“Family Glitch” Update: IRS Revises Recent ACA-Related Guidance

Under the Affordable Care Act (ACA), applicable large employers (ALEs) must offer minimum essential health care coverage that’s affordable and provides minimum value to full-time employees and their dependents. An ALE may incur a penalty if at least one full-time employee receives a premium tax credit for buying coverage through a Health Insurance Marketplace (commonly known as an “exchange”).

Recently, the IRS finalized regulations that change the eligibility standards for the premium tax credit. Beginning in 2023, affordability of employer-sponsored coverage for an employee’s family members will be based on the employee’s cost for family coverage, rather than the cost of employee-only coverage. The tax agency took this step to fix what was referred to as “the family glitch.”

The IRS also issued related guidance allowing participants in only non–calendar-year cafeteria plans to revoke their elections for family health coverage midyear to allow one or more family members to enroll in a qualified health plan (QHP) through a Health Insurance Marketplace. This guidance has been revised.

Conditions must be satisfied

According to the revised guidance, any cafeteria plan — regardless of plan year — can be amended to allow prospective midyear election changes from family coverage to employee-only coverage under a group health plan that’s not a health flexible spending account and provides minimum essential coverage. However, the following two conditions must be met:

- One or more related individuals are eligible for a special enrollment period to enroll in a QHP through a Health Insurance Marketplace, or one or more already-covered related individuals seek to enroll in a QHP during the Marketplace’s annual open enrollment period, and

- The election change corresponds to the intended QHP enrollment for new coverage effective beginning no later than the day immediately following the last day of the revoked coverage.

Plans may rely on an employee’s reasonable representation regarding enrollment or intended enrollment in a QHP. The guidance applies to elections that are effective on or after January 1, 2023.

Amendments must be adopted on or before the last day of the plan year in which the changes are allowed. An amendment may be effective retroactively to the first day of that plan year if the plan operates in accordance with the guidance and participants are informed of the amendment. However, amendments for a plan year beginning in 2023 can be adopted on or before the last day of the plan year beginning in 2024.

Flexibility granted

The new family-member enrollment event is optional, but employers that sponsor calendar-year cafeteria plans have been granted the flexibility to offer it under their plans. Although plan amendments may be adopted retroactively as provided in the guidance, election changes to revoke coverage retroactively aren’t permitted. Our firm can help you manage the tax and information-reporting complexities of offering health care coverage.

© 2022

PreviewThese days, most businesses have some intangible assets. The tax treatment of these assets can be complex.

What makes intangibles so complicated?

IRS regulations require the capitalization of costs to:

- Acquire or create an intangible asset,

- Create or enhance a separate, distinct intangible asset,

- Create or enhance a “future benefit” identified in IRS guidance as capitalizable, or

- “Facilitate” the acquisition or creation of an intangible asset.

Capitalized costs can’t be deducted in the year paid or incurred. If they’re deductible at all, they must be ratably deducted over the life of the asset (or, for some assets, over periods specified by the tax code or under regulations). However, capitalization generally isn’t required for costs not exceeding $5,000 and for amounts paid to create or facilitate the creation of any right or benefit that doesn’t extend beyond the earlier of 1) 12 months after the first date on which the taxpayer realizes the right or benefit or 2) the end of the tax year following the tax year in which the payment is made.

What’s an intangible?

The term “intangibles” covers many items. It may not always be simple to determine whether an intangible asset or benefit has been acquired or created. Intangibles include debt instruments, prepaid expenses, non-functional currencies, financial derivatives (including, but not limited to options, forward or futures contracts, and foreign currency contracts), leases, licenses, memberships, patents, copyrights, franchises, trademarks, trade names, goodwill, annuity contracts, insurance contracts, endowment contracts, customer lists, ownership interests in any business entity (for example, corporations, partnerships, LLCs, trusts, and estates) and other rights, assets, instruments and agreements.

Here are just a few examples of expenses to acquire or create intangibles that are subject to the capitalization rules:

- Amounts paid to obtain, renew, renegotiate or upgrade a business or professional license;

- Amounts paid to modify certain contract rights (such as a lease agreement);

- Amounts paid to defend or perfect title to intangible property (such as a patent); and

- Amounts paid to terminate certain agreements, including, but not limited to, leases of the taxpayer’s tangible property, exclusive licenses to acquire or use the taxpayer’s property, and certain non-competition agreements.

The IRS regulations generally characterize an amount as paid to “facilitate” the acquisition or creation of an intangible if it is paid in the process of investigating or pursuing a transaction. The facilitation rules can affect any type of business, and many ordinary business transactions. Examples of costs that facilitate acquisition or creation of an intangible include payments to:

- Outside counsel to draft and negotiate a lease agreement;

- Attorneys, accountants and appraisers to establish the value of a corporation’s stock in a buyout of a minority shareholder;

- Outside consultants to investigate competitors in preparing a contract bid; and

- Outside counsel for preparation and filing of trademark, copyright and license applications.

Are there any exceptions?

Like most tax rules, these capitalization rules have exceptions. There are also certain elections taxpayers can make to capitalize items that aren’t ordinarily required to be capitalized. The above examples aren’t all-inclusive, and given the length and complexity of the regulations, any transaction involving intangibles and related costs should be analyzed to determine the tax implications.

Need help or have questions?

Contact us to discuss the capitalization rules to see if any costs you’ve paid or incurred must be capitalized or whether your business has entered into transactions that may trigger these rules. You can also contact us if you have any questions.

© 2022

PreviewMost growing small businesses reach a point where the owner looks around at the leadership team and says, “It’s time. We need to offer employees a retirement plan.”

Often, this happens when the company is financially stable enough to administer a retirement plan and make substantive contributions. Other times it occurs when the business grows weary of losing good job candidates because of a less-than-impressive benefits package.

Whatever the reason, if you don’t have a retirement plan and see one in your immediate future, you’ll want to carefully select the one that will work best for your company and its employees. Here are some basics about three of the most tried-and-true plans.

1. 401(k) plans offer flexibility

Available to any employer with one or more employees, a 401(k) plan allows employees to contribute to individual accounts. Contributions to a traditional 401(k) are made pretax, reducing taxable income, but distributions are taxable.

Both employees and employers can contribute. For 2023, employees can contribute up to $22,500 (up from $20,500 in 2022). Participants who are age 50 or older by the end of the year can make an additional “catch-up” contribution of $7,500 (up from $6,500 in 2022). Within limits, employers can deduct contributions made on behalf of eligible employees.

