

- Communication skills to build effective relationships with internal and external stakeholders to maintain alignment with corporate strategy.

In addition, respondents emphasized the need for CFO candidates to possess “general business acumen” and “emotional intelligence.” However, the survey cautions that most hiring managers assume candidates who apply for executive positions have already mastered these general skills.

What’s the right fit for your executive team?

Finding the right person to head up your company’s finance and accounting department can be challenging in today’s tight labor market. The CFO’s main responsibility is to provide timely, relevant financial data to other departments — including information technology, operations, sales and supply chain logistics — to help improve how the business operates. He or she also must be able to drum up cross-departmental support for major initiatives. So, it’s important that you choose a candidate who’s a team player. You might even want to outsource the position to a skilled professional. Contact us for help evaluating CFO candidates to find the right mix of skills and experience for your company’s finance and accounting department.

© 2024

While America was celebrating Labor Day this year, another auspicious occasion was taking place that probably flew under most people’s radar: The Employee Retirement Income Security Act (ERISA) turned 50.

For employers, ERISA is a constant regulatory presence when choosing, launching and administering employee benefit plans. If you’ve been dealing with it for years, you might not recall or even know why the law came about or how it’s evolved. Let’s take a look.

Brief history

The seeds of ERISA can be found in the Revenue Acts of 1921, 1926 and 1942. These laws addressed the growing trend of employer-sponsored pensions, also known as defined benefit plans.

The Revenue Acts established increasingly strict requirements — such as minimum employee coverage, employer contribution requirements and mandated disclosures — for the first qualified plans. Employers that met the qualifications for such plans could deduct pension contributions, while participants could accumulate tax-free savings and defer income taxes until taking distributions. The IRS was primarily tasked with enforcing the Revenue Acts.

In 1959, the federal government escalated its regulation of retirement plans with the Welfare and Pension Plans Disclosure Act, which was amended in 1962. It introduced the requirement that employers must file plan descriptions and annual reports. With this law, the U.S. Department of Labor (DOL) became the chief enforcer.

Yet, despite the passage of these laws, labor advocacy groups continued to decry the instability of pensions and the risks they posed to workers — many of whom depended on those funds for retirement only to see them vanish. And so, throughout the 1960s and early 1970s, the regulatory ideas that would eventually form the provisions of ERISA were developed. The law itself was finalized during the Ford administration and signed into law on Labor Day, 1974.

Purpose, titles and more

According to the DOL’s website, “The goal of Title I of ERISA is to protect the interests of participants and their beneficiaries in employee benefit plans.” You may note the phrase “employee benefit plans,” not “employee pension plans,” in that sentence. Indeed, over time, ERISA has expanded to include both major types of retirement plans: defined benefit plans and defined contribution plans, such as 401(k)s, which are now much more widely sponsored than pensions. ERISA also covers certain health and welfare benefit plans.

In addition, you may note the reference to Title I. In fact, the law has four Titles:

- Title I, which generally includes the rules regarding plan reporting and disclosures, participation, vesting, accrual of benefits and funding,

- Title II, which covers the tax treatment of plans,

- Title III, which addresses jurisdiction, administration and enforcement, primarily assigning these responsibilities to the DOL and the U.S. Department of the Treasury, and

- Title IV, which established and sets forth the powers and rules of the Pension Benefit Guaranty Corporation, essentially a government insurer of pension plans.

Over the years, many of the most powerful and well-known laws related to employee benefits have been enacted under or in relation to ERISA. These include the Consolidated Omnibus Budget Reconciliation Act (popularly known as “COBRA”), the Health Insurance Portability and Accountability Act and the Affordable Care Act.

One important recent development is multistate employers’ concern about the erosion of ERISA’s “preemption.” ERISA has always preempted state and local laws related to employee benefit plans, and it continues to do so. But some states have been quietly challenging this long-standing legal principle. It’s something to keep an eye on if your organization could be adversely affected.

Fundamental mandate

Ultimately, ERISA’s fundamental mandate is fiduciary responsibility — that is, plan sponsors must always act in the best interests of participants when administrating plans and managing their assets. For questions about compliance, contact your attorney. And for help identifying and managing the costs and tax impact of your organization’s benefit plans, contact us.

