Yeo & Yeo Promotes Stephanie Vogel to Director of Human Resources

Yeo & Yeo is pleased to announce Stephanie Vogel’s promotion to Director of Human Resources. Stephanie leads strategic HR initiatives for all four of Yeo & Yeo’s companies, encompassing more than 250 employees. She oversees a dynamic four-person team focused on recruiting, payroll, and HR support.

Yeo & Yeo President & CEO Dave Youngstrom commended Stephanie’s contributions to the firm: “Stephanie has been an exceptional leader. With her forward-thinking mindset, she ensures that our policies and benefits not only prioritize our team’s well-being but also foster their professional growth, making Yeo & Yeo a place where our people are empowered to succeed.”

Since joining the firm in 2021 as Senior Human Resources Manager, Stephanie has been a catalyst for positive change. Under her guidance, Yeo & Yeo has achieved several significant HR milestones. The firm has developed comprehensive career paths for employees, streamlined the new hire onboarding process, and enhanced employee benefits and recognition programs. Additionally, Stephanie has been instrumental in implementing Boon coaching and maintaining the firm’s gold-standard benefits package. Her efforts have contributed to Yeo & Yeo being repeatedly named among Michigan’s Best and Brightest in Wellness, West Michigan’s Best and Brightest Companies to Work For, and Metro Detroit’s Best and Brightest Companies to Work For.

With a Master of Science in Administration from Central Michigan University and credentials such as Society for Human Resource Management Senior Certified Professional (SHRM-SCP), Certified Benefits Professional (CBP), and Certified Compensation Professional (CCP), Stephanie brings a wealth of experience. Her extensive background in HR management equips her to develop and implement firm-wide HR programs and policies that align with Yeo & Yeo’s values and goals.

Stephanie expressed her excitement about contributing to the firm’s ongoing success. “I am excited to expand and drive new projects that further our commitment to a people-first and community-oriented culture at Yeo & Yeo.”

Jim Bellor, CPA, was recently promoted to Senior Manager. Let’s learn about Jim and his perspective on his career, working with clients, and what it takes to be successful in public accounting.

What are your roles in the firm?

I specialize in estate & trusts, individual tax planning and preparation, and family business consulting. By providing personalized solutions, I strive to create tailored estate plans, optimize tax strategies, and offer guidance on succession planning and financial management for businesses and individuals. I am passionate about staying updated on industry trends and regulations so that I can deliver the best solutions to my clients to help them meet their goals.

Describe your career path.

I graduated from Northwood University in May of 2013. Shortly after, I started my career working for a financial firm as a tax specialist. I worked for a few other companies before finding Yeo & Yeo in October 2020. Since then, I have really enjoyed getting to know our clients and attending events in the Midland community, including those hosted by the Midland Young Professionals and the Midland Business Alliance.

What do you enjoy most about your career?

I enjoy the value-added skillset a CPA brings to the table. I am passionate about being a trusted advisor, working closely with individuals from diverse backgrounds to address their unique needs. I also enjoy building strong relationships with my clients.

What’s the biggest factor that has helped you be successful?

On the day-to-day, calendar management has been key for me. In this profession, it can be easy to get caught up in busy season, but I have learned to set time aside on my calendar for me and my family. That has really helped me maintain a good work-life balance. Looking at the bigger picture, I have always been driven to put my best foot forward and give my all in everything I do. Whether at home or work, I want to give 100 percent and be the best version of myself I can be. That mindset has really helped me in my career throughout the years.

What do you enjoy most about working with clients?

Whether it is a long-term client relationship or a new business owner, seeing businesses grow and clients use your recommendations to meet their goals is very rewarding.

When did you know you wanted to be a CPA, and why did you gravitate toward this profession?

I knew I wanted to become a CPA when I took my first accounting class in the spring of 2010. Not only did I do well, but I really enjoyed it. One class and that was it. I knew I wanted to be an accountant. I’m really thankful that I discovered my passion so early on.

What advice do you have for those considering a career in public accounting?

Talk to your professors and get their insight on public accounting and their experiences. See if they have any connections with accounting firms in your area and start building a network with people at those firms. Apply for internships to gain first-hand experience. Chances are, if you enjoy your internship, you will enjoy a career in accounting. I also recommend getting the CPA exam out of the way as soon as possible.

What are your hobbies or interests outside of accounting?

I enjoy the outdoors – camping, golfing, and doing any kind of outdoor activity. Especially in Michigan, where the summers are short, I always try to make the most out of the season by getting outside as much as possible.

It’s perhaps strange to think that, if one used the word “hybrid” in 2019, it usually referred to a gas/electric vehicle or a breed of exotic pet. Now, in the post-pandemic world, the word usually brings to mind “hybrid work” — the once-outrageous notion of employees working in the office on some days and at home on others.

Indeed, hybrid work is a practice that has caught on. In March 2023, global employment law firm Littler Mendelson released The Littler Annual Employer Survey Report. Its data is based on a survey of 515 in-house lawyers, executives and HR staffers from a wide range of industries and companies. The report found that 71% of U.S. employers intend to continue offering hybrid work arrangements this year.

