Get Serious About Your Strategic Planning Meetings

Most business owners would likely agree that strategic planning is important. Yet many companies rarely engage in active measures to gather and discuss strategy. Sometimes strategic planning is tacked on to a meeting about something else; other times it occurs only at the annual company retreat when employees may feel out of their element and perhaps not be fully focused.

Businesses should take strategic planning seriously. One way to do so is to hold meetings exclusively focused on discussing your company’s direction, establishing goals and identifying the resources you’ll need to achieve them. To get the most from strategy sessions, follow some of the best practices you’d use for any formal business meeting.

Set an agenda

Every strategy session should have an agenda that’s relevant to strategic planning — and only strategic planning. Allocate an appropriate amount of time for each agenda item so that the meeting is neither too long nor too short.

Before the meeting, distribute a document showing who’ll be presenting on each agenda topic. The idea is to create a “no surprises” atmosphere in which attendees know what to expect and can thereby think about the topics in advance and bring their best ideas and feedback.

Lay down rules (if necessary)

Depending on your workplace culture, you may want to state some upfront rules. Address the importance of timely attendance and professional decorum — either in writing or by announcement as the meeting begins.

Every business may not need to do this, but meetings that become hostile or chaotic with personal conflicts or “side chatter” can undermine the purpose of strategic planning. Consider whether to identify conflict resolution methods that participants must agree to follow.

Choose a facilitator

A facilitator should oversee the meeting. He or she is responsible for:

- Starting and ending on time,

- Transitioning from one agenda item to the next,

- Enforcing the rules as necessary,

- Motivating participation from everyone, and

- Encouraging a positive, productive atmosphere.

If no one at your company feels up to the task, you could engage an outside consultant. Although you’ll need to vet the person carefully and weigh the financial cost, a skilled professional facilitator can make a big difference.

Keep minutes

Recording the minutes of a strategic planning meeting is essential. An official record will document what took place and which decisions (if any) were made. It will also serve as a log of potentially valuable ideas or future agenda items.

In addition, accurate meeting minutes will curtail miscommunications and limit memory lapses of what was said and by whom. If no record is kept, people’s memories may differ about the conclusions reached and disagreements could later arise about where the business is striving to head.

Gather ’round

By gathering your best and brightest to discuss strategic planning, you’ll put your company in a stronger competitive position. Contact our firm for help laying out some of the tax, accounting and financial considerations you’ll need to talk about.

© 2021

A critical deadline is approaching for many of the businesses that have received loans under the Paycheck Protection Program (PPP), which was created in March 2020 by the CARES Act. If these borrowers don’t take action before the deadline expires, their loans will become standard loans, and the borrowers could be responsible for repaying the full amount plus 1% interest before the maturity date. In addition, some borrowers could face audits.

PPP basics

PPP loans generally are 100% forgivable if the borrower allocates the funds on a 60/40 basis between payroll and eligible nonpayroll costs. Nonpayroll costs initially included only mortgage interest, rent, utilities and interest on any other existing debt, but the Consolidated Appropriations Act (CAA), enacted in late 2020, significantly expanded the eligible nonpayroll costs. For example, the funds can be applied to certain operating expenses and worker protection expenses.

The CAA also withdrew the original requirement that borrowers deduct the amount of any Small Business Administration (SBA) Economic Injury Disaster Loan (EIDL) advance from their PPP forgiveness amount. And it provides that a borrower doesn’t need to include any forgiven amounts in its gross income and can deduct otherwise deductible expenses paid for with forgiven PPP proceeds.

Forgiveness filings

PPP borrowers can apply for forgiveness at any time before their loans’ maturity date (loans made before June 5, 2020, generally have a two-year maturity, while loans made on or after that date have a five-year maturity). But, if a borrower doesn’t apply for forgiveness within 10 months after the last day of the “covered period” — the eight-to-24 weeks following disbursement during which the funds must be used — its PPP loan payments will no longer be deferred and it must begin making payments to its lender.

That 10-month period is coming to an end for many so-called “first-draw” borrowers. For example, a business that applied early in the program might have a covered period that ended on October 30, 2020. It would need to apply for forgiveness by August 30, 2021, to avoid loan repayment responsibilities.

Borrowers apply for forgiveness by filing forms with their lenders, who’ll then submit the forms to the SBA. The specific type of form needed to be filed is dependent on the amount of the loan and whether a business is a sole proprietor, independent contractor or self-employed individual with no employees.

If the SBA doesn’t forgive a loan or forgives only part of it, the lender will notify the borrower when the first payment is due. Interest accrues during the time from disbursement of the loan proceeds to SBA remittance to the lender of the forgiven amount, and the borrower must pay the accrued interest on any amount not forgiven.

Some businesses may have delayed filing their forgiveness applications to maximize their employee retention tax credits. That’s because qualified wages paid after March 12, 2020, through December 31, 2021, that are taken into account for purposes of calculating the credit amount can’t be included when calculating eligible payroll costs for PPP loan forgiveness. These businesses should pay careful attention to when their 10-month period expires to avoid triggering loan repayment.

Audit action

Borrowers also should be aware of the possibility that they’ll be audited by the SBA’s Office of Inspector General, with support from the IRS and other federal agencies. The SBA will automatically audit every loan that’s more than $2 million after the borrower applies for forgiveness, but smaller loans may be subject to scrutiny, too.