© 2024

Every business needs a budget, but not every budget looks the same. Some companies have intricately detailed ones, others rely on simple templates generated with off-the shelf software, and still others forego formal budgets in favor of a “fly by the seat of your pants” approach. (That last option isn’t recommended.)

Because budgeting is such an essential part of running a business, it’s easy to take for granted. You may fall into a routine that, over time, doesn’t keep up with your company’s evolving needs. To identify areas of improvement, here are six key elements of a business budget and some best practices to consider:

1. Current overview. You may think you’ve created a sound budget, but its usefulness will be limited if it’s based on what your business looked like and how it operated five years ago. Compose an up-to-date description of your business. This should include its strategic goals, sales targets, the state of your industry and market, and impactful economic factors.

2. Budget rationale. Explain in clear language how the budget supports your company’s mission, vision, values, goals and objectives. To be included in the budget, every line item (see below) must support all five of those factors. If one doesn’t, question its merit.

3. Detailed line items. Naturally, the “meat” of every budget is its line items. These typically include:

- Revenue, such as sales income and interest income,

- Expenses, such as salaries and wages, rent, and utilities,

- Capital expenditures, such as equipment purchases and property improvements, and

- Contingency funds, such as a cash reserve.

An important question to ask is: Are we including everything the business spends money on? Although maintaining a detailed budget can be tedious, it’s imperative to managing cash flow.

4. Selected performance metrics. Among the primary purposes of a budget is to compare projected spending to actual spending — making adjustments as necessary. As part of the budgeting process, establish precisely which metrics you’ll use to determine whether you’re making, breaking or beating the budget.

5. Supporting appendices. Discuss with your leadership team whether your budget would be more useful with additional information. Commonly attached supporting appendices include historical budget and results analyses, department spending summaries, tables and graphs depicting market and cost trends, organizational charts, and glossaries of terminology.

6. Executive summary. This brief written snapshot, which usually appears at the very top of the budget report, is intended to provide a concise overview of the chief objectives and major sections of the budget. If you’re not already using one, consider it. For you and other internal users, an executive summary can serve as a quick reference and help you set your expectations. Perhaps more important, it can make your budget easier to understand for outside parties such as lenders and investors.

Your current budget may not include all six of these elements — and that’s OK. As mentioned, companies are free to create budgets in whatever format suits their size and needs. But you should approach budgeting with an eye on continuous improvement. And to that end, please contact us. We can assess your budgeting process from start to finish and suggest ways to perform this critical business function more efficiently and effectively.

© 2024

The average cost of a data breach has reached $4.88 million, up 10% from last year, according to a recent report. As businesses increasingly rely on technology, cyberattacks are becoming more sophisticated and aggressive, and risks are increasing. What can your organization do to protect its profits and assets from cyberthreats?

Recent report

In August 2024, IBM published “Cost of a Data Breach Report 2024.” The research, conducted independently by Ponemon Institute, covers 604 organizations that experienced data breaches between March 2023 and February 2024. It found that, of the 16 countries studied, the United States had the highest average data breach cost ($9.36 million).

The report breaks down the global average cost per breach ($4.88 million) into the following four components:

- $1.47 million for lost business (for example, revenue loss due to system downtime and costs related to lost customers, reputation damage and diminished goodwill),

- $1.63 million for detection and escalation (such as forensic and investigative activities, assessment and audit services, crisis management, and communications to executives and boards),

- $1.35 million for post-breach response (including product discounts, regulatory fines, legal fees, and costs related to setting up call centers and credit monitoring / identity protection services for breach victims), and

- $430,000 for notifying regulators, as well as individuals and organizations affected by the breach.

A silver lining from the report is that the average time to identify and contain a breach has fallen to 258 days from 277 days in the 2023 report, reaching a seven-year low. One key reason for faster detection and recovery is that organizations are giving more attention to cybersecurity measures.

Implementing cybersecurity protocols

Cybersecurity is a process where internal controls are designed and implemented to:

- Identify potential threats,

- Protect systems and information from security events, and

- Detect and respond to potential breaches.