Plans may offer employees a Roth 401(k) option, which, on some level, is the opposite of a traditional 401(k). This is because contributions don’t reduce taxable income currently but distributions are tax-free.

Establishing a 401(k) plan typically requires, among other steps, adopting a written plan and arranging a trust fund for plan assets. Annually, employers must file Form 5500 and perform discrimination testing to ensure the plan doesn’t favor highly compensated employees. With a “safe harbor” 401(k), however, the plan isn’t subject to discrimination testing.

2. Employers fully fund SEP plans

Simplified Employee Pension (SEP) plans are available to businesses of any size. Establishing one requires completing Form 5305-SEP, “Simplified Employee Pension—Individual Retirement Accounts Contribution Agreement,” but there’s no annual filing requirement.

SEP plans are funded entirely by employer contributions, but you can decide each year whether to contribute. Contributions immediately vest with employees. In 2023, contribution limits will be 25% of an employee’s compensation or $66,000 (up from $61,000 in 2022).

SIMPLEs target small businesses

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a type of plan available only to businesses with no more than 100 employees. It’s up to employees whether to contribute. Although employer contributions are required, you can choose whether to:

- Match employee contributions up to 3% of compensation, which can be reduced to as low as 1% in two of five years, or

- Make a 2% nonelective contribution, including to employees who don’t contribute.

Employees are immediately 100% vested in contributions, whether from themselves or their employers. The contribution limit in 2023 will be $15,500 (up from $14,000 in 2022).

A big step forward

Obviously, choosing a retirement plan to offer your employees is just the first step in the implementation process. But it’s a big step forward for any business. Let us help you assess the costs and tax impact of any plan type that you’re considering.

© 2022

PreviewYou create an estate plan to meet technical objectives, such as minimizing gift and estate taxes and protecting your assets from creditors’ claims. But it’s also important to consider “softer,” yet equally critical, goals.

These softer goals may include educating your children or other loved ones on how to manage wealth responsibly. Or, you may want to promote shared family values and encourage charitable giving. Using a family advancement sustainability trust (FAST) is one option to achieve these goals.

Fill the leadership gap

It’s not unusual for the death of the older generation to create a leadership gap within a family. A FAST can help fill this gap by establishing a leadership structure and providing resources to fund educational and personal development activities for younger family members.

For example, a FAST might finance family retreats and educational opportunities. It also might outline specific best practices and establish a governance structure for managing the trust responsibly and effectively.

Form a common governance structure

Typically, FASTs are created in states that 1) allow perpetual, or “dynasty,” trusts that benefit many generations to come, and 2) have directed trust statutes, which make it possible to appoint an advisor or committee to direct the trustee with regard to certain matters. A directed trust statute makes it possible for both family members and trusted advisors with specialized skills to participate in governance and management of the trust.

A common governance structure for a FAST includes four decision-making entities:

- An administrative trustee, often a corporate trustee, that deals with administrative matters but doesn’t handle investment or distribution decisions,

- An investment committee — consisting of family members and an independent, professional investment advisor — to manage investment of the trust assets,

- A distribution committee — consisting of family members and an outside advisor — to help ensure that trust funds are spent in a manner that benefits the family and promotes the trust’s objectives, and

- A trust protector committee — typically composed of one or more trusted advisors — which stands in the shoes of the grantor after his or her death and makes decisions on matters such as appointment or removal of trustees or committee members and amendment of the trust document for tax planning or other purposes.

Explore funding options

Establish a FAST during your lifetime. Doing so helps ensure that the trust achieves your objectives and allows you to educate your advisors and family members on the trust’s purpose and guiding principles.

FASTs generally require little funding when created, with the bulk of the funding provided upon the death of the trust holder. Although funding can come from the estate, a better approach is to fund a FAST with life insurance or a properly structured irrevocable life insurance trust. Using life insurance allows you to achieve the FAST’s objectives without depleting the assets otherwise available for the benefit of your family.

Is a FAST right for you?

If your children or other family members are in line to inherit a large estate, a FAST may be right for you. Properly designed and implemented, this trust type can help prepare your heirs to receive wealth and educate them about important family values and financial responsibility. We can help you determine if a FAST should be part of your estate plan.

© 2022

PreviewQuality Living Systems (QLS) is an organization in Flint that houses and cares for individuals with mental disabilities. The organization helps those who need 24-hour care and those living independently who need help with grocery shopping and other tasks. I have been a part of QLS for around 20 years, and I volunteer whenever I can with fundraisers and other events.

My oldest brother, Jimmy, is a resident in one of their assisted living homes with 11 others. The staff have taken great care of him and even helped him get a job. They cook his meals, host different parties, and make sure to give him a comfortable life.

My oldest brother, Jimmy, is a resident in one of their assisted living homes with 11 others. The staff have taken great care of him and even helped him get a job. They cook his meals, host different parties, and make sure to give him a comfortable life.

It is always great walking into QLS. The residents always have a smile on their faces when you show up. Even though they might not know who you are, they make you feel like the most special person in the world. And the staff are some of the most kind and patient people I know.

When I called to tell the staff at QLS that they had received a Yeo & Yeo Foundation grant, they were ecstatic. Through this experience and my time as the Foundation’s Grant Committee Representative for the Flint office, I have learned that no matter how small, donations of time and treasures go a long way.

I give back because I want to support those who selflessly care for others.

As year-end approaches, now is a good time to think about planning moves that may help lower your tax bill for this year and possibly next.

This year likely brought challenges and disruptions that impacted your personal and business financial situation. This year’s planning could be more challenging as you contend with the provisions of the American Rescue Plan Act from 2021 and the new Inflation Reduction Act in 2022.

Yeo & Yeo’s Year-end 2022 Tax Guide provides action items that may help you save tax dollars if you act before year-end. These are just some of the steps that can be taken to save taxes. Not all actions may apply in your particular situation, but you or a family member can likely benefit from many of them.

Next steps

After reviewing the Year-end Tax Guide, reach out to your Yeo & Yeo tax advisor, who can help narrow down the specific actions you can take and tailor a tax plan unique to your current personal and business situation.

Together we can:

- Identify tax strategies and advise you on which tax-saving moves to make.

- Evaluate tax planning scenarios.

- Determine how we can help.

We will continue to monitor tax changes and share information as it becomes available.

Middle-market businesses lose an average of almost $300,000 annually to invoice fraud, according to a recent survey by software company Medius and researcher Censuswide. Invoice fraud can be challenging to spot — and even more difficult to recover from — but your company can take steps to prevent it from happening.