Although the SBA has established an audit safe harbor for loans of $2 million or less, that carveout applies only to the examination of the borrower’s good faith certification on the loan application that the “current economic uncertainty makes the loan request necessary to support the ongoing operations” of the business. The SBA also recently notified lenders that it’s eliminating the loan necessity requirement for loans of more than $2 million. Those borrowers will no longer need to complete a burdensome Loan Necessity Questionnaire.

All borrowers, however, still might be audited on matters such as eligibility (for example, the number of employees), calculation of the loan amount, how the funds were used and entitlement to forgiveness. Borrowers that receive adverse audit findings may be required to repay their loans and, depending on the missteps uncovered, could face civil penalties and prosecution under the federal False Claims Act.

Businesses that received loans of more than $2 million shouldn’t wait to prepare for their audits. They can begin to work with their CPAs now to gather and organize the documents and information that auditors are likely to request, including:

- Financial statements,

- Income and employment tax returns,

- Payroll records for all pay periods within the applicable covered period,

- Calculation of full-time equivalent employees, and

- Bank and other records related to how the funds were used (for example, canceled checks, utility bills, leases and mortgage statements).

Note that some of this documentation will overlap with that required when filing the application for loan forgiveness.

Act now

Businesses nearly always have a lot on their plates, so it’s not surprising that some might not have been laser-focused on the various dates relevant to their PPP loans. Now is the time to ensure that you file your forgiveness application in a timely manner and have the necessary documentation gathered to survive the SBA audit that may follow. Contact us for assistance.

© 2021

Yeo & Yeo, a leading Michigan accounting and advisory firm, is proud to be named an INSIDE Public Accounting (IPA) Top 200 Accounting Firm for the thirteenth consecutive year.

Yeo & Yeo, a leading Michigan accounting and advisory firm, is proud to be named an INSIDE Public Accounting (IPA) Top 200 Accounting Firm for the thirteenth consecutive year.

“It’s an honor to be continuously recognized as one of the top 200 firms in the nation,” said President & CEO Thomas Hollerback. “We are thankful to our clients who put their trust in Yeo & Yeo and to our people who define the excellence of our firm and culture.”

“We have experienced a very challenging time in history,” added Hollerback. “I am proud of Yeo & Yeo’s ability to quickly adapt and help our clients, our people and our communities navigate the ever-changing environment. We continue to demonstrate our agility in providing our clients with outstanding assurance, tax, technology, wealth management and advisory services.”

This is INSIDE Public Accounting’s 31st annual ranking of the largest accounting firms in the nation. Firms are ranked according to U.S. net revenues and are further analyzed according to responses received for IPA’s Survey and Analysis of Firms.

View the list of top-ranked IPA firms in its entirety.

INSIDE Public Accounting, founded in 1987, is published by The Platt Group. Dedicated to helping firm leaders, and their firms, achieve their ultimate potential, IPA reports and analyzes the news, trends, strategies and politics that affect the nation’s public accounting firms, providing them with the information and resources they need to compete and operate more profitably.

More than 43 million student borrowers are in debt with an average of $39,351 each, according to the research group EducationData.org. If you have student loan debt, you may wonder if you can deduct the interest you pay. The answer is yes, subject to certain limits. However, the deduction is phased out if your adjusted gross income exceeds certain levels — and they aren’t as high as the income levels for many other deductions.

Basics of the deduction

The maximum amount of student loan interest you can deduct each year is $2,500. The interest must be for a “qualified education loan,” which means a debt incurred to pay tuition, room and board, and related expenses to attend a post-high school educational institution, including certain vocational schools. Post-graduate programs may also qualify. For example, an internship or residency program leading to a degree or certificate awarded by an institution of higher education, hospital, or health care facility offering post-graduate training can qualify.

It doesn’t matter when the loan was taken out or whether interest payments made in earlier years on the loan were deductible or not.

For 2021, the deduction is phased out for single taxpayers with AGI between $70,000 and $85,000 ($140,000 and $170,000 for married couples filing jointly). The deduction is unavailable for single taxpayers with AGI of more than $85,000 ($170,000 or married couples filing jointly).

Married taxpayers must file jointly to claim this deduction.

The deduction is taken “above the line.” In other words, it’s subtracted from gross income to determine AGI. Thus, it’s available even to taxpayers who don’t itemize deductions.

Not eligible

No deduction is allowed to a taxpayer who can be claimed as a dependent on another tax return. For example, let’s say a parent is paying for the college education of a child whom the parent is claiming as a dependent. In this case, the interest deduction is only available for interest the parent pays on a qualifying loan, not for any of the interest the child may pay on a loan the student may have taken out. The child will be able to deduct interest that is paid in later years when he or she is no longer a dependent.

Other requirements

The interest must be on funds borrowed to cover qualified education costs of the taxpayer or his spouse or dependent. The student must be a degree candidate carrying at least half the normal full-time workload. Also, the education expenses must be paid or incurred within a reasonable time before or after the loan is taken out.

Taxpayers must keep records to verify qualifying expenditures. Documenting a tuition expense isn’t likely to pose a problem. However, care should be taken to document other qualifying education-related expenses including books, equipment, fees, and transportation.

Documenting room and board expenses should be straightforward for students living and dining on campus. Student who live off campus should maintain records of room and board expenses, especially when there are complicating factors such as roommates.

Contact us if you’d like help in determining whether you qualify for this deduction or if you have questions about it.