The increasing number of employees working from home exposes their employers to greater cybersecurity risk. Many companies now have sensitive data stored in more places than ever before — including laptops, firm networks, cloud-based storage, email, portals, mobile devices and flash drives — providing many potential areas for unauthorized access.

Targeted data

When establishing new cybersecurity protocols and reviewing existing ones, it’s important to identify potential vulnerabilities. This starts by inventorying the types of employee and customer data that hackers might want to steal. This sensitive material may include:

- Personally identifiable information, such as phone numbers, physical and email addresses and Social Security numbers,

- Protected health information, such as test results and medical histories, and

- Payment card data.

Companies need to have effective controls over this data to comply with their obligations under federal and state laws and industry standards.

Hackers may also try to access a company’s network to steal valuable intellectual property, such as customer lists, proprietary software, formulas, strategic business plans and financial data. These intangible assets may be sold or used by competitors to gain market share or competitive advantage.

Auditing cyber risks

No organization, large or small, is immune to cyberattacks. As the frequency and severity of data breaches continue to increase, cybersecurity has become a critical part of the audit risk assessment.

Audit firms provide varying levels of guidance, both when assessing risk at the start of the engagement and when uncovering a breach that happened during the period under audit or during audit fieldwork.

We can help

Contact us to discuss your organization’s vulnerabilities and the effectiveness of its existing controls over sensitive data. Additionally, if your company’s data is hacked, we can help you understand what happened and fortify your defenses going forward.

© 2024

Yeo & Yeo is pleased to announce that Rebecca Millsap, CPA, and Steven Treece, CPA, have earned the Personal Financial Specialist (PFS) designation from the American Institute of Certified Public Accountants.

The PFS credential is awarded to CPAs with extensive training and experience in financial planning. This knowledge enables Millsap and Treece to provide more informed and strategic advice, particularly in tax planning, estate planning, risk management, and investment strategies.

Millsap, who has been with Yeo & Yeo since 1994, is the Managing Principal of the Flint office. She leads the firm’s Estate and Trust Group and finds joy in helping clients plan for their futures and protect their legacies. Her knowledge spans taxation, financial reporting, business consulting, and strategic planning. Beyond her professional role, Millsap is dedicated to her community, serving as treasurer of the Flint Rotary Club and on the Finance Committee for both the Grand Blanc Chamber of Commerce and Holy Family Catholic Church in Grand Blanc.

Reflecting on earning this credential, Millsap shared, “Estate planning and financial planning often go hand in hand. When I help clients plan for the future, I look at the full picture, including their goals and potential tax burden. Earning this credential has given me even more insight to help my clients succeed.”

Steven Treece joined Yeo & Yeo in 2013 after receiving his bachelor’s degree in accounting from the University of Michigan. Treece is a senior manager and member of the firm’s Agribusiness Services Group and Estate and Trust Services Group. He enjoys guiding clients through the complexities of taxation and providing thoughtful advice. He is a mentor within the firm, hosting internal podcasts to help his colleagues enhance their client service skills. Active in the community, Treece is a board member and past president of the Rotary Club of Burton. He supports the Old Newsboys of Flint and volunteers with the Food Bank of Eastern Michigan and Genesee County Habitat for Humanity.

“Delivering five-star client service has consistently been my priority,” Treece said. “Earning this credential reflects my dedication to best supporting my clients, ensuring they can confidently navigate complex financial landscapes.”

About Yeo & Yeo Wealth Management

Yeo & Yeo Wealth Management (www.yeoandyeo.com) helps businesses and individuals with their wealth management and investment strategies. Working closely with Avantax®, a national wealth management company, Yeo & Yeo Wealth Management delivers a holistic approach that connects financial planning, tax strategies, and insurance solutions. Wealth management services are offered in Yeo & Yeo’s offices throughout Michigan.

Avantax WM HoldingsSM is the holding company for the group of companies providing financial services under the Avantax® name. Investment advisory services are offered through Avantax Planning PartnersSM. Commission-based securities products are offered through Avantax Investment ServicesSM, Member FINRA, SIPC. Insurance services offered through licensed agents of Avantax Planning Partners. 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. The Avantax entities are independent of and unrelated to Yeo & Yeo Wealth Management. Although Avantax does not provide or supervise tax or accounting services, our Financial Professionals may offer these services through their independent outside business. Not all Financial Professionals are licensed to offer all products or services. Financial planning and investment advisory services require separate licenses.