Common types

The most common type of invoice fraud is fraudulent billing. In billing schemes, a real or fake vendor sends an invoice for goods or services that the business never received (and may not have ordered in the first place). Overbilling schemes are similar. Your company may have received goods it ordered, but the vendor’s invoice is higher than agreed upon. Duplicate billing is where a fraud perpetrator sends you the same invoice more than once, even though you’ve already paid.

Employees sometimes commit invoice fraud as well. This can happen when a manager approves payments for personal purchases. In other cases, a manager might create fictitious vendors, issue invoices from the fake vendors and approve the invoices for payment. Such schemes generally are more successful when employees collude. For example, one perpetrator might work in receiving and the other in accounts payable. Or a receiving worker might collude with a vendor or other outside party.

4 steps

To stop invoice fraud and perpetrators from succeeding in their schemes, take the following four steps:

1. Conduct due diligence. Verify the identity of any new supplier before doing business with it. Research its ownership, operating history, registered address and customer reviews, if they exist online. Also, try to find someone who has done business with the vendor and can vouch for its legitimacy. This could be a competitor or an employee who knows the supplier from working at another company.

2. Review invoices carefully and methodically. Don’t “rubber stamp” invoices for payment. Look them over for any red flags, such as unexpected changes in the amount due or unusual payment terms. Manual alterations to an invoice require additional scrutiny, as do invoices from new vendors. If something seems wrong, contact the vendor that issued the invoice to confirm it’s legitimate. If the response lacks credibility or raises additional concerns, decline to pay until you’ve cleared up any confusion.

3. Control the review and approval process. Implement and adhere to antifraud controls when processing invoices. For example, confirm with your receiving department that goods were delivered and check invoices against previous ones from the same vendor to ensure no discrepancies. Also, you may want to require more than one person to approve invoices for payment.

4. Depend on technology solutions. Automating your accounts payable process can help prevent and detect invoice fraud. For example, using optical character recognition (OCR) to scan and read invoices can help ensure they’re paid on time and that the amounts and line items match the prices quoted and any documentation in your company’s financial records. OCR minimizes employee intervention and the potential to divert payments to personal accounts. It also makes collusion with vendors more difficult.

If the worst occurs

Even if you take all precautions, invoice fraud may occur. If you discover a scheme in progress, act quickly to minimize the damage. Notify your bank or credit card company to stop payment on invoices that haven’t yet been paid. And if you intend to file an insurance claim or want to pursue criminal charges, be sure to file a police report.

We can help you and your attorney build a case against a suspect by gathering and analyzing fraud evidence and even testifying in court. Contact us if you need assistance or have questions about invoice fraud.

© 2022

Businesses shut down for many reasons. Some of the reasons that businesses shutter their doors:

- An owner retirement,

- A lease expiration,

- Staffing shortages,

- Partner conflicts, and

- Increased supply costs.

If you’ve decided to close your business, we’re here to assist you in any way we can, including taking care of the various tax obligations that must be met.

For example, a business must file a final income tax return and some other related forms for the year it closes. The type of return to be filed depends on the type of business you have. Here’s a rundown of the basic requirements.

Sole Proprietorships. You’ll need to file the usual Schedule C, “Profit or Loss from Business,” with your individual return for the year you close the business. You may also need to report self-employment tax.

Partnerships. A partnership must file Form 1065, “U.S. Return of Partnership Income,” for the year it closes. You also must report capital gains and losses on Schedule D. Indicate that this is the final return and do the same on Schedules K-1, “Partner’s Share of Income, Deductions, Credits, Etc.”

All Corporations. Form 966, “Corporate Dissolution or Liquidation,” must be filed if you adopt a resolution or plan to dissolve a corporation or liquidate any of its stock.

C Corporations. File Form 1120, “U.S. Corporate Income Tax Return,” for the year you close. Report capital gains and losses on Schedule D. Indicate this is the final return.

S Corporations. File Form 1120-S, “U.S. Income Tax Return for an S Corporation” for the year of closing. Report capital gains and losses on Schedule D. The “final return” box must be checked on Schedule K-1.

All Businesses. Other forms may need to be filed to report sales of business property and asset acquisitions if you sell your business.

Duties involving workers

If you have employees, you must pay them final wages and compensation owed, make final federal tax deposits and report employment taxes. Failure to withhold or deposit employee income, Social Security and Medicare taxes can result in full personal liability for what’s known as the Trust Fund Recovery Penalty.

If you’ve paid any contractors at least $600 during the calendar year in which you close your business, you must report those payments on Form 1099-NEC, “Nonemployee Compensation.”

More tax issues to consider

If your business has a retirement plan for employees, you’ll want to terminate the plan and distribute benefits to participants. There are detailed notice, funding, timing and filing requirements that must be met by a terminating plan. There are also complex requirements related to flexible spending accounts, Health Savings Accounts, and other programs for your employees.

We can assist you with many other complicated tax issues related to closing your business, including debt cancellation, use of net operating losses, freeing up any remaining passive activity losses, depreciation recapture and possible bankruptcy issues.

We can advise you on the length of time you need to keep business records. You also must cancel your Employer Identification Number (EIN) and close your IRS business account.

If your business is unable to pay all the taxes it owes, we can explain the available payment options to you. Contact us to discuss these issues and get answers to any questions.

© 2022

We’re excited for what’s ahead. 2023 marks Yeo & Yeo’s 100th anniversary, and we’re enthusiastically planning for what’s next. We’ve been working hard as a team and have reached out to our clients and communities to help us embrace our authentic differences, our longstanding values, and our vision for the future.

The result? In January, we’ll unveil our new brand identity, which builds upon our story. It spotlights our points of difference: the power of listening, the benefit of our perspective, and the connectedness of our purpose. The Yeo & Yeo name is not changing — but our look, feel, and clarity of message are taking a bold step forward. We simply can’t wait to show you.

Keep an eye out for updates and be the first to see it all by staying in touch with us through our social channels, our website, and email updates.

Defined benefit retirement plans, better known as pensions, have been at risk for decades now. In fact, the Pension Benefit Guaranty Corporation (PBGC), a federal agency dedicated to protecting “the retirement incomes of over 33 million American workers in private sector defined benefit pension plans,” was created under the Employee Retirement Income Security Act of 1974.

One of the functions of the PBGC is to periodically increase the federal guarantee (insurance) limit for pension plans that fail. The annual changes are linked to increases in a Social Security index.