© 2021

Do you play a major role in a closely held corporation and sometimes spend money on corporate expenses personally? These costs may wind up being nondeductible both by an officer and the corporation unless proper steps are taken. This issue is more likely to arise in connection with a financially troubled corporation.

Deductible vs. nondeductible expenses

In general, you can’t deduct an expense you incur on behalf of your corporation, even if it’s a legitimate “trade or business” expense and even if the corporation is financially troubled. This is because a taxpayer can only deduct expenses that are his own. And since your corporation’s legal existence as a separate entity must be respected, the corporation’s costs aren’t yours and thus can’t be deducted even if you pay them.

What’s more, the corporation won’t generally be able to deduct them either because it didn’t pay them itself. Accordingly, be advised that it shouldn’t be a practice of your corporation’s officers or major shareholders to cover corporate costs.

When expenses may be deductible

On the other hand, if a corporate executive incurs costs that relate to an essential part of his or her duties as an executive, they may be deductible as ordinary and necessary expenses related to his or her “trade or business” of being an executive. If you wish to set up an arrangement providing for payments to you and safeguarding their deductibility, a provision should be included in your employment contract with the corporation stating the types of expenses which are part of your duties and authorizing you to incur them. For example, you may be authorized to attend out-of-town business conferences on the corporation’s behalf at your personal expense.

Alternatively, to avoid the complete loss of any deductions by both yourself and the corporation, an arrangement should be in place under which the corporation reimburses you for the expenses you incur. Turn the receipts over to the corporation and use an expense reimbursement claim form or system. This will at least allow the corporation to deduct the amount of the reimbursement.

Contact us if you’d like assistance or would like to discuss these issues further.

© 2021

Analytical software tools will never fully replace auditors, but they can help auditors do their work more efficiently and effectively. Here’s an overview of how data analytics — such as outlier detection, regression analysis and semantic modeling — can enhance the audit process.

Auditors bring experience and professional skepticism

When it’s appropriate, instead of manually testing a representative data sample, auditors can use analytical software tools to compare an entire data population against selected criteria. This process quickly identifies anomalies hidden in large amounts of data that can be tagged for further examination by auditors during fieldwork. Analytical software tools can test various kinds of data, including accounting, internal communications and documents, and external benchmarking data.

If unusual transactions or trends are found, auditors will investigate them further using the following procedures:

- Interviewing management about what happened and why,

- Conducting external research online and from industry publications to independently understand what happened or to verify management’s explanation, and

- Performing additional manual testing procedures to determine the nature of the anomaly or exception.

In addition, confirmations and representation letters from attorneys, customers and other external parties may corroborate what management says and external research reveals.

Audit findings may require action

Often, auditors conclude that irregularities have reasonable explanations. For instance, they may be due to an unexpected change in the company’s operations or external market conditions. If a change is expected to continue, it may alter the auditor’s expectations about the company’s operations going forward. Sometimes, a change discovered while auditing one part of the financials may affect audit procedures (including analytics) that will be performed on other accounts.

Alternatively, auditors may attribute some irregularities to inadvertent mistakes or intentional fraud schemes. Auditors usually communicate with the audit committee or the company’s owners as soon as possible if they discover any material errors or fraud. These irregularities might require adjustments to the financial statements. The company also might need to take action to mitigate financial losses and prevent the problem from recurring.

For example, the controller may need additional training on recent changes to the tax and accounting rules. Or management may need to implement additional internal control procedures to safeguard against dishonest behaviors. Or the owner may need to contact the company’s attorney and hire a forensic accountant to perform a formal fraud investigation.

Audit smarter

Today, companies generate, process and store massive amounts of electronic data on their networks. Increasingly, auditors are using analytical tools on this data to conduct basic audit procedures, such as vouching transactions and comparing data to external benchmarks. This frees up auditors to focus their efforts on complex transactions, suspicious relationships and high-risk accounts. Contact us for more information about how our auditors use analytical software tools in the field.

© 2021

Yeo & Yeo CPAs & Business Consultants is pleased to announce the promotion of Zaher Basha and Taylor Diener to Senior Manager.

Zaher Basha, CPA, CM&AA, has  been promoted to Senior Manager. His areas of expertise include tax planning and preparation, business advisory services, business valuation, and mergers and acquisitions, with an emphasis on the healthcare industry. He is a member of the firm’s Healthcare Services Group and the Business Valuation and Litigation Support Services Group. As a Certified Merger & Acquisition Advisor, Basha provides clients with in-depth expertise on all aspects of the merger and acquisition process, from due diligence and financial modeling to business valuation, negotiations and transaction closing.

been promoted to Senior Manager. His areas of expertise include tax planning and preparation, business advisory services, business valuation, and mergers and acquisitions, with an emphasis on the healthcare industry. He is a member of the firm’s Healthcare Services Group and the Business Valuation and Litigation Support Services Group. As a Certified Merger & Acquisition Advisor, Basha provides clients with in-depth expertise on all aspects of the merger and acquisition process, from due diligence and financial modeling to business valuation, negotiations and transaction closing.

Basha is a member of the Michigan Association of Certified Public Accountants’ Healthcare Task Force, the Auburn Hills Chamber of Commerce and the Troy Chamber of Commerce. In the community, he serves as treasurer of the Muhammad Ali Center and the Syrian American Rescue Network. He also volunteers for The Syria Institute.