Artificial intelligence (AI) has become a cornerstone of technological advancement, offering transformative potential across various industries. However, this powerful tool is also being exploited by cybercriminals, amplifying the threat landscape and necessitating a heightened awareness of cybersecurity among individuals and businesses.

How AI is Empowering Cybercriminals

- Automated Attacks: AI enables cybercriminals to automate and scale their attacks. Phishing schemes, malware distribution, and ransomware campaigns can now be conducted on a much larger scale with minimal human intervention.

- Enhanced Phishing Tactics: Traditional phishing attacks often rely on generic messages that are easy to spot. With AI, cybercriminals can analyze large datasets, including social media profiles and publicly available information, to craft highly targeted and convincing phishing messages. This approach, known as spear phishing, makes it more challenging for individuals to distinguish between legitimate and malicious communications.

- Sophisticated Malware: AI can be used to develop more sophisticated malware that adapts and evolves to bypass traditional security measures. For instance, AI-powered malware can analyze a target’s system in real-time, identifying vulnerabilities and adjusting its behavior to avoid detection by antivirus software.

- Deepfake Technology: Deepfake technology, powered by AI, allows cybercriminals to create highly realistic fake videos and audio recordings. These can be used to impersonate individuals, spread misinformation, or manipulate social engineering attacks. The increasing quality of deepfakes makes it difficult for individuals to verify the authenticity of digital content, posing significant security risks.

- Password Cracking: AI-driven algorithms can accelerate the process of cracking passwords by analyzing patterns and using machine learning to predict likely password combinations. This capability enables cybercriminals to breach accounts and access sensitive information more efficiently.

The Need for Heightened Cybersecurity Awareness

The rise of AI-driven cybercrime underscores the urgent need for organizations to adopt robust cybersecurity practices. Here are some critical steps to enhance cybersecurity awareness:

- Educate Yourself: Stay informed about the latest cybersecurity threats and trends. Understanding how cybercriminals use AI can help you recognize and respond to potential threats more effectively.

- Strengthen Passwords: Use complex, unique passwords for different accounts and enable multi-factor authentication (MFA) wherever possible. Consider using a password manager to keep track of your credentials securely.

- Verify Communications: Avoid unsolicited emails, messages, and phone calls, especially those requesting personal information or urgent actions. Verify the sender’s authenticity before responding or clicking on links.

- Update Software Regularly: Keep your operating system, software, and antivirus programs current. Regular updates often include security patches that address vulnerabilities exploited by cybercriminals.

- Use Security Tools: To protect your devices, use reputable antivirus and anti-malware software. Firewalls and virtual private networks (VPNs) can also enhance your security by safeguarding your internet connection and data.

- Be Skeptical of Digital Content: Question the authenticity of digital content, particularly videos and audio recordings. Look for signs of manipulation and use tools designed to detect deepfakes.

- Report Suspicious Activity: If you encounter suspicious activity or believe you have been targeted by a cyberattack, report it to the appropriate authorities. Prompt reporting can help mitigate the impact of an attack and prevent further incidents.

As AI continues to evolve, so too does its potential to empower both positive advancements and malicious activities. The increasing sophistication of AI-driven cybercrime highlights the critical need for heightened cybersecurity awareness among individuals. By staying informed, adopting robust security practices, and remaining vigilant, we can better protect ourselves against the growing threats posed by AI-enhanced cybercriminals.

In April 2024, the Federal Trade Commission (FTC) approved a final rule prohibiting most noncompete agreements with employees. The ban was scheduled to take effect on September 4, 2024, but ran into multiple court challenges. Now the court in one of those cases has knocked down the rule, leaving its future uncertain.

The FTC ban

The FTC’s rule would have prohibited noncompetes nationwide. In addition, existing noncompetes for most workers would no longer be enforceable after it became effective. The rule was expected to affect 30 million workers.