The guarantee formula provides for different limits based on a covered person’s age when that individual begins getting benefits from the PBGC. For example, the limit is lower for people who begin getting benefits at a younger age, reflecting the fact that they’ll receive more monthly pension checks over their expected lifetimes. Conversely, the limit is higher for people who start receiving benefits later in life. In addition, the formula calls for adjustments for retirees who choose a payment form that continues payments to a beneficiary after the retiree’s death.

In October, the PBGC announced that the guarantee limit for single-employer pension plans that are insured by the agency and fail in 2023 will be 8.79% higher than the limit that applied for 2022. A table showing the 2023 guarantee limits for various ages and payment forms — that is, straight-life annuities and joint and 50% survivor annuities — is posted on the PBGC’s website. (The guarantee limit under a separate program for multiemployer plans isn’t indexed and, thus, remains unchanged.)

Earlier in 2022, the PBGC reminded participating employers that the login process for its My Plan Administration Account (PAA) online portal has been modified to meet new federal cybersecurity requirements for public-facing websites. Most notably, there’s now a requirement to implement two-factor authentication. My PAA users may now log in via Login.gov, a secure sign-in service used by the public to access participating government services — including the U.S. Transportation Security Administration’s PreCheck, Social Security and USAJobs. With this new process, users can use the same email address and password to access all participating government services.

Our firm can provide further information on the single-employer guarantee limit, as well as offer support in managing the financial challenges of a pension plan.

© 2022

Estate planning can be one of the hardest topics to talk about. No one likes to confront their own mortality, but there are several things you can do to make it easier on the loved ones you leave behind.

Prepaid funeral arrangements

Arranging for your funeral can be done at any point in your life and can help ensure that your arrangements will be taken care of later. The type of funeral service, the location of your grave, and even what kind of casket or urn you will have can all be planned and paid for in advance. Funeral planning will save friends and family from having to figure out these details in their time of grief.

In Michigan, when you prepay for a funeral, the funeral home may secure your funds in a couple of ways. The funds could be used to purchase a life insurance policy with the funeral home named as the beneficiary, or the funds could be placed in an escrow account in low-risk investments. Funeral homes that use the latter option have a yearly examination by an accountant to ensure your deposit is handled appropriately.

Prepaid funeral arrangements can be guaranteed or non-guaranteed.

- A guaranteed contract means that the funeral home will perform the services you agreed to regardless of the current cost of those services. These types of contracts are an excellent way to ensure there will be no additional expenses for your funeral, but excess funds will not be refunded to the family.

- A non-guaranteed contract will apply the balance of the funds deposited and their earnings toward the current cost of the funeral. With this option, there may be a balance due or a refund of an overpayment.

Either option will allow you to preplan your funeral. Irrevocable funeral contracts are an option for individuals who are on means-tested assistance. These types of contracts cannot be canceled, but can use up excess funds the individual may have received and plan for their funeral at the same time.

Wills, trusts, and designated beneficiaries

A will is a legal document declaring what a person wishes to happen to their property, and a trust is an arrangement where a designated person (or persons) manage assets for the good of one or more beneficiaries. Probate is a court process that handles the distribution of a decedent’s property. A will is still subject to probate but gives direction as to the estate’s executor and how the assets will be distributed.

One way to avoid probate is to transfer all assets into a revocable trust, sometimes referred to as a living trust. The trust document will determine how the assets and income of the trust are to be distributed, name the beneficiaries, and designate a trustee who will manage and execute the trust. Often, living trusts are used in conjunction with a pour-over will that simply designates that any remaining assets in the decedent’s estate will automatically transfer to the trust.

Several account types have their own designated beneficiary and are not subject to probate. These include life insurance policies, some bank accounts, and retirement plans with beneficiaries or payable-on-death designations. For these accounts, it is very important to keep the beneficiary information up to date with your wishes.

Succession planning

For every business owner, it is a good idea to have a long-term succession plan for eventual retirement and an emergency succession plan in case of a sudden emergency. A long-term plan allows you to lay out the future of your business and your involvement in it. Will you eventually sell the business to fund retirement or pass it on to the next generation? Whichever option you elect, planning options are available to help you along the way, including business valuations and gifting. Sometimes, things do not go according to plan, and an unexpected death can leave your business in disarray. Having an emergency succession plan mapped out can give employees and family members guidance and stability while ensuring everything will be handled how you would want.

Which options are best?

The options listed above each have pros and cons that fit different situations and should be considered carefully. Yeo & Yeo’s Trust and Estate Services Group can help you evaluate the best options to serve your situation. Please reach out to us at 800.968.0010.

If you’re taking a second trip down the aisle, you may have different expectations than you did when you got married the first time — especially when it comes to estate planning. For example, if you have children from a previous marriage, your priority may be to provide for them. Or perhaps you feel that your new spouse should have limited rights to your assets compared to those of your spouse from your first marriage.

Unfortunately, the law doesn’t see it that way. In nearly every state, a person’s spouse has certain property rights that apply regardless of the terms of the estate plan. And these rights are the same, whether it’s your first marriage or your second. Here’s an introduction to spousal property rights and strategies you may be able to use to limit them.

Defining a spouse’s “elective share”

Spousal property rights are creatures of state law, so it’s critical to familiarize yourself with the laws in your state to achieve your planning objectives. Most, but not all, states provide a surviving spouse with an “elective share” of the deceased spouse’s estate, regardless of the terms of his or her will or certain other documents.

Generally, a surviving spouse’s elective share ranges from 30% to 50%, though some states start lower and provide for progressively larger shares as the duration of the marriage increases. Perhaps the most significant variable, with respect to planning, is the definition of assets subject to the surviving spouse’s elective share rights.

In some states, the elective share applies only to the “probate estate” — generally, assets held in the deceased spouse’s name alone that don’t have a beneficiary designation. In other states, it applies to the “augmented estate,” which is the probate estate plus certain nonprobate assets. These assets may include revocable trusts, life insurance policies, and retirement or financial accounts that pass according to a beneficiary designation or transfer-on-death designation.

By developing an understanding of how elective share laws apply in your state, you can identify potential strategies for bypassing them.

Using planning strategies

Elective shares are designed to protect surviving spouses from being disinherited. But there may be good reasons for limiting the amount of property that goes to your spouse when you die. For one thing, your spouse may possess substantial wealth in his or her own name. And you may want most of your estate to go to your children from a previous marriage.

Strategies for minimizing the impact of your spouse’s elective share on your estate plan include making lifetime gifts. By transferring property to your children or other loved ones during your lifetime (either outright or through an irrevocable trust), you remove those assets from your probate estate and place them beyond the reach of your surviving spouse’s elective share. If your state uses an augmented estate to determine a spouse’s elective share, lifetime gifts will be protected so long as they’re made before the lookback period or, if permitted, your spouse waives the lookback period.

Seeking professional help

Elective share laws are complex and can vary dramatically from state to state. If you’re remarrying, we can help you evaluate their impact on your estate plan and explore strategies for protecting your assets.

© 2022

An impressive 432,834 new business applications for tax identification numbers were submitted during October 2022, according to the U.S. Census Bureau. Indeed, despite the relatively higher costs of doing business these days, plenty of start-ups are still launching.

One thing that every new company needs, along with a business plan, is a sensible budget. And that holds true for well-established entities as well. Let’s review some fundamentals of budgeting for start-ups, which can also apply in some shape or form to companies that have been around for a while.

Forecast your financial statements

Many businesses that have been up and running for a while base their budgets on the previous year’s financial results. Of course, start-ups lack historical financial statements, which can make budgeting difficult.

For the first year of operation, however, an entrepreneur can create an annual budget by forecasting the monthly numbers that will likely be reflected in the three basic parts of their financial statements:

1. The income statement. Start your annual budget by estimating how much you expect to sell each month. Then, estimate direct costs (such as materials, labor, sales tax and shipping) based on that sales volume. Many operating costs (such as rent, salaries and insurance) will be fixed over the short run.

Once you spread overhead costs over your sales, you might not be able to report a net profit in your first year of operation. Don’t panic! Profitability takes time and hard work. Once you turn a profit, however, remember to save room in your budget for income taxes.

2. The balance sheet. To start generating revenue, you’ll also need equipment and marketing materials — including a website. Other operating assets, such as accounts receivable and inventory, typically move in tandem with revenue. How will you finance these assets? Entrepreneurs may invest personal funds, take out loans or receive money from other investors. These items fall under liabilities and equity on the balance sheet.

3. The statement of cash flows. This report tracks sources and uses of cash from operating, investing and financing activities. Essentially, it shows how your business will make ends meet each month. In addition to acquiring assets, start-ups need to cover fixed monthly expenses.

Ask for help

By forecasting these three statements every month for at least a year, you can identify when cash shortfalls, as well as seasonal peaks and troughs, are likely to occur. Naturally, you should expect to adjust the budget occasionally or even frequently to account for miscalculations and macroeconomic forces.

We can help you put together a realistic budget based on industry benchmarks and market research into the likely demand for your products or services. And, again, even if your company has been operating for a while now, you may be able to gain some helpful insights from having an objective professional review your budget.

© 2022

It’s been a tumultuous year for many businesses, and the current economic climate promises more uncertainty for the short term, if not longer. Regardless of how your company has fared so far in 2022, there’s still time to make moves that may reduce your federal tax liability. Read on for some strategies worth your consideration.

Time your income and expenses

When it comes to year-end tax reduction strategies, the granddaddy of them all — for businesses that use cash-basis accounting — is probably the practice of accelerating deductions into the current tax year and deferring income into the next year. You can accelerate deductions by, for example, paying bills or employee bonuses due in 2023 before year end and stocking up on supplies. Meanwhile, you can defer income by holding off on invoicing until late December or early January.

You should consider this strategy only if you don’t expect to see significantly higher profits next year. If you think you will, flip the approach, accelerating income and pushing deductions into the future when they’ll be more valuable. Also, bear in mind that reducing your income could reduce your qualified business income (QBI) deduction, depending on your business entity.

Maximize your QBI deduction

Pass-through entities (that is, sole proprietors, partnerships, limited liability companies and S corporations) can deduct up to 20% of their QBI, subject to certain limitations based on W-2 wages paid, the unadjusted basis of qualified property and taxable income. The deduction, created by the Tax Cuts and Jobs Act (TCJA), is set to expire after 2025, absent congressional action, so make the most of it while you can.

You could increase your deduction by increasing wages (for example, by converting independent contractors to employees or raising pay for existing employees) or purchasing capital assets. (Of course, these moves usually have other consequences, such as higher payroll taxes, that you should weigh before proceeding.) You can avoid the income limit by timing your income and deductions, as discussed above.

If the W-2 wage limitation doesn’t limit the QBI deduction, S corporation owners can increase their QBI deductions by reducing the wages the business pays them. (This won’t work for sole proprietorships or partnerships, which don’t pay their owners salaries.) Conversely, if the wage limitation does limit the deduction, S corporation owners might be able to take a greater deduction by boosting their wages.

Accelerate depreciation — while you can

The TCJA also increased the Section 168(k) first-year bonus depreciation to 100% of the purchase price, through 2022. Beginning next year, the allowable deduction will drop by 20% each year until it evaporates altogether in 2027 (again, absent congressional action). Combining bonus depreciation with the Section 179 deduction can produce substantial tax savings for 2022.

Under Sec. 179, you can deduct 100% of the purchase price of new and used eligible assets in the year you place them in service — even if they’re only in service for a day or two. Eligible assets include machinery, office and computer equipment, software, and certain business vehicles. The deduction also is available for improvements to nonresidential property.

The maximum Sec. 179 deduction for 2022 is $1.08 million and it begins phasing out on a dollar-for-dollar basis when your qualifying property purchases exceed $2.7 million. The maximum deduction also is limited to the amount of your income from the business, although unused amounts can be carried forward indefinitely.

Alternatively, you can claim excess amounts as bonus depreciation, which is subject to no limits or phaseouts in 2022. Bonus depreciation is available for computer systems, software, vehicles, machinery, equipment, office furniture and qualified improvement property (generally, interior improvements to nonresidential property).

For all their immediate appeal, bonus depreciation and Sec. 179 expensing aren’t always advisable. You may, for example, want to skip accelerated depreciation if you claim the QBI deduction. The deduction is limited by your taxable income, and depreciation reduces such income.

It might be wise to have some depreciation available to offset your income in 2023 through 2025 so you can claim the QBI deduction while it’s still around. You might think twice, too, if you have expiring net operating losses, charitable contributions or credit carryforwards that are affected by taxable income.

The good news is that you don’t have to decide now. As long as you place qualified property in service by December 31, 2022, you have the option of choosing the most advantageous approach when you file your tax return in 2023.

Get real about your bad debts

Business owners are sometimes slow to accept that they’re going to go unpaid for services rendered or goods delivered. If you use accrual-basis accounting, though, facing the facts can land you a bad debt deduction.

The IRS allows businesses to deduct “worthless” debts, in full or in part, that they’ve previously included in their income. To show that a debt is worthless, you need to show that you’ve taken reasonable steps to collect but without success. You aren’t required to go to court if you can show that a judgment from a court would be uncollectible.

You still have time to take reasonable steps to collect outstanding debts. It’s important to keep detailed records of these efforts. If you determine you can’t collect, you may be able to deduct some or all of those debts for 2022.

Start or replace your retirement plan

If you’ve put off establishing a retirement plan, or simply outgrown the plan you started years ago, you have time to possibly trim your taxes this year — and likely improve your employee recruitment and retention at the same time — by starting a new plan. Eligible employers can claim a tax credit of up to $5,000, for the first three years, for the costs of starting a SEP IRA, SIMPLE IRA or a qualified plan such as a 401(k) plan.

The credit is 50% of your costs to set up and administer the plan and educate your employees about it. You can claim up to the greater of $500 or the lesser of:

- $250 multiplied by the number of non-highly compensated employees who are eligible to participate in the plan, or

- $5,000.

You can begin to claim the credit in the tax year before the year the plan becomes effective. And, if you add an auto-enrollment feature, you can claim a tax credit of $500 per year for a three-year period beginning in the first taxable year the feature is included.

Leverage your startup expenses

If you launched a new business this year, you might qualify for a limited deduction for certain costs. The IRS allows you to deduct up to $5,000 of startup costs and $5,000 of organizational costs (such as the costs of creating a partnership). The deduction is reduced by the amount by which your total startup or organizational costs exceed $50,000. You must amortize any remaining costs.

An eligible cost is one that you could deduct if it were paid or incurred to operate an existing business in the same field. Eligible costs also must be paid or incurred before the active business begins. Examples include business analysis costs, advertisements for the business’s opening, travel and other costs related to lining up prospective distributors, suppliers or customers, and certain salaries, wages and fees.

Turn to us for planning advice

Many of the strategies detailed here involve tradeoffs that require thoughtful evaluation and analysis. We can help you make the right choices to minimize your company’s tax bill.

© 2022

For wage reporting purposes, employers periodically need to verify the identities of their employees. To do so, someone in your organization must lay hands and eyes on a worker’s Social Security card, right?

Not necessarily. In the Fall 2022 SSA/IRS Reporter, a quarterly newsletter published by the U.S. Social Security Administration, the federal agency reminds employers that they don’t need to physically inspect an employee’s Social Security card to verify a name and Social Security number.

Instead, employers may use the Social Security Number Verification Service, which is available through the Social Security Administration’s Business Services Online website. The service allows users to immediately verify up to 10 names and Social Security numbers online. Users can also upload up to 250,000 names and Social Security numbers, and usually receive next day results.

If you encounter a mismatch between the Social Security number presented by an employee and the results provided by the Social Security Number Verification Service, don’t immediately take an adverse action such as suspending or terminating the individual. Also keep in mind that a mismatch isn’t indicative of a worker’s immigration status.

Here are some commonly recommended steps to handling a mismatch:

- Review your own employment records to verify the Social Security number.

- Ask the employee to confirm the Social Security number on file.

- Double-check the spelling of the employee’s name — particularly if it’s hyphenated or relatively easy to misspell.

If your records and/or the employee confirms the Social Security number as accurate, but you still get a mismatch, ask the employee to check into the matter with the local Social Security office. Then, resubmit with updated information when it’s available.

In some cases, an employee might refuse to provide a current valid Social Security number. Or you may be unable to reach someone who works remotely. If either circumstance arises, carefully document your efforts to obtain the correct info and retain this documentation for at least three years.

Finally, should you furnish a W-2 with an incorrect name and/or Social Security number, you’ll need to submit a Form W-2c, “Corrected Wage and Tax Statement,” to the IRS. Contact us for further information on wage reporting or other issues related to payroll tax compliance.

© 2022

Did you know that one of the most effective estate-tax-saving techniques is also one of the simplest and most convenient? By making maximum use of the annual gift tax exclusion, you can pass substantial amounts of assets to loved ones during your lifetime without any gift tax. For 2022, the amount is $16,000 per recipient. In 2023, the amount will increase by $1,000, to $17,000 per recipient.

Maximizing your gifts

Despite a common misconception, federal gift tax applies to the giver of a gift, not to the recipient. But gifts can generally be structured so that they’re — at least to a limited degree — sheltered from gift tax. More specifically, they’re covered by the annual gift tax exclusion and, if necessary, the unified gift and estate tax exemption for amounts above the exclusion. (Using the unified exemption during your lifetime, however, erodes the available estate tax shelter.)

For 2022, you can give each family member up to $16,000 a year without owing any gift tax. For instance, if you have three adult children and seven grandchildren, you may give each one up to $16,000 by year end, for a total of $160,000. Then you can turn around and give each one $17,000 beginning in January 2023, for $170,000. In this example, you could reduce your estate by a grand total of $330,000 in a matter of months.

Furthermore, the annual gift exclusion is available to each taxpayer. If you’re married and your spouse consents to a joint gift, also called a “split gift,” the exclusion amount is effectively doubled to $32,000 per recipient in 2022 ($34,000 in 2023).

Bear in mind that split gifts and large gifts trigger IRS reporting responsibilities. A gift tax return is required if you exceed the annual exclusion amount, or you give joint gifts with your spouse. Unfortunately, you can’t file a “joint” gift tax return. In other words, each spouse must file an individual gift tax return for the year in which they both make gifts.

Coordinating with the lifetime exemption

The lifetime gift tax exemption is part and parcel of the unified gift and estate tax exemption. It can shelter from tax gifts above the annual gift tax exclusion. Under current law, the exemption effectively shelters $10 million from tax, indexed for inflation. In 2022, the amount is $12.06 million, and in 2023 the amount will increase to $12.92 million. However, as mentioned above, if you tap your lifetime gift tax exemption, it erodes the exemption amount available for your estate.

Exceptions to the rules

Be aware that certain gifts are exempt from gift tax, thereby preserving both the full annual gift tax exclusion amount and the exemption amount. These include gifts:

- From one spouse to the other,

- To a qualified charitable organization,

- Made directly to a healthcare provider for medical expenses, and

- Made directly to an educational institution for a student’s tuition.

For example, you might pay the tuition for a grandchild’s upcoming school year directly to the college. That gift won’t count against the annual gift tax exclusion.