Taylor Diener, CPA,  has been promoted to Senior Manager. Diener is a member of the firm’s Education Services Group and Audit Services Group. Her areas of expertise include audits for school districts, nonprofits, for-profit businesses and government entities.

has been promoted to Senior Manager. Diener is a member of the firm’s Education Services Group and Audit Services Group. Her areas of expertise include audits for school districts, nonprofits, for-profit businesses and government entities.

Diener is a member of the Michigan School Business Officials (MSBO) and has presented at MSBO annual conferences. She is also a frequent contributor to the Yeo & Yeo blog, providing audit and compliance insights for education and nonprofit organizations. In the community, Diener serves as treasurer of the PartnerShift Network.

The COVID-19 pandemic has dramatically affected the way people interact and do business. Even before the crisis, there was a trend toward more digital interactions in sales. Many professionals predicted that companies’ experiences during the pandemic would accelerate this trend, and that seems to be coming to pass.

As this transformation continues, your business should review its remote selling processes and regularly consider adjustments to adapt to the “new normal” and stay ahead of the competition.

3 tips to consider

How can you maximize the tough lessons of 2020 and beyond? Here are three tips for keeping your remote sales operations sharp:

1. Stay focused on targeted sales. Remote sales can seemingly make it possible to sell to anyone, anywhere, anytime. Yet trying to do so can be overwhelming and lead you astray. Choose your sales targets carefully. For example, it’s typically far easier to sell to existing customers with whom you have an established relationship or to prospects that you’ve thoroughly researched.

Indeed, in the current environment, it’s even more critical to really know your customers and prospects. Determine whether and how their buying capacity and needs have changed because of the pandemic and resulting economic changes — and adjust your sales strategies accordingly.

2. Leverage technology. For remote selling to be effective, it needs to work seamlessly and intuitively for you and your customers or prospects. You also must recognize technology’s limitations.

Even with the latest solutions, salespeople may be unable to pick up on body language and other visual cues that are more readily apparent in a face-to-face meeting. That’s why you shouldn’t forego in-person sales calls if safe and feasible — particularly when it comes to closing a big deal.

In addition to video, other types of technology can enhance or support the sales process. For instance, software platforms that enable you to create customized, interactive, visually appealing presentations can help your sales staff meet some of the challenges of remote interactions. In addition, salespeople can use brandable “microsites” to:

- Share documents and other information with customers and prospects,

- Monitor interactions and respond quickly to questions, and

- Appropriately tailor their follow-ups.

Also, because different customers have different preferences, it’s a good idea to offer a variety of communication platforms — such as email, messaging apps, videoconferencing and live chat.

3. Create an outstanding digital experience. Customers increasingly prefer the convenience and comfort of self-service and digital interactions. So, businesses need to ensure that customers’ experiences during these interactions are positive. This requires maintaining an attractive, easily navigable website and perhaps even offering a convenient, intuitive mobile app.

An important role

The lasting impact of the pandemic isn’t yet clear, but remote sales will likely continue to play an important role in the revenue-building efforts of many companies. We can help you assess the costs of your technology and determine whether you’re getting a solid return on investment.

© 2021

If you’re planning your estate, or you’ve recently inherited assets, you may be unsure of the “cost” (or “basis”) for tax purposes.

The current rules

Under the current fair market value basis rules (also known as the “step-up and step-down” rules), an heir receives a basis in inherited property equal to its date-of-death value. So, for example, if your grandmother bought stock in 1935 for $500 and it’s worth $1 million at her death, the basis is stepped up to $1 million in the hands of your grandmother’s heirs — and all of that gain escapes federal income tax.

The fair market value basis rules apply to inherited property that’s includible in the deceased’s gross estate, and those rules also apply to property inherited from foreign persons who aren’t subject to U.S. estate tax. It doesn’t matter if a federal estate tax return is filed. The rules apply to the inherited portion of property owned by the inheriting taxpayer jointly with the deceased, but not the portion of jointly held property that the inheriting taxpayer owned before his or her inheritance. The fair market value basis rules also don’t apply to reinvestments of estate assets by fiduciaries.

Gifting before death

It’s crucial to understand the current fair market value basis rules so that you don’t pay more tax than you’re legally required to.

For example, in the above example, if your grandmother decides to make a gift of the stock during her lifetime (rather than passing it on when she dies), the “step-up” in basis (from $500 to $1 million) would be lost. Property that has gone up in value acquired by gift is subject to the “carryover” basis rules. That means the person receiving the gift takes the same basis the donor had in it ($500 in this example), plus a portion of any gift tax the donor pays on the gift.

A “step-down” occurs if someone dies owning property that has declined in value. In that case, the basis is lowered to the date-of-death value. Proper planning calls for seeking to avoid this loss of basis. Giving the property away before death won’t preserve the basis. That’s because when property that has gone down in value is the subject of a gift, the person receiving the gift must take the date of gift value as his basis (for purposes of determining his or her loss on a later sale). Therefore, a good strategy for property that has declined in value is for the owner to sell it before death so he or she can enjoy the tax benefits of the loss.

Change on the horizon?

Be aware that President Biden has proposed ending the ability to step-up the basis for gains in excess of $1 million. There would be exemptions for family-owned businesses and farms. Of course, any proposal must be approved by Congress in order to be enacted.