The rule includes an exception for existing noncompete agreements with “senior executives,” defined as workers earning more than $151,164 annually who are in policy-making positions. Policy-making positions include:

- A company’s president,

- A chief executive officer or equivalent,

- Any other officer who has policy-making authority, and

- Any other natural person who has policy-making authority similar to an officer with such authority.

Employers couldn’t enter new noncompetes with senior executives under the new rule.

Unlike an earlier proposed rule issued for public comment in January 2023, the final rule didn’t require employers to legally modify existing noncompetes by formally rescinding them. Instead, they were required only to provide notice to workers bound by an existing agreement — other than senior executives — that they wouldn’t enforce such agreements against the workers.

Legal challenges

On the day the FTC announced the new rule, a Texas tax services firm filed a lawsuit challenging the rule in the Northern District of Texas (Ryan, LLC v. Federal Trade Commission). The U.S. Chamber of Commerce and similar industry groups joined the suit in support of the plaintiff. Additional lawsuits were filed in the Eastern District of Pennsylvania (ATS Tree Services, LLC v. Federal Trade Commission) and the Middle District of Florida (Properties of the Villages, Inc. v. Federal Trade Commission).

The Ryan case is the first to reach judgment. On August 20, 2024, the U.S. District Court for the Northern District of Texas held that the FTC exceeded its authority in implementing the rule and that the rule was arbitrary and capricious. It further held that the FTC cannot enforce the ban, a ruling that applies on a nationwide basis.

Notably, in July 2024, the U.S. District Court for the Eastern District of Pennsylvania denied the plaintiff’s request for a preliminary injunction and stay of the rule’s effective date. It found the plaintiff didn’t establish that it was reasonably likely to succeed in its argument against the ban. By contrast, on August 14, 2024, the U.S. District Court for the Middle District of Florida granted the plaintiff a preliminary injunction and stay. That plaintiff requested relief only for itself, though, not nationwide. But the Ryan ruling means the FTC can’t enforce the ban at all unless it prevails on appeal.

An appeal would be before the conservative U.S. Court of Appeals for the Fifth Circuit, which has become a favorite destination for challenges to President Biden’s policies. Although the court often sides with the challengers, it’s also regularly been reversed by the U.S. Supreme Court.

An FTC appeal could face an uphill battle regardless, though, in light of a recent Supreme Court ruling that reversed the longstanding doctrine of “Chevron deference.” Under that precedent, courts gave deference to federal agencies’ interpretations of the laws they administer. According to the new ruling, however, it’s now up to courts to decide “whether the law means what the agency says.”

The bottom line

For now, the FTC’s noncompete ban remains in limbo and won’t take effect on September 4, 2024. But that doesn’t mean noncompetes aren’t still vulnerable to attack. For example, some private parties are using anti-trust laws to challenge such agreements. And an FTC spokesperson has indicated that the Ryan ruling won’t deter the agency “from addressing noncompetes through case-by-case enforcement actions.”

© 2024

Understanding payroll accounting is crucial for maintaining financial integrity and ensuring compliance with legal and tax obligations. Payroll accounting involves tracking and recording all payroll-related transactions, including employee paychecks, taxes, deductions, and employer contributions. Accurate payroll accounting ensures timely and correct employee payments and maintains an organization’s financial health. Let’s dive into the key components of payroll accounting and how to avoid common pitfalls.

Setting Up the Chart of Accounts

Before you can begin recording payroll, setting up the appropriate accounts in the chart of accounts is essential. These typically include:

- Expense accounts: For wages, employer-paid benefits, and the employer’s portion of taxes.

- Liability accounts: For amounts deducted from employee paychecks and temporarily held before remittance.

Account Mapping

Once the chart of accounts is set up, the next crucial step is mapping the pay items to the correct accounts. This process ensures that each specific pay item is recorded accurately within the chart of accounts, whether you’re processing payroll within accounting software or entering payroll journal entries manually.

Gathering Essential Reports

To create accurate payroll journal entries, you’ll need to collect key documents:

- Payroll Register: This comprehensive report details all payroll transactions during the pay period, including employee names, pay dates, and payment amounts. It may also include quarter-to-date and year-to-date totals.

- Payroll Tax Liability Report: This report provides a breakdown of taxes owed by the business and taxes withheld from employee paychecks.