Trouble at home

However, not all the data coming out about hybrid work is positive. In May 2023, child-care provider Bright Horizons published its 9th Annual Modern Family Index. The report’s findings are based on a survey of more than 2,000 U.S. adults who are employed with children under 18.

On the one hand, about 58% of respondents said that schedule flexibility (including hybrid) contributes to them feeling more fulfilled at their current job than they did three years ago. But survey participants also noted that remote/hybrid work is causing them to feel more isolated. According to the report, about 47% said they talk to only people in their own households, and 41% reported going days without leaving their homes. Such factors could have long-term implications on the mental health of hybrid workers.

Potential risks

As the data comes in and employers gain experience with hybrid work, potential downsides are emerging. It’s important to identify the risks and determine whether and how they might apply to your organization. These may include:

Employees feeling disconnected. As revealed by the Bright Horizons report, many employees struggle with isolation, as well as the lack of in-person supervision and interaction with colleagues, while working largely from home. To mitigate this risk, many employers are moving away from a “DIY” approach and toward mandated/scheduled days on-site. To the extent feasible, work on those days should focus on collaboration and training rather than tasks that can be performed alone and remotely.

Too much distance between supervisors and staff members. Supervisors may need training on how to manage in a hybrid environment. Even if you’ve provided training in the past, additional sessions may be in order if your hybrid work arrangements have changed over time. Employees, in turn, could benefit from coaching on how to create and nurture productive relationships with supervisors as well as how to avoid the pitfalls of remote work.

Problems with organizational culture. Many organizations have varying degrees of hybrid work, with some employees not working remotely at all. This can lead to resentment and confusion. For example, in-office workers might believe — usually wrongly, according to many studies — that their remote counterparts aren’t working as hard. And new employees may find it difficult to form connections with colleagues.

Devote some time and resources to identifying your organizational culture and cultivating a positive, productive version of it. An employee survey can help determine whether issues exist and, if so, what they are. Team-building initiatives can help bring staff together.

A moving target

For many employers, hybrid work is probably here to stay. But these arrangements are turning out to be moving targets that call for regular reassessment and occasional adjustment. Our firm can help you identify and track productivity and turnover metrics that offer key insights into what’s right for your organization.

© 2023

It’s common for high-growth and seasonal businesses to have occasional shortfalls in their checking accounts. The reason relates to the cash conversion cycle — that is, it takes time to collect on customer invoices. In the meantime, of course, employees and suppliers want to get paid. The “cash gap” is currently getting wider for many companies. A recent study by CFO / The Hackett Group shows that the cash conversion cycle increased from 35.2 days in 2021 to 36.4 days in 2022. To add insult to injury, interest rates and many operational costs are rising.

Fortunately, when cash is tight, small business owners can sometimes turn to receivables for relief. Here are some strategies for converting outstanding invoices into fast cash to pay bills.

Applying for a line of credit

A line of credit can be collateralized by unpaid invoices, just like you pledge equipment and property for conventional term loans. Banks typically charge fees and interest for securitized receivables. Each financial institution sets its own rates and conditions, but these arrangements generally provide immediate loans for up to 90% of the value of an outstanding debt and are typically repaid as customers pay their bills.

For example, a custom manufacturer had difficulty making payroll after two of its large clients delayed payment on outstanding invoices. A local bank gave the company a line of credit for $80,000. To secure the loan, the company was required to put up $100,000 in unpaid invoices as collateral and then repay the loan, plus fees and interest, once customers remitted payments.

Factoring receivables

Factoring is another option for companies that want to monetize uncollected receivables. Here, receivables are sold to a third-party factoring company for immediate cash.

Beware: Costs associated with receivables factoring can be much higher than those for collateral-based loans. And factoring companies are likely to scrutinize the creditworthiness of your customers. But selling receivables for upfront cash may be advantageous, especially for smaller businesses, because it reduces the burden on accounting staff and saves time.

For instance, a wholesaler faced cash flow issues because customers were paying bills between 60 and 90 days after issuance. As a result, the owner used a high-interest-rate credit card to make payroll and spent at least three days a month chasing down late bills. So, the owner sold off roughly $200,000 of the company’s annual receivables to an online factoring firm. This saved the company hundreds of personnel hours annually and allowed it to stop building up high-rate credit card interest expenses, while considerably easing cash flow concerns.

We can help

Before monetizing receivables, banks and factoring companies will ask for a receivables aging schedule — and most won’t touch any receivable that’s over 90 days outstanding. Before you write off your stale receivables, call customers and ask what’s happening. Sometimes you might be able to negotiate a lower amount — this might be better than nothing if your customer is facing bankruptcy. If all else fails, you might consider a commission-based collection agency or collection attorney.

Contact us to discuss your delinquent accounts receivable and other cash flow concerns. We can help you find creative solutions to convert receivables into fast cash.

© 2023

If philanthropy is an important part of your legacy, consider taking steps to ensure that your donations are used to fulfill your intended charitable purposes. Indeed, outright gifts can be risky, especially large donations that will benefit a charity over a long period of time.