These are the basic rules. Other rules and limits may apply. For example, in some cases, a deceased person’s executor may be able to make an alternate valuation election. Contact us for tax assistance when estate planning or after receiving an inheritance. We’ll keep you up to date on any tax law changes.

© 2021

Despite the COVID-19 pandemic, government officials are seeing a large increase in the number of new businesses being launched. From June 2020 through June 2021, the U.S. Census Bureau reports that business applications are up 18.6%. The Bureau measures this by the number of businesses applying for an Employer Identification Number.

Entrepreneurs often don’t know that many of the expenses incurred by start-ups can’t be currently deducted. You should be aware that the way you handle some of your initial expenses can make a large difference in your federal tax bill.

How to treat expenses for tax purposes

If you’re starting or planning to launch a new business, keep these three rules in mind:

- Start-up costs include those incurred or paid while creating an active trade or business — or investigating the creation or acquisition of one.

- Under the tax code, taxpayers can elect to deduct up to $5,000 of business start-up and $5,000 of organizational costs in the year the business begins. As you know, $5,000 doesn’t go very far these days! And the $5,000 deduction is reduced dollar-for-dollar by the amount by which your total start-up or organizational costs exceed $50,000. Any remaining costs must be amortized over 180 months on a straight-line basis.

- No deductions or amortization deductions are allowed until the year when “active conduct” of your new business begins. Generally, that means the year when the business has all the pieces in place to start earning revenue. To determine if a taxpayer meets this test, the IRS and courts generally ask questions such as: Did the taxpayer undertake the activity intending to earn a profit? Was the taxpayer regularly and actively involved? Did the activity actually begin?

Eligible expenses

In general, start-up expenses are those you make to:

- Investigate the creation or acquisition of a business,

- Create a business, or

- Engage in a for-profit activity in anticipation of that activity becoming an active business.

To qualify for the election, an expense also must be one that would be deductible if it were incurred after a business began. One example is money you spend analyzing potential markets for a new product or service.

To be eligible as an “organization expense,” an expense must be related to establishing a corporation or partnership. Some examples of organization expenses are legal and accounting fees for services related to organizing a new business and filing fees paid to the state of incorporation.

Plan now

If you have start-up expenses that you’d like to deduct this year, you need to decide whether to take the election described above. Recordkeeping is critical. Contact us about your start-up plans. We can help with the tax and other aspects of your new business.

© 2021

Yeo & Yeo CPAs & Business Consultants is pleased to announce that Marisa Ahrens, CPA, will lead the firm’s Employee Benefit Plan Audit Services Group.

Ahrens specializes in employee benefit plan audits and advisory services, including defined contributions, 401(k) and 403(b) plan audits, defined benefit plan audits, employee stock ownership plan (ESOP) audits, internal controls, and efficiency consulting. Ahrens is a Senior Manager based in Yeo & Yeo’s Saginaw office. She has more than 12 years of experience providing audits for nonprofits, healthcare organizations and for-profit companies, with specialized training and expertise in employee benefit plan audits.

Ahrens specializes in employee benefit plan audits and advisory services, including defined contributions, 401(k) and 403(b) plan audits, defined benefit plan audits, employee stock ownership plan (ESOP) audits, internal controls, and efficiency consulting. Ahrens is a Senior Manager based in Yeo & Yeo’s Saginaw office. She has more than 12 years of experience providing audits for nonprofits, healthcare organizations and for-profit companies, with specialized training and expertise in employee benefit plan audits.

“We are excited to have Marisa as the leader of our Employee Benefit Plan Audit Services Group,” said Principal and assurance service line leader Dave Youngstrom. “She is an experienced employee benefit plan auditor with deep expertise in the requirements of the American Institute of Certified Public Accountants (AICPA), Department of Labor, Employee Retirement Income Security Act (ERISA) and IRS. She has a strong dedication to serving our clients and is an outstanding mentor to members of the team.”

Ahrens is a member of the Michigan Association of Certified Public Accountants and the American Institute of Certified Public Accountants. She is the treasurer for the Mid-Michigan Children’s Museum and past treasurer for the Saginaw County Business & Education Partnership. She also coaches youth soccer in the Frankenmuth community.

Yeo & Yeo is a select member of the American Institute of Certified Public Accountants (AICPA) Employee Benefit Plan Audit Quality Center, a membership center for eligible CPA firms that perform quality employee benefit plan audits.

Soon you will receive, or you may have already received, a letter from the Michigan Department of Treasury titled “ESA – Statement/Payment Reminder.” This letter is related to your organization’s personal property tax return that was filed with the State in January or February 2021. Please be aware that this letter is legitimate and the taxes assessed will be accurate given that a personal property tax return was, in fact, timely filed on your behalf. The taxes have been assessed by your local assessor based on the cost of personal property held at your organization’s address.

When you receive the letter, please follow the steps within to log in to your MTO account and pay the amount due by August 15, 2021. If you have any questions, please contact us.

No matter the size or shape of a business, one really can’t overstate the importance of sound accounts receivable policies and procedures. Without a strong and steady inflow of cash, even the most wildly successful company will likely stumble and could even collapse.

If your collections aren’t as efficient as you’d like, consider these five ways to improve them:

1. Redesign your invoices. It may seem superficial, but the design of invoices really does matter. Customers prefer bills that are aesthetically pleasing and easy to understand. Sloppy or confusing invoices will likely slow down the payment process as customers contact you for clarification rather than simply remit payment. Of course, accuracy is also critical to reducing questions and speeding up payment.