- Deductions Register: This document outlines employee deductions from gross wages that must be paid to third parties, such as taxes, health insurance premiums, retirement account deferrals, child support, or garnishments.

Journal Entries

Payroll journal entries typically involve debiting gross wage expenses and crediting various liabilities. Remember, employer contributions and taxes should be recorded as both expenses and liabilities until paid.

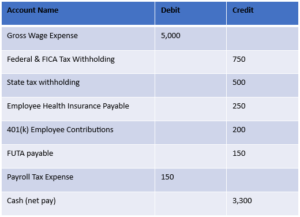

Here is a simple example:

Avoiding Common Payroll Accounting Errors

To maintain accurate records and ensure compliance, be vigilant about these common errors:

- Over or underpayment of payroll taxes

- Failing to record employer benefit contributions as expenses

- Incorrectly applying benefit payments entirely to expense accounts

- Misconfigured payroll account mapping in software systems

Conduct monthly reviews of the balance sheet to ensure liability accounts are zeroing out appropriately and payments are applied to the correct accounts. Perform quarterly reviews of payroll activities to identify and address potential issues promptly. Compare monthly payroll expenses and verify that tax expense accounts align with payroll reports.

Mastering payroll accounting is essential for a business’s financial health. By understanding the key components, avoiding common errors, and implementing best practices, you can ensure accurate financial reporting and compliance with tax obligations. At Yeo & Yeo, we’re committed to helping businesses navigate the complexities of payroll accounting. For personalized guidance on optimizing your payroll processes, contact our team.

The IRS announced a second Voluntary Disclosure Program for employers to resolve erroneous claims for credit or refund involving the COVID-19 Employee Retention Credit (ERC). The program is designed to help businesses with questionable claims to self-correct and repay the credits they received after filing erroneous ERC claims, many of which were driven by unscrupulous marketing promoters.

- The first ERC Voluntary Disclosure Program was announced in late December 2023 and ended on March 22, 2024. Over 2,600 taxpayers applied to the first program to resolve their improper ERC claims and avoid civil penalties and unnecessary litigation.

- The second ERC Voluntary Disclosure Program is limited to ERC claims filed for the 2021 tax period. It allows businesses to repay 85% of the credit amount they received, effectively offering a 15% discount on the repayment.

Procedures for the Second Voluntary Disclosure Program

To apply, employers must file Form 15434, Application for Employee Retention Credit Voluntary Disclosure Program, and submit it through the IRS Document Upload Tool. Employers must provide the IRS with the names, addresses, telephone numbers and details about the services provided by any advisors or tax preparers who advised or assisted them with their claims.

Employers are expected to repay their full ERC claimed, minus the 15% reduction allowed through the Voluntary Disclosure Program.

Eligible employers must apply by 11:59 p.m. local time on November 22, 2024.

For more information, see the IRS’s Employee Retention Credit – Voluntary Disclosure Program or contact Yeo & Yeo.

Partnerships are often used for business and investment activities. So are multi-member LLCs that are treated as partnerships for tax purposes. A major reason is that these entities offer federal income tax advantages, the most important of which is pass-through taxation. They also must follow some special and sometimes complicated federal income tax rules.

Governing documents

A partnership is governed by a partnership agreement, which specifies the rights and obligations of the entity and its partners. Similarly, an LLC is governed by an operating agreement, which specifies the rights and obligations of the entity and its members. These governing documents should address certain tax-related issues. Here are some key points when creating partnership and LLC governing documents.

Partnership tax basics

The tax numbers of a partnership are allocated to the partners. The entity issues an annual Schedule K-1 to each partner to report his or her share of the partnership’s tax numbers for the year. The partnership itself doesn’t pay federal income tax. This arrangement is called pass-through taxation, because the tax numbers from the partnership’s operations are passed through to the partners who then take them into account on their own tax returns (Form 1040 for individual partners).

Partners can deduct partnership losses passed through to them, subject to various federal income tax limitations such as the passive loss rules.