Add restrictions to your gifts

Even if a charity is financially sound when you make a gift, there are no guarantees that it won’t suffer financial distress, file for bankruptcy protection or even cease operations down the road. The last thing you want is for a charity to use your gifts to pay off its creditors or for some other purpose unrelated to the mission that inspired you to give in the first place.

One way to help preserve your charitable legacy is to place restrictions on the use of your gifts. For example, you might limit the use of your funds to assisting a specific constituency or funding medical research. These restrictions can be documented in your will or charitable trust or in a written gift or endowment fund agreement.

Depending on applicable federal and state laws and other factors, carefully designed restrictions can prevent your funds from being used to satisfy creditors in the event of the charity’s bankruptcy. If these restrictions are successful, the funds will continue to be used according to your charitable intent, either by the original charity (in the case of a Chapter 11 reorganization) or by an alternate charity (in the case of a Chapter 7 liquidation).

Research potential charities

In addition to restricting your gifts, research the charities you’re considering to help ensure that they’re financially stable and use their funds efficiently and effectively. One powerful research tool is the IRS’s Tax Exempt Organization Search (TEOS), found at https://bit.ly/43MVQ3e. TEOS provides access to information about charitable organizations, including newly filed tax returns (Forms 990), IRS determination letters and eligibility to receive tax-deductible contributions.

If you’d like to incorporate charitable giving into your estate plan, please contact us. We can explain your options.

© 2023

Yeo & Yeo, a leading Michigan-based accounting and advisory firm, has been named one of the 2023 Metro Detroit’s Best and Brightest Companies to Work For for the twelfth consecutive year.

The Best and Brightest programs recognize organizations for their commitment to excellence in human resources practices and employee engagement. It celebrates companies that go above and beyond to foster a positive work environment, nurture talent, and empower employees to thrive both personally and professionally.

Yeo & Yeo’s culture is one of learning, growth and purpose. The firm offers an award-winning CPA certification bonus program, an award-winning wellness program, gold-standard benefits, year-round training opportunities, and a flexible work environment that includes hybrid and remote work capabilities. Yeo & Yeo is also dedicated to giving back to the community through the Yeo & Yeo Foundation, an employee-sponsored organization that is a channel for giving time, talent and financial support to charitable causes throughout Michigan. The firm prioritizes employee appreciation, hosting company-wide events, including Detroit Tigers trips, gifting branded swag and promoting work-life balance through initiatives like half-day summer Fridays.

Yeo & Yeo’s culture is one of learning, growth and purpose. The firm offers an award-winning CPA certification bonus program, an award-winning wellness program, gold-standard benefits, year-round training opportunities, and a flexible work environment that includes hybrid and remote work capabilities. Yeo & Yeo is also dedicated to giving back to the community through the Yeo & Yeo Foundation, an employee-sponsored organization that is a channel for giving time, talent and financial support to charitable causes throughout Michigan. The firm prioritizes employee appreciation, hosting company-wide events, including Detroit Tigers trips, gifting branded swag and promoting work-life balance through initiatives like half-day summer Fridays.

At the heart of Yeo & Yeo is its exceptional team of professionals. They have consistently delivered outstanding client service, helping Yeo & Yeo build enduring relationships and establish itself as a trusted partner in the community.

“We are immensely proud of our talented team members who contribute their skills, expertise, and dedication to Yeo & Yeo,” added Thomas O’Sullivan, managing principal of the Ann Arbor office. “Our people have been the driving force behind the firm’s success for the last 100 years, and we are dedicated to creating a work environment where they can thrive.”

“Our people are our most valuable asset, and their passion, knowledge, and innovative thinking are what set us apart in the industry,” added Tammy Moncrief, managing principal of the Auburn Hills office. “It’s because of their work that we continue to be recognized as a Best and Brightest company.”

To truly appreciate the incredible impact the team members have on Yeo & Yeo’s success, we invite you to watch this video. It provides insight into the work Yeo & Yeo does and the positive difference the firm makes in the lives of its clients.

If you own or manage a business with employees, there’s a harsh tax penalty that you could be at risk for paying personally. The Trust Fund Recovery Penalty (TFRP) applies to Social Security and income taxes that are withheld by a business from its employees’ wages.

Sweeping penalty

The TFRP is dangerous because it applies to a broad range of actions and to a wide range of people involved in a business.

Here are some answers to questions about the penalty:

What actions are penalized? The TFRP applies to any willful failure to collect, or truthfully account for, and pay over taxes required to be withheld from employees’ wages.

Why is it so harsh? Taxes are considered the government’s property. The IRS explains that Social Security and income taxes “are called trust fund taxes because you actually hold the employee’s money in trust until you make a federal tax deposit in that amount.”

The penalty is sometimes called the “100% penalty” because the person found liable is personally penalized 100% of the taxes due. The amounts the IRS seeks are usually substantial and the IRS is aggressive in enforcing the penalty.

Who’s at risk? The penalty can be imposed on anyone “responsible” for collecting and paying tax. This has been broadly defined to include a corporation’s officers, directors and shareholders, a partnership’s partners and any employee with related duties. In some circumstances, voluntary board members of tax-exempt organizations have been subject to this penalty. In other cases, responsibility has been extended to professional advisors and family members close to the business.