2. Appoint a collections champion. At some companies, there may be several people handling accounts receivable but no one primarily focusing on collections. Giving one employee the ultimate responsibility for resolving past due invoices ensures the “collection buck” stops with someone. If budget allows, you could even hire an accounts receivable specialist to fill this role.

3. Expand your payment options. The more ways customers can pay, the easier it is for them to pay promptly. Although some customers still like traditional payment options such as mailing a check or submitting a credit card number, more and more people now prefer the convenience of mobile payments via a dedicated app or using third-party services such as PayPal, Venmo or Square.

4. Get acquainted (or reacquainted) with your customers. If your business largely engages in B2B transactions, many of your customers may have specific procedures that you must follow to properly format and submit invoices. Review these procedures and be sure your staff is following them carefully to avoid payment delays. Also, consider contacting customers a couple of days before payment is due — especially for large payments — to verify that everything is on track.

5. Generate accounts receivable aging reports. Often, the culprit behind slow collections is a lack of timely, accurate data. Accounts receivable aging reports provide an at-a-glance view of each customer’s current payment status, including their respective outstanding balances. Aging reports typically track the payment status of customers by time periods, such as 0–30 days, 31–60 days, 61–90 days and 91+ days past due.

With easy access to this data, you’ll have a better idea of where to focus your efforts. For example, you can concentrate on collecting the largest receivables that are the furthest past due. Or you can zero in on collecting receivables that are between 31 and 60 days outstanding before they get any further behind.

Need help setting up aging reports or improving the ones you’re currently running? Please let us know — we’d be happy to help with this or any aspect of improving your accounts receivable processes.

© 2021

Do you have significant investment-related expenses, including the cost of subscriptions to financial services, home office expenses and clerical costs? Under current tax law, these expenses aren’t deductible through 2025 if they’re considered investment expenses for the production of income. But they’re deductible if they’re considered trade or business expenses.

For years before 2018, production-of-income expenses were deductible, but they were included in miscellaneous itemized deductions, which were subject to a 2%-of-adjusted-gross-income floor. (These rules are scheduled to return after 2025.) If you do a significant amount of trading, you should know which category your investment expenses fall into, because qualifying for trade or business expense treatment is more advantageous now.

In order to deduct your investment-related expenses as business expenses, you must be engaged in a trade or business. The U.S. Supreme Court held many years ago that an individual taxpayer isn’t engaged in a trade or business merely because the individual manages his or her own securities investments — regardless of the amount or the extent of the work required.

A trader vs. an investor

However, if you can show that your investment activities rise to the level of carrying on a trade or business, you may be considered a trader, who is engaged in a trade or business, rather than an investor, who isn’t. As a trader, you’re entitled to deduct your investment-related expenses as business expenses. A trader is also entitled to deduct home office expenses if the home office is used exclusively on a regular basis as the trader’s principal place of business. An investor, on the other hand, isn’t entitled to home office deductions since the investment activities aren’t a trade or business.

Since the Supreme Court decision, there has been extensive litigation on the issue of whether a taxpayer is a trader or investor. The U.S. Tax Court has developed a two-part test that must be satisfied in order for a taxpayer to be a trader. Under this test, a taxpayer’s investment activities are considered a trade or business only where both of the following are true:

- The taxpayer’s trading is substantial (in other words, sporadic trading isn’t considered a trade or business), and

- The taxpayer seeks to profit from short-term market swings, rather than from long-term holding of investments.

Profit in the short term

So, the fact that a taxpayer’s investment activities are regular, extensive and continuous isn’t in itself sufficient for determining that a taxpayer is a trader. In order to be considered a trader, you must show that you buy and sell securities with reasonable frequency in an effort to profit on a short-term basis. In one case, a taxpayer who made more than 1,000 trades a year with trading activities averaging about $16 million annually was held to be an investor rather than a trader because the holding periods for stocks sold averaged about one year.

Contact us if you have questions or would like to figure out whether you’re an investor or a trader for tax purposes.

© 2021

Throughout the pandemic, the government has strived to lessen the impact on employers. Through various pieces of legislation, credit and grant programs have emerged. One such relief program, the Employee Retention Credit, provides refundable credits to employers. And thanks to year-end legislation, employers who participated in the Paycheck Protection Program also became eligible to receive the ERC. Read more about how to qualify and claim the credit.

The interaction between various pandemic programs and other factors raises questions about how to account for the credit. Let’s take a closer look at GAAP reporting and considerations for nonprofit organizations.

Accounting for the ERC under US GAAP

Nonprofit entities following US GAAP must account for the credit under ASC Subtopic 958-605 as a nonexchange transaction with a governmental entity that is accounted for as a conditional contribution. Organizations must consider the circumstances as of the period end date. Certain conditions must be met to claim the credit, for example, a decline in gross receipts and incurring qualified payroll and health care costs. When an organization has a PPP loan, eligible expenses cannot be used for both PPP forgiveness and the ERC (in other words, no double-dipping). The same holds for other government grants in which a nonprofit organization participates. Management must carefully allocate specific wages between the programs to ensure expenses are used only once.