Special tax allocations

Partnerships are allowed to make special tax allocations. This is an allocation of partnership loss, deduction, income or gain among the partners that’s disproportionate to the partners’ overall ownership interests. The best measure of a partner’s overall ownership interest is the partner’s stated interest in the entity’s distributions and capital, as specified in the partnership agreement. An example of a special tax allocation is when a 50% high-tax-bracket partner is allocated 80% of the partnership’s depreciation deductions while the 50% low-tax-bracket partner is allocated only 20% of the depreciation deductions.

Any special tax allocations should be set forth in the partnership agreement. However, to make valid special tax allocations, you must comply with complicated rules in IRS regulations.

Distributions to pay partnership-related tax bills

Partners must recognize taxable income for their allocations of partnership income and gains — whether those income and gains are distributed as cash to the partners or not. Therefore, a common partnership agreement provision is one that calls for the partnership to make cash distributions to help partners cover their partnership-related tax liabilities. Of course, those liabilities will vary, depending on the partners’ specific tax circumstances. The partnership agreement should specify the protocols that will be used to calculate distributions intended to help cover partnership-related tax bills.

For instance, the protocol for long-term capital gains might call for distributions equal to 15% or 20% of each partner’s allocation of the gains.

Such distributions may be paid out in early April of each year to help cover partners’ tax liabilities from their allocations of income and gains from the previous year.

Contact us for assistance

When putting together a partnership or LLC deal, tax issues should be addressed in the agreement. Contact us to be involved in the process.

© 2024

Workers’ compensation insurance can provide medical care and financial assistance to employees who are injured or incapacitated at work. However, this important benefit is also subject to fraud perpetrated by dishonest workers. The Coalition Against Insurance Fraud says that 16% of workers’ comp claims are fraudulent, adding up to $9 billion in annual losses. Such losses hurt businesses, insurers and states. But you can help reduce the possibility that a scheme will be perpetrated in your organization.

Common employee and employer schemes

Employees violate workers’ comp rules if they file claims for injuries they didn’t experience or injuries or illnesses they did experience, but not at work. Workers’ comp fraudsters also might exaggerate the severity of their injuries or illnesses, or falsely state that they can’t work in any capacity while receiving benefits. For example, an employee who breaks a finger with a hammer in his home workshop might file a workers’ comp claim that says he broke the finger on his company’s production line. Or he may claim that not just his finger, but his arm, too, is broken and that he can’t work at all until his breaks heal — even though these are lies.

Employers are responsible for contributing to workers’ compensation funds for all of their employees. And it’s important to acknowledge that some employers engage in workers’ comp fraud. They might, for instance, misclassify employees as independent contractors (for whom they don’t have to pay insurance) or understate the number of people on their payrolls. Or they might “forget” to buy workers’ comp insurance altogether. So, to protect employees and avoid serious legal trouble, make sure your business complies with all your state’s labor rules and requirements.

Prevention tips

As for preventing employee-perpetrated workers’ comp fraud, you should craft comprehensive policies and procedures. Your employees need to know what to do if there’s an accident. They also need to understand the difference between legitimate claims and fraud — and the ramifications of making false claims (such as termination or legal action).

Mitigating fraud threats starts before you hire workers. As part of the background check process, look for records that indicate prospective employees have committed workers’ comp fraud at previous jobs. Then, during new employee training, explain your process for validating the authenticity of claims and disclose that your insurance company may assign its own investigators to scrutinize them.

If employees file workers’ comp claims, trust that the paperwork is legitimate but verify the claims anyway. If possible, secure witness testimony from coworkers, customers and other witnesses, and gather any supporting evidence such as surveillance footage and timecards. Increasingly, workers’ comp fraudsters get caught in lies based on their social media posts. So if an employee says she must rest in bed for six weeks but you see recent photos on her Facebook page of her partying with friends, be sure to collect the evidence.

Exercise care

Fraudulent workers’ comp claims cost businesses, insurance companies and states billions of dollars every year. As with other types of fraud, preventing workers’ comp fraud, including questioning employee claims, can be complicated. For this reason, you should consider engaging an attorney who specializes in labor issues. Your legal counsel can help prevent the inadvertent violation of workers’ rights as you work to get to the bottom of suspicious claims. And contact us if you need help investigating potential occupational fraud.

© 2024