According to the IRS, responsibility is a matter of status, duty and authority. Anyone with the power to see that taxes are (or aren’t) paid may be responsible. There’s often more than one responsible person in a business, but each is at risk for the entire penalty. You may not be directly involved with the payroll tax withholding process in your business. But if you learn of a failure to pay withheld taxes and have the power to pay them, you become a responsible person. Although taxpayers held liable can sue other responsible people for contribution, this action must be taken entirely on their own after the TFRP is paid.

What’s considered willful? There doesn’t have to be an overt intent to evade taxes. Simply paying bills or obtaining supplies instead of paying over withheld taxes is willful behavior. And just because you delegate responsibilities to someone else doesn’t necessarily mean you’re off the hook. Failing to do the job yourself can be treated as willful.

Recent cases

Here are two cases that illustrate the risks.

- A U.S. Appeals Court held a hospital administrator liable for the TFRP. The administrator was responsible for payroll, as well as signing and reviewing checks. She also knew that the financially troubled hospital wasn’t paying withheld taxes to the IRS. Instead of prioritizing paying taxes, she paid vendors and employees’ wages. (Cashaw, CA 5, 5/31/23)

- A corporation owner’s daughter/corporate officer was assessed a $680,472 TFRP for unpaid payroll taxes. She argued that she wasn’t a responsible party. She owned no stock and couldn’t hire and fire employees. But she did have the power to write checks and pay vendors and was aware of the unpaid taxes. A U.S. Appeals Court found the “great weight of evidence” indicated she was a responsible party and the TFRP was upheld. (Scott, CA 11, 10/31/22)

Best advice

Under no circumstances should you “borrow” from withheld amounts. All funds withheld should be paid over to the government on time. Contact us with any questions.

© 2023

While the value of virtual currency continues to fluctuate, the IRS’s interest in it has only increased. In 2021, for example, the agency launched Operation Hidden Treasure to root out taxpayers who don’t report income from cryptocurrency transactions on their federal income tax returns.

Moreover, the Inflation Reduction Act, enacted in 2022, allocated $80 billion to the IRS, with much of it designated for enforcement activities. However, the Fiscal Responsibility Act, enacted in May 2023, will claw back $21.39 billion of that amount by the end of 2025. The IRS’s strategic operating plan for 2023 through 2031 lays out the agency’s intention to ramp up enforcement related to digital assets. If you buy, sell or otherwise engage in transactions involving virtual currency, you need to stay up to date with the latest tax developments.

Terminology

The IRS defines a “virtual asset” as any virtual representation of value that’s recorded on a cryptographically secured distributed ledger or similar technology. The term includes:

- Convertible virtual currency (meaning it has an equivalent value in real currency or acts as a substitute for real currency) such as Bitcoin,

- Stablecoins (a type of currency whose value is tied to the value of another asset, such as the U.S. dollar), and

- Non-fungible tokens (NFTs).

According to the IRS, cryptocurrency is an example of a convertible virtual currency that can be used as a payment for goods and services, digitally traded between users, and exchanged for or into real currencies or digital assets. Cryptocurrency uses cryptography to secure transactions that are digitally recorded on a distributed ledger (for example, blockchain).

Taxation of transactions

For federal tax purposes, digital assets are treated as property. Thus, transactions involving virtual currency are subject to the same general tax rules that apply to property transactions, such as purchases and sales of stock or real estate.

Several types of virtual currency transactions can trigger reporting obligations, including:

Sales. If you sell virtual currency, you must recognize any capital gain or loss on the sale, subject to any limitations on the deductibility of capital losses. The gain or loss equals the difference between your adjusted tax basis in the currency and the amount you receive for it. You should report the amount you receive on your federal income tax return in U.S. dollars (see below for more information on reporting obligations).

Your basis is the amount you spent to acquire the virtual currency, including fees, commissions and other costs. Your adjusted basis is your basis increased by certain expenditures and reduced by certain deductions or credits.

Property exchanges. If you exchange virtual currency that you hold as a capital asset for other property (including goods or other digital assets), you must recognize a capital gain or loss. The gain or loss is the difference between the fair market value (FMV) of the property you receive and your adjusted tax basis in the virtual currency. If, as part of an arm’s length transaction, you transfer a digital asset and receive other property in exchange, your tax basis in the property you receive is its FMV at the time of the exchange.

Payment for services. If you receive virtual currency for performing services — regardless of whether you perform the services as an employee or an independent contractor — you recognize the FMV of the currency when received as ordinary income. The FMV will also be your tax basis in that asset.

On the flip side, if you pay for a service using virtual currency that you hold as a capital asset, you’ve exchanged a capital asset for the service and will have a capital gain or loss. In addition, the FMV of virtual currency that’s paid as wages, at the date of receipt, is subject to federal income tax withholding, Federal Insurance Contributions Act (FICA) tax and Federal Unemployment Tax Act (FUTA) tax. It also must be reported on Form W-2, “Wage and Tax Statement.”