If the conditions for eligibility are met as of the period end date, then the credit would be recorded as grant revenue under Subtopic 958-605 and reflected as a refund receivable or reduction of payroll tax liabilities. On the statement of cash flows, the change in refund receivable and/or reduction in payroll tax liabilities would be reflected in cash flows from operating activities. Required disclosures include the accounting method used, significant terms of the credit program, relevant information about the line items and amounts included in the financial statements, and the conditions that have not been substantially met (if applicable).

Subsequent events

Organizations that received the PPP loan were originally not eligible to receive the ERC under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was passed in March 2020. However, the Consolidated Appropriates Act of 2021, which passed in late December 2020, later enabled PPP loan recipients to also claim the ERC. Newly eligible employers can retroactively claim the credit by filing amended Form 941 returns for 2020. Organizations with a 12/31/20 fiscal year-end or later should reflect the subsequently claimed credit as of the financial statement date if the financial statements haven’t been issued yet.

Suppose financial statements were already issued before claiming the refundable credit. In that case, management must assess the facts and circumstances to determine the appropriate way to reflect the change on the next financial statements. The change in prior period information would be considered a change in estimate. If the estimate was made in good faith, then the financial statements can reflect the change on a prospective basis. If the organization missed information readily available to them when the estimate was made, a prior period adjustment would be appropriate.

Contact us with questions about claiming and accounting for the ERC.

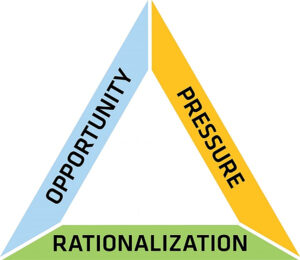

The fraud triangle was introduced by Donald Cressey in the 1970s. Those who lead nonprofit organizations should understand this model for explaining the factors that cause someone to commit fraud – it’s still relevant today.

An individual must feel pressure, something that makes them feel a financial burden that they can’t share. For example, this could be unexpected medical bills or a gambling problem. The individual must recognize an opportunity to use their position to ease their financial pressure and not get caught. Nobody else is looking or double-checking, and they have access to the organization’s assets. Most people don’t think of themselves as bad people, so they find ways to rationalize or justify their actions. They might tell themselves, “I’m just borrowing it; I’ll pay it back,” or “I work so hard for this organization, they owe me.

Organizations don’t have control over the pressure an employee is facing or whether or not the employee can rationalize their decisions. However, they can reduce the opportunity that employee has by implementing appropriate internal controls.

Contact Yeo & Yeo for help with implementing fraud prevention and detection measures in your nonprofit organization.

The Fraud Triangle

Yeo & Yeo CPAs & Business Consultants is pleased to announce that Bradley DeVries, CPA, CAE, has been promoted to managing principal of the firm’s Lansing office.

DeVries succeeds Mark Perry, CPA, who has served as the managing principal of the Lansing office for more than 18 years, since 2003. While Perry is stepping down as office managing principal, he will remain an active member of the principal group helping to mentor and foster future leadership. He will continue to dedicate his time and expertise in providing audit, accounting and tax services for the firm’s real estate, nonprofit and government clients.

DeVries succeeds Mark Perry, CPA, who has served as the managing principal of the Lansing office for more than 18 years, since 2003. While Perry is stepping down as office managing principal, he will remain an active member of the principal group helping to mentor and foster future leadership. He will continue to dedicate his time and expertise in providing audit, accounting and tax services for the firm’s real estate, nonprofit and government clients.

“I am grateful for Mark’s continued dedication to the firm and excited for Brad to lead the Lansing office as managing principal,” said president & CEO Thomas Hollerback. “Brad is a talented professional and a strong leader who is committed to helping Yeo & Yeo’s clients succeed.”

In his new role, DeVries is responsible for the day-to-day operations at Yeo & Yeo’s Lansing office, including office growth, personnel and client care. His expertise spans audit, consulting and tax services for nonprofit organizations, affordable housing agencies, trade associations and real estate entities. He is a member of the firm’s Nonprofit, Audit and Real Estate Services Groups. As a Certified Association Executive, DeVries provides clients with in-depth expertise in nonprofit and association management.

DeVries joined Yeo & Yeo in 2005 and was named principal in 2019. He is a member of the Michigan Society of Association Executives and the Michigan Nonprofit Association. He has authored numerous articles and presented at several conferences, including, most recently, the 2021 Michigan Society of Association Executives’ Operations Conference. He is a graduate of Leadership Lansing.

There’s a harsh tax penalty that you could be at risk for paying personally if you own or manage a business with employees. It’s called the “Trust Fund Recovery Penalty” and it applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages.

Because taxes are considered property of the government, the employer holds them in “trust” on the government’s behalf until they’re paid over. The penalty is also sometimes called the “100% penalty” because the person liable and responsible for the taxes will be penalized 100% of the taxes due. Accordingly, the amounts IRS seeks when the penalty is applied are usually substantial, and IRS is aggressive in enforcing the penalty.

Wide-ranging penalty

The Trust Fund Recovery Penalty is among the more dangerous tax penalties because it applies to a broad range of actions and to a wide range of people involved in a business.

Here are some answers to questions about the penalty so you can safely avoid it.

What actions are penalized? The Trust Fund Recovery Penalty applies to any willful failure to collect, or truthfully account for, and pay over Social Security and income taxes required to be withheld from employees’ wages.