Planning your gifting strategy

The annual gift tax exclusion remains a powerful tool in your estate-planning toolbox. Contact us for help developing a gifting strategy that works best for your specific situation.

© 2022

It has been quite a year — high inflation, rising interest rates and a bear stock market. While there’s not a lot you can do about any of these financial factors, you may have some control over how your federal tax bill for the year turns out. Here are some strategies to consider executing before year end that may reduce your 2022 or future tax liability.

1. Convert your traditional IRA to a Roth IRA

The down stock market could make this an especially lucrative time to convert all or some of the funds in a traditional pre-tax IRA to an after-tax Roth IRA. Although you must pay income tax on the amount converted in 2022, Roth accounts hold some significant advantages over their traditional counterparts.

Unlike traditional IRAs, for example, Roths aren’t subject to required minimum distributions (RMDs). The funds in a Roth will appreciate tax-free. Qualified future distributions also will be tax-free, which will pay off if you’re subject to higher tax rates at that time, whether due to RMDs or other income.

How does the poorly performing stock market incentivize a Roth conversion? If your traditional IRA contains stocks or mutual funds that have lost significant value, you can convert more shares than you could if they were worth more, for the same amount of tax liability.

Roth conversions are also advisable if you have lower income and therefore are in a lower tax bracket this year. Perhaps you lost your job at the end of 2021 and didn’t resume working until this past summer, or you’re retired but not yet receiving Social Security payments. You may be able to save by converting before the end of the year.

Currently, you can use a Roth conversion as a workaround for the income limits on your ability to contribute to Roth IRAs — what’s known as a backdoor Roth IRA — because converted funds aren’t treated as contributions. But be aware that, if you’re under age 59½, you can’t access the transferred funds without penalty.

Further, be aware that a Roth conversion will likely increase your adjusted gross income (AGI). As such, it could affect your eligibility for tax breaks that phase out based on AGI or modified adjusted gross income (MAGI).

2. Defer or accelerate income and deductions

A common tax reduction technique is to defer income into the next year and accelerate deductions into the current year. Doing so can allow you to make the most of tax breaks that phase out based on income (such as the IRA contribution deduction, child tax credits and education tax credits). If you’re self-employed, for example, you might delay issuing invoices until late December (increasing the odds they won’t be paid until 2023) and make equipment purchases in December, rather than January (assuming you use cash-basis accounting).

On the other hand, you might want to defer deductions and accelerate income if you expect to land in a higher tax bracket in the future. You can accelerate income by, for example, realizing deferred compensation, exercising stock options, recognizing capital gains or engaging in a Roth conversion.

High-income individuals should think about income deferral from the perspective of the 3.8% net investment income tax (NIIT), too. The NIIT kicks in when MAGI is more than $200,000 for single and head of household filers, $250,000 for married filing jointly and $125,000 for married filing separately. Deferring investment income could mean escaping that potentially hefty tax bite.

3. Manage your itemized deductions wisely

Accelerating deductions generally is helpful only if you itemize your deductions, of course. If you don’t think you’ll qualify to itemize, think about “bunching” itemized deductions so that they exceed the standard deduction (in 2022, $12,950 for single filers, $25,900 for married filing jointly and $19,400 for heads of household). If you claim itemized deductions this year and the standard deduction next year, you could end up with a larger two-year total deduction than if you took the standard deduction both years.

Potential expenses ripe for bunching include medical and dental expenses (if you qualify to deduct eligible expenses that exceed 7.5% of your AGI), charitable contributions, and state and local tax (SALT). For example, you could get dental services before year end, make your 2022 and 2023 charitable donations in December of this year, and pre-pay property taxes due next year, if possible.

The deduction for SALT-like property tax generally is subject to a $10,000 cap. Check, though, to determine if you might be able to take advantage of a pass-through entity (PTE) tax. More than two dozen states and New York City have enacted these laws, which permit a PTE to pay state tax at the entity level, rather than the individual taxpayer level. PTEs aren’t subject to a federal limit on SALT deductions.

4. Give to charity

The AGI limit for deductible cash donations has returned to 60% of AGI for 2022. But the possibility for substantial savings from making a charitable donation remains. For example, if you donate appreciated assets that you’ve held at least one year, you can deduct their fair market value and avoid income tax on the amount of appreciation if you itemize.

A qualified charitable distribution (QCD) from your IRA may confer tax benefits. Taxpayers who are age 70½ years or older can make a direct transfer of up to $100,000 per year from their IRAs to a qualified charity — and exclude the transferred amount from their gross income. (Note that transfers to a donor-advised fund or supporting organization don’t qualify). If you’re age 72 or older, a QCD can count toward your RMDs, as well.

You also may want to explore establishing a donor-advised fund. You can set it up and contribute assets in 2022 to claim a deduction for this year, while delaying your selection of the recipient charity and the actual contribution until 2023.

5. Harvest your capital losses

This is another way to leverage the poor market performance in 2022 — selling off your investments that have lost value to offset any capital gains. If your capital losses exceed your capital gains, you can deduct up to $3,000 ($1,500 for married filing separately) a year from your ordinary income and carry forward any remaining excess indefinitely.

You could further juice the benefit of loss harvesting by donating the proceeds from the sale to charity. You’ll offset realized gains while boosting your charitable contribution deduction (subject to AGI limitations on the charitable contribution deduction).

Take heed of the wash-rule, though. It says you can’t write off losses if you acquire “substantially identical” securities within 30 days before or after the sale.

Act now

It’s been a rocky financial year for many people, and uncertainty about the economy will continue into next year. One thing is certain, though — everyone wants to cut their tax bills. Contact us to help you with your year-end tax planning.

© 2022

My husband was killed in action while deployed to Afghanistan in 2006. Shortly after, I was approached by the Saginaw County Veterans Memorial Plaza, which was in search of a treasurer. The Plaza is a beautiful place where you can go to honor and remember those who have passed away or who have served. I felt like it was the right organization to join and be a part of, as I had just lost someone very important to me.

Fourteen years later, I am on my fourth four-year term as treasurer, attending monthly meetings and continuing to support the organization. As a board member, I help plan free public ceremonies on Memorial Day and Veterans Day. When we aren’t putting on ceremonies, we maintain the grounds and the bricks people can buy for their loved ones.

Fourteen years later, I am on my fourth four-year term as treasurer, attending monthly meetings and continuing to support the organization. As a board member, I help plan free public ceremonies on Memorial Day and Veterans Day. When we aren’t putting on ceremonies, we maintain the grounds and the bricks people can buy for their loved ones.

The Plaza relies on its volunteers and donations from the Saginaw area and will put on fundraisers like 5k races to help provide adequate funding. We also hold appreciation lunches around Flag Day for the companies and individuals who have donated their services and time to help take care of the Plaza.

Through giving my time, I have realized that the more people you talk to, the more you understand that everyone has a story. Sometimes they might even have one that is similar to yours. Finding an organization that speaks to you and developing more of a connection by giving your time is key. It is very rewarding, and I think it is our duty to volunteer where we can.

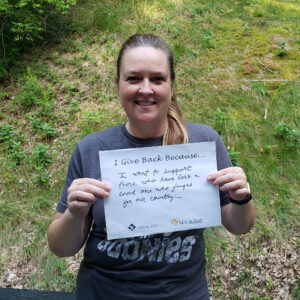

I give back because I want to support those who have lost a loved one fighting for our country.

No one needs to remind business owners that the cost of employee health care benefits keeps going up. One way to provide some of these benefits is through an employer-sponsored Health Savings Account (HSA). For eligible individuals, an HSA offers a tax-advantaged way to set aside funds (or have their employers do so) to meet future medical needs. Here are the key tax benefits:

- Contributions that participants make to an HSA are deductible, within limits.

- Contributions that employers make aren’t taxed to participants.

- Earnings on the funds in an HSA aren’t taxed, so the money can accumulate tax-free year after year.

- Distributions from HSAs to cover qualified medical expenses aren’t taxed.

- Employers don’t have to pay payroll taxes on HSA contributions made by employees through payroll deductions.

Eligibility and 2023 contribution limits

To be eligible for an HSA, an individual must be covered by a “high deductible health plan.” For 2023, a “high deductible health plan” will be one with an annual deductible of at least $1,500 for self-only coverage, or at least $3,000 for family coverage. (These amounts in 2022 were $1,400 and $2,800, respectively.) For self-only coverage, the 2023 limit on deductible contributions will be $3,850 (up from $3,650 in 2022). For family coverage, the 2023 limit on deductible contributions will be $7,750 (up from $7,300 in 2022). Additionally, annual out-of-pocket expenses required to be paid (other than for premiums) for covered benefits for 2023 will not be able to exceed $7,500 for self-only coverage or $15,000 for family coverage (up from $7,050 and $14,100, respectively, in 2022).

An individual (and the individual’s covered spouse, as well) who has reached age 55 before the close of the tax year (and is an eligible HSA contributor) may make additional “catch-up” contributions for 2023 of up to $1,000 (unchanged from the 2022 amount).

Employer contributions

If an employer contributes to the HSA of an eligible individual, the employer’s contribution is treated as employer-provided coverage for medical expenses under an accident or health plan. It’s also excludable from an employee’s gross income up to the deduction limitation. Funds can be built up for years because there’s no “use-it-or-lose-it” provision. An employer that decides to make contributions on its employees’ behalf must generally make comparable contributions to the HSAs of all comparable participating employees for that calendar year. If the employer doesn’t make comparable contributions, the employer is subject to a 35% tax on the aggregate amount contributed by the employer to HSAs for that period.

Making withdrawals

HSA withdrawals (or distributions) can be made to pay for qualified medical expenses, which generally means expenses that would qualify for the medical expense itemized deduction. Among these expenses are doctors’ visits, prescriptions, chiropractic care and premiums for long-term care insurance.

If funds are withdrawn from the HSA for other reasons, the withdrawal is taxable. Additionally, an extra 20% tax will apply to the withdrawal, unless it’s made after reaching age 65, or in the event of death or disability.

HSAs offer a flexible option for providing health care coverage and they may be an attractive benefit for your business. But the rules are somewhat complex. Contact us if you have questions or would like to discuss offering HSAs to your employees.

© 2022

When new technologies emerge, it can take time for the general public to learn how they work. Non-fungible tokens, or NFTs, first appeared in 2014, yet many people are still confused about what they are and how to buy and store them. This gives criminals who understand the technology an advantage. In addition to money laundering, tax evasion and terrorist funding, NFTs are being used to commit fraud and steal from unsuspecting asset buyers. For example, more than $100 million in NFTs was stolen between July 2021 and July 2022, according to analytics company Elliptic.

Snapshot view

In their simplest form, NFTs are immutable digital assets — often related to art, sports, music, digital culture and avatars — linked to the blockchain, the digital ledger used to support cryptocurrencies. Many artists sell unique pieces in the form of NFTs. And one of the best known NFTs is Twitter founder Jack Dorsey’s first tweet, which was sold in 2021 for $2.9 million.

The blockchain enables NFT creators and owners to establish and maintain a digital certificate of authenticity. Most NFT buyers pay with cryptocurrency on the Ethereum network and use a digital wallet to store NFT assets. But there’s no guarantee NFTs will retain their value. When the buyer of the Jack Dorsey tweet tried to flip it in 2022, the highest bid he received was $277.

Where criminals come in

Not surprisingly, there’s plenty of opportunity for fraud on the NFT market. The following are some of the more common schemes buyers should watch out for:

Counterfeits. Some criminals create NFTs using intellectual property that doesn’t belong to them. When it becomes apparent an NFT is counterfeit, its resale value plummets. There’s no recourse for the buyer because cryptocurrency transactions provide sellers with anonymity.

“Free” assets. Scammers might offer a free NFT for signing up for a new website or service. To facilitate the NFT transfer, the mark is told to provide crypto wallet information. Criminals then use that information to steal the wallet’s contents.

Fake marketplaces. Here, fraudsters create websites that look like well-known NFT marketplaces. Users enter their login credentials and receive error messages. Behind the scenes, fraudsters use the newly acquired login data to raid the user’s real account and take control of their digital wallets.

Rug pulls. Dishonest creators might promote a forthcoming NFT via social media, generating interest that pushes up the asset’s bid price. Once buyers pay for the NFT, the promoters disappear, causing the digital asset to plunge in value.

Pump and dump. Similar to “rug pulls” and stock pump-and-dumps, this scheme drives up the price of otherwise valueless NFTs using hype and deception. Co-conspirators help boost prices by buying and selling the NFTs. But once a victim bites, the sellers and co-conspirators disappear and the buyer is left with a worthless asset.

Be careful

As with all financial transactions, exercise caution and skepticism when buying NFTs. Take time to scrutinize your transaction’s details, and if you’re at all suspicious about the legitimacy of the asset or seller, cancel it immediately. Contact us for more information about cryptocurrency and digital asset fraud.

© 2022