Reporting obligations

You may have noticed a new line on your individual federal income tax return in recent years. The 2022 version asks:

“At any time during 2022, did you: (a) receive (as a reward, award or payment for property or services); or (b) sell, exchange, gift or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

If you answer “yes,” you must report all related income, whether as income, a capital gain or loss, or otherwise (for example, as a gift).

The Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, created additional new reporting requirements for digital asset transactions. These provisions were enacted with an eye toward generating additional tax revenues to help fund infrastructure projects. The requirements provide the IRS with more information to work from and establish more potential compliance tripwires for taxpayers who engage in virtual currency transactions.

The IIJA expanded the definition of brokers that are required to report their customers’ gains and losses on the sale of securities during the tax year to the IRS on Form 1099-B, “Proceeds from Broker and Barter Exchange Transactions.” The form generally requires a description of each sale, the cost basis, the acquisition date and price, the sale date and price, and the resulting short- or long-term gain or loss.

Under the IIJA, operators of trading platforms for digital assets, such as cryptocurrency exchanges, are subject to the same reporting requirements as traditional securities brokers. The effective date remains to be seen, though, as the IRS hasn’t yet issued final regulations with instructions. After the new rules take effect, cryptocurrency platforms will need to collect Form W-9, “Request for Taxpayer Identification Number and Certification,” from their customers.

The IIJA also amended existing anti-money laundering laws to treat digital assets as cash for purposes of those laws. As a result, beginning in 2023, businesses must report to the IRS when they receive more than $10,000 in digital assets in one transaction or multiple related transactions.

Such transactions should be reported on IRS Form 8300, “Report of Cash Payments Over $10,000 Received in a Trade or Business.” To complete the form, a business will need to gather the name, address and taxpayer identification number, among other information, from the payer. Failure to comply may lead to significant civil and criminal penalties.

Enforcement tool

One way the IRS may uncover digital assets is through the use of a “John Doe summons.” The U.S. Department of Justice notes that “because transactions in cryptocurrencies can be difficult to trace and have an inherently pseudo-anonymous aspect, taxpayers may be using them to hide taxable income from the IRS.” By asking a court to serve a John Doe summons on a crypto dealer or exchange, the IRS can find out information about a person’s account.

In one recent case, an individual challenged the IRS’s use of a summons to obtain his account information from a virtual currency exchange. He argued it was unconstitutional. A U.S. District Court disagreed and ruled that the IRS’s actions “fall squarely” within its powers to pursue unpaid taxes. (Harper, DC NH, 5/26/23)

An evolving area

With its new infusion of enforcement funding, the IRS’s focus on virtual currency transactions is likely to intensify. We’ll help you stay in compliance with the applicable rules and requirements.

© 2023

Expanding operations into foreign countries can help U.S. businesses reduce labor and operating costs. It can also provide them with access to new markets and potentially higher profits. You may be attracted to a country by a plentiful labor supply, significant tax benefits or government incentives. But, beware: Some foreign business environments present serious fraud risks. Before you make the decision to cross borders, familiarize yourself with the country’s culture and laws.

Threats everywhere

Corruption is a business risk in every country, but in some countries, it’s omnipresent. For example, if you want to build a factory, you could encounter officials who expect gifts to “grease the wheels” or local politicians who are accustomed to excessive wining and dining in exchange for their cooperation. If you import or export goods, customs officials might solicit bribes to process shipments faster.

Other common fraud risks can involve:

Hiring employees. You could face pressure to hire friends, family members and associates of government decision-makers. These job candidates may be unqualified for open positions and you might be pressured to pay them above-market rates so that they can give the official who “recommended” them a kickback.

Cybersecurity. Hacking is particularly common when businesses employ individuals who don’t understand or simply don’t follow cybersecurity best practices. Not only can a cyberattack harm overseas operations, but once criminals compromise that system, they can use the knowledge to attack your other IT assets.

Intellectual property (IP). Some countries provide only limited legal protection of IP — or may not enforce laws that are on the books. This means rival companies could use your logo, patents, trade secrets and other IP without approval. Litigation can be expensive and claims may be difficult to prove. To make matters worse, if you do attempt to sue, a foreign legal system could treat U.S.-headquartered businesses differently from locally owned companies.

Banking. Large financial institutions generally have people, processes and technology to prevent fraud. But smaller banks in a foreign country may struggle to prevent sophisticated fraud schemes. This can result in thieves gaining access to your business accounts.

5 steps

For many businesses, the benefits of operating across borders outweigh the fraud risks. Even if, after performing a risk/benefit assessment, you decide to go ahead and establish foreign operations, take these five steps to minimize fraud exposure:

- Engage legal and accounting professionals who have clients and contacts in your destination country to inform you about the culture, business practices, politics, labor situation and regulatory environment.

- Identify the fraud risks you’ll likely face and evaluate the effectiveness of your internal controls when confronted with them. Once you’re up and operating, add or revise controls as necessary.

- Conduct thorough due diligence on all potential suppliers, business partners and major customers in the country before giving them your money, products or trust.

- Develop hiring policies and programs for foreign-based employees, including antifraud training. Make sure your employee handbook specifies activities (such as accepting bribes) that will result in termination.

- Scrutinize your IT and data security defenses and work with professionals to remediate any shortcomings.

Of course, every country has a unique set of fraud risks. You’re likely to find operating environments most similar to that of the United States in counties such as Canada, Australia, Japan, the U.K. and in the European Union. In developing countries, authorities may be more willing to turn a blind eye to corruption and courts may not be as friendly to the interests of businesses and business owners.

Don’t let it deter you

From bribery and kickbacks to cybercrime and IP theft, there are probably going to be new fraud risks if you decide to operate abroad. These risks shouldn’t necessarily deter your business expansion plans. But you should invest in additional internal controls, ramp up due diligence and work with knowledgeable advisors. Contact us for more information and advice.

© 2023

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

July 31

- Report income tax withholding and FICA taxes for second quarter 2023 (Form 941) and pay any tax due. (See the exception below, under “August 10.”)

- File a 2022 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension.

August 10

- Report income tax withholding and FICA taxes for second quarter 2023 (Form 941), if you deposited on time and in full all of the associated taxes due.

September 15

- If a calendar-year C corporation, pay the third installment of 2023 estimated income taxes.

- If a calendar-year S corporation or partnership that filed an automatic six-month extension:

- File a 2022 income tax return (Form 1120-S, Form 1065 or Form 1065-B) and pay any tax, interest and penalties due.

- Make contributions for 2022 to certain employer-sponsored retirement plans.

© 2023

If your profitable business has trouble making ends meet, it’s not alone. Many business owners mistakenly equate profits with cash flow, leading to shortfalls in the checking account. The truth is that there are many reasons these numbers might differ.

Fluctuations in working capital

Profits (or pretax earnings) are closely related to taxable income. Reported at the bottom of your company’s income statement, they’re essentially the result of revenue earned minus operating expenses incurred in the accounting period. Under U.S. Generally Accepted Accounting Principles (GAAP), companies must “match” costs and expenses to the period in which the related revenue is earned. It doesn’t necessarily matter when you pay for a product or service.

So, inventory items that are in progress or are completed but haven’t yet been sold can’t be deducted — even if they’ve been long paid for (or financed). The cost hits your income statement only when an item is sold or used. Your inventory account contains many cash outflows that are waiting to be expensed.

Other working capital accounts — such as receivables, accrued expenses and payables — also represent a difference between the timing of cash outflows and the matching of expenses to sales. As businesses grow and prepare for increasing future sales, they need to invest more in working capital, which temporarily depletes cash.

Capital expenditures and financing transactions

Working capital tells only part of the story, however. Your income statement also includes depreciation and amortization, which are noncash expenses. And it excludes capital expenditures and financing, which both affect your cash on hand.

To illustrate, suppose your company purchased a new piece of equipment in 2022. Expanded bonus depreciation and Section 179 allowances permitted your company to immediately deduct the purchase price of the equipment, which lowered its taxable income for 2022. After making a modest down payment, the remaining amount of the purchase was financed with debt, so actual cash outflows from the investment were minimal in 2022. Throughout 2023, your company has been making loan payments, and the principal repayment portion of these payments reduced the company’s checking account balance but not its profits.

Capital contributions, dividends and stock repurchases

You also can link discrepancies between profits and cash flow to owners’ equity accounts. For example, owners might pay out dividends based on their personal financial needs, regardless of whether the business is profitable.

Dividends (or distributions) paid to owners lower cash on hand, but they have no effect on the profits reported on the company’s income statement. Likewise, additional capital contributions and stock repurchases will hit the company’s checking account without affecting profits.

Efficient cash flow management

It’s important for business owners to understand the key differences between profits and cash flow. Some growing, profitable companies will experience cash shortages. And some mature “cash cows” will have ample cash on hand, despite lackluster revenue growth. If your business is facing a cash crunch, contact us for help devising strategies to improve cash flow. We can help your business pay its bills on time and find resources to seize value-building opportunities.

© 2023

For employers of all sizes, choosing an affordable yet fully featured health plan to sponsor for employees isn’t easy. And yet, for most organizations, it’s an imperative.

Under the Affordable Care Act, employers with 50 or more full-time or full-time-equivalent employees must offer a health plan that meets certain standards or face a financial penalty. Organizations with fewer than 50 such employees can choose not to offer health insurance, but most find that a strong benefits package, which includes health coverage, is necessary for attracting and retaining talent.

Whether your organization is choosing a plan for the first time or looking to change its coverage, affordability will no doubt be a concern. However, be careful about picking the cheapest plan without studying the details. Many are inexpensive for a reason. Here are some basic factors to consider when evaluating affordable health coverage.

Fully insured vs. self-funded

A fully insured health plan is one you buy from an insurance company. This is the most common plan for small to midsize employers because it limits your financial risk while offering the most predictable costs.

Alternatively, with a self-funded plan, your organization funds and administers the insurance — often with the help of a third-party administrator. This approach can save money under some circumstances. However, you assume financial risk for the plan and costs can be unpredictable.

Size and structure of network

The size of the plan’s network influences how many options your employees will have when picking their care and how much they’ll pay out of pocket. A smaller network of preferred providers often grants the most coverage with lower out-of-pocket costs for employees when they visit those providers. Participants can typically still pick out-of-network services, but they’ll usually pay more out of pocket. Rightsizing your network is critical to participant satisfaction.

Tax-advantaged accounts

Although technically not insurance, Health Savings Accounts (HSAs), which must be offered in conjunction with a high-deductible health plan, and Flexible Spending Accounts (FSAs) can be strong additions to a benefits package.

HSAs and FSAs let employees set aside pretax dollars from their paychecks to use for eligible medical expenses. HSA funds remain in your account until you use them, while FSA dollars typically must be spent within the year or lost (though a plan can provide for a grace period of up to 2½ months after the end of the plan year). A third option is a Health Reimbursement Arrangement (HRA). This is an employer-funded plan under which participants submit out-of-pocket medical expenses, such as deductibles or copays, for tax-free reimbursement.

Government assistance

If your organization happens to be considered a small business for health insurance purposes, you may want to check out the Small Business Health Options Program (SHOP). This federal marketplace is designed for small-business owners looking for health care plans. To qualify, a company typically must:

- Have one to 50 employees,

- Provide health benefits to all staffers working 30 or more hours per week,

- Reach plan enrollment of at least 70% of employees, and

- Maintain an office or have an employee in the state of the SHOP used.

Every state runs its own SHOP marketplace, but they’re similar.

What you really need

Before you choose or switch coverage, it’s a good idea to survey your staff to determine which health plan features they most value. You also might want to engage an insurance broker to help you shop for a plan that best suits your needs and budget. Contact us for help assessing the costs and tax impact of any employer-sponsored benefit.

© 2023

For 2023, the federal gift and estate tax exemption amount stands at $12.92 million ($25.84 million for married couples). But without action from Congress, on January 1, 2026, it’s scheduled to drop to only $5 million ($10 million for married couples). Based on current estimates, those figures are expected to be adjusted for inflation to a little over $6 million and $12 million, respectively.

If you expect your estate’s worth to exceed those estimated 2026 exemption amounts, consider implementing planning techniques today that may help reduce or avoid gift and estate tax liability down the road. One such technique is a spousal lifetime access trust (SLAT). Under the right circumstances, a SLAT allows you to remove significant wealth from your estate tax-free while providing a safety net in the event your needs change in the future.

SLAT basics

A SLAT is an irrevocable trust that permits the trustee to make distributions to your spouse, during his or her lifetime, if a need arises. Typically, SLATs are designed to benefit your children or other heirs, while paying income to your spouse during his or her lifetime.

You can make completed gifts to the trust, removing those assets from your estate. But you continue to have indirect access to the trust by virtue of your spouse’s status as a beneficiary. Usually, this is accomplished by appointing an independent trustee with full discretion to make distributions to your spouse.

Beware of potential pitfalls

SLATs must be planned and drafted carefully to avoid unwanted consequences. For example, to avoid inclusion of trust assets in your spouse’s estate, your gifts to the trust must be made with your separate property. This may require additional planning, especially if you live in a community property state. And after the trust is funded, it’s critical to ensure that the trust assets aren’t commingled with community property or marital assets.

It’s important to keep in mind that a SLAT’s benefits depend on indirect access to the trust through your spouse, so your marriage must be strong for this strategy to work. There’s also a risk that you’ll lose the safety net provided by a SLAT if your spouse predeceases you. One way to hedge your bets is to set up two SLATs: one created by you with your spouse as a beneficiary and one created by your spouse naming you as a beneficiary.

If you and your spouse each establish a SLAT, you’ll need to plan carefully to avoid the reciprocal trust doctrine. Under that doctrine, if the IRS concludes that the two trusts are interrelated and place you and your spouse in about the same economic position as if you had each created a trust for your own benefit, it may undo the arrangement. To avoid this outcome, the trusts’ terms should be varied so that they’re not substantially identical.

Contact us for more information.

© 2023

On July 8, 2022, the Internal Revenue Service issued a revenue procedure (Rev. Proc. 2022-32) that allows certain estates to elect portability of a deceased spousal unused exclusion (DSUE) amount up to five years from the decedent’s date of death. This is an update from a previous revenue procedure that allowed certain estates to elect portability up to two years after the decedent’s date of death. If a deceased taxpayer doesn’t use their entire estate tax exemption, the excess may be made available for the surviving spouse to utilize for their gift and estate transfers through portability. For more information about portability and how it may affect estate taxes, please read our article, Estate Planning Discussion: What Is Portability and How Can It Affect You?

To take advantage of portability, the estate must generally file Form 706, U.S. Estate Tax Return, on a timely basis to make the election. However, if the estate is not otherwise required to file Form 706, this revenue procedure offers a streamlined process to elect portability on a late Form 706, and you now have up to five years to make the election. This election is made by the appointed executor of the decedent’s estate, which may not necessarily be the surviving spouse.

The current estate tax exemption in 2022 is $12,060,000 per person, or $24,120,000 for a married couple. Effective January 1, 2026, the exemption is set to fall to $5,000,000 per individual, or $10,000,000 for a married couple with an adjustment for inflation. By electing portability, the higher exemption will be preserved for the surviving spouse even when the exemption decreases in the future and may result in significant estate tax savings.

Please contact our Yeo & Yeo professionals to discuss how portability may apply to your situation. Our professionals can help you navigate the election, especially in a tax environment with volatile tax law changes.

Yeo & Yeo’s Education Services Group professionals are pleased to present five sessions during the April 27-28 MSBO conference at Amway Grand Plaza and DeVos Place, Grand Rapids. We invite you to join us to gain new insights into managing your Michigan school.

Wednesday, April 27

- Accounting and Auditing Update – 9:20-10:20 a.m.

- Presenters: Michael Evrard & Kristi Krafft-Bellsky

- SKE With District-wide Financials – 10:40-11:40 a.m.

- Presenter: Jennifer Watkins

Thursday, April 28

- Understanding and Completing Your SEFA – 8:20-9:20 a.m.

- Presenters: Kristi Krafft-Bellsky and Kathy Abela from Royal Oak Schools

- Federal Procedures Manual and Policy Writing – 9:40-10:40 a.m.

- Presenters: Jessica Rolfe and Jennifer Watkins

- IT Vendor Fraud – 1:15-1:45 p.m.

- Presenter: Jennifer Watkins

We encourage you to visit our booth for one-on-one conversations with our education professionals. Hope to see you there!

Register and learn more about the MSBO Conference sessions.

The State of Michigan is launching a grant program to distribute up to $409 million of its American Rescue Plan Act funds. The program will support “Afflicted Businesses” – as defined by Public Act 132 of 2021 – that have experienced financial hardship due to the COVID-19 pandemic. The nine eligible business categories include:

- Entertainment Venues

- Recreational Facilities and Public Places of Amusement

- Barbers and Cosmetologists

- Exercise Facilities

- Food Establishments

- Nursery Dealers and Growers

- Athletic Trainers

- Body Art Facilities

- Hotels and Bed & Breakfast Establishments

How do businesses apply?

An online application will open on Tuesday, March 1, at Michigan.gov/abr. Grants will not be based on a first come, first served basis. All applications must be submitted no later than 11:59 p.m. EDT on March 31, 2022.

Information requirements

Businesses will need to complete an online application, provide supporting documents and make a series of certifications. Eligible companies will also need to submit electronically the following:

- Financial Documentation and Information to verify their decline in Michigan total sales from calendar year 2019 to calendar year 2020 for businesses in operation on October 1, 2019.

- Financial Documentation and Information to verify their fixed costs for calendar year 2020 for businesses that were not in operation on October 1, 2019, but started before June 1, 2020.

- Beneficiary Agreement with terms and conditions that has been electronically signed.

For more information on eligibility, requirements and award methodology, please read the Michigan ABR Grant Program Fact Sheet or visit Michigan.gov/abr.

To prevent and detect vendor fraud, first we need to understand what fraud is and why it occurs.

Fraud is a deception that is intentional and caused by an employee or organization for personal gain. In other words, fraud is a deceitful activity used to gain an advantage or generate an illegal profit. Also, the unlawful act benefits the perpetrator and harms other parties involved, such as your school district.

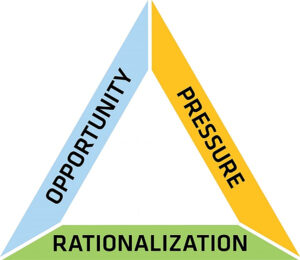

Understanding the fraud triangle provides excellent insight as to why fraud occurs. The fraud triangle is a framework for spotting high-risk fraud situations. The three parts of the fraud triangle are Pressure/Incentive, Opportunity, and Rationalization.

- Pressure/Incentive – Financial hardships, personality changes, living beyond one’s means, outside business interests, unwillingness to share workplace duties, and need to meet budgets/projections.

- Opportunity – Weak internal controls, poor oversight, poor tone at the top, and inadequate accounting policies and procedures.

- Rationalization – I’m underpaid! The boss steals; why not me? It’s just a loan! I volunteer – I deserve something! I am working more and getting paid less! Whatever a person can tell themselves to make it seem okay.

In the fraud triangle, school districts have the most control over opportunity. You can’t control a person’s rationalization or the outside pressures on them; however, you can put controls in place in your district to prevent fraud from occurring.

Common purchasing/vendor frauds that happen at school districts include:

- Fictitious vendors set up by employees

- Use of foodservice supplies for personal catering business

- Purchasing construction supplies for private residence from bond money

- Falsification of records by vendors

- Personal utility bills paid with school district funds

- Approving invoices to pay for goods/services not received

- Bid rigging for a specific vendor

- Collusion with or kickback from a vendor

When it comes to preventing fraud, the best defense is a good offense:

- Solid internal controls that are implemented and followed correctly are the best deterrent to fraud.

- Policies and procedures should be designed to provide reasonable assurance that the school district’s assets are safeguarded against