Who is at risk? The penalty can be imposed on anyone “responsible” for collection and payment of the tax. This has been broadly defined to include a corporation’s officers, directors and shareholders under a duty to collect and pay the tax as well as a partnership’s partners, or any employee of the business with such a duty. Even voluntary board members of tax-exempt organizations, who are generally exempt from responsibility, can be subject to this penalty under some circumstances. In some cases, responsibility has even been extended to family members close to the business, and to attorneys and accountants.

According to the IRS, responsibility is a matter of status, duty and authority. Anyone with the power to see that the taxes are (or aren’t) paid may be responsible. There’s often more than one responsible person in a business, but each is at risk for the entire penalty. You may not be directly involved with the payroll tax withholding process in your business. But if you learn of a failure to pay over withheld taxes and have the power to pay them but instead make payments to creditors and others, you become a responsible person.

Although a taxpayer held liable can sue other responsible people for contribution, this action must be taken entirely on his or her own after the penalty is paid. It isn’t part of the IRS collection process.

What’s considered “willful?” For actions to be willful, they don’t have to include an overt intent to evade taxes. Simply bending to business pressures and paying bills or obtaining supplies instead of paying over withheld taxes that are due the government is willful behavior. And just because you delegate responsibilities to someone else doesn’t necessarily mean you’re off the hook. Your failure to take care of the job yourself can be treated as the willful element.

Never borrow from taxes

Under no circumstances should you fail to withhold taxes or “borrow” from withheld amounts. All funds withheld should be paid over to the government on time. Contact us with any questions about making tax payments.

© 2021

During the COVID-19 pandemic, school districts received monetary relief from the federal government, but local businesses and communities also helped by donating materials such as personal protective equipment (PPE). How should a school district’s financial records reflect the donated materials received?

Treat the donated PPE similarly to donated commodities. GASB 33 and N50 Nonexchange Transactions in GASB’s Codification of Governmental Accounting and Financial Reporting Standards offer guidance on recording donated materials. The PPE should be recognized as revenue in the school district’s governmental fund statements in the period when all applicable eligibility requirements are met and the resources are available. The school district should record the expenditures following its supplies policy – either as supplies inventory or an expenditure when the revenue is recognized.

The school district should have documentation for how it determined the revenue it recognizes. Maintain records for the quantity of PPE received as accurately as possible – counts performed by the school district or lists provided by the donor are the best documentation to have available. Additionally, the school district should have a basis for valuing the PPE received. If the donor did not provide the value, the school district could use the market prices of similar PPE at the time of donation.

School districts should also maintain records and disclose any donated PPE the donor purchased with federal sources. Disclose the amount of donated federal PPE as a separate footnote in the Schedule of Expenditures of Federal Awards (SEFA) at the fair market value of time of receipt. The amount will not be considered for determining single audit thresholds and is not required to be audited as a major program.

We continue to receive many questions related to accounting for the 2021 school year, and we are here to help you navigate those challenges. Please reach out to your Yeo & Yeo professionals for assistance.

During the past year and a half, many government entities have experienced significant turnover in several positions. Some governments are left scrambling to continue with day-to-day operations while trying to find qualified applicants to fill vacant positions.

Unexpected events and uncertainties about the future make planning for turnover more important than ever, given the changes the pandemic has brought about in the workplace. Governments can take several steps to prepare for turnover and ensure that all duties will be covered during employee vacations, medical leaves, etc. Consider the following measures and create a plan to ensure that your government can continue to run smoothly, no matter what obstacles present themselves.

Accounting procedures are imperative to a well-functioning government. These are considered the “how” when performing accounting functions (cutting checks, processing payroll, etc.). While most government accounting personnel know what their duties are, these day-to-day accounting procedures are often left undocumented in a manual. While it is crucial to have the policies required by state laws approved by the council or board – such as a credit card acceptance policy and electronic transaction policy – it is just as important to document the complete procedures for actually processing transactions. Accounting procedures should be written for each key transaction cycle, typically those include disbursements, receipts, and payroll, to ensure that the day-to-day transactions are being processed and recorded correctly in the event of turnover. Further, it is recommended that these procedures be reviewed and updated frequently to reflect changes in the procedures that result from gaining efficiencies or changes in the software.

Once accounting procedures have been well documented, cross-train employees to ensure that all key transaction cycles are covered in the event of turnover and cover vacations or medical leave. Even during holidays, payroll will still need to be processed and checks cut. Cross-training allows employees to take time off without the government suffering as their duties have been well documented, and other departments have been trained to handle the processing of the transactions.

While cross-training is essential, it is also important to consider segregation of duties when determining which employees will cover which key transaction cycles in the event of vacations, turnover, etc. For example, the signer of the checks should not prepare the checks.

Well-documented accounting procedures and cross-training are very useful tools to ensure that the government’s operations can continue during interruptions such as turnover. However, management and the council or board should also know when to ask for external help. The pandemic has resulted in individuals retiring or taking different positions, which can adversely affect operations at the governments if they were responsible for many duties. Combined with a lack of documented procedures, this can cause the government to get behind on day-to-day transactions and annual audits, which may result in increased monitoring by the state and potentially the withholding of funding. Oversight by management and the council or board is necessary as a lack of timely financial reports can indicate that things are falling behind. Limited consulting services are often available through your audit firm, such as cash to accrual entries for audit preparation, capital asset tracking, etc. Discussion with your external auditor is always a good starting place as they work closely with firms that can assist with the day-to-day processing of transactions without impairing their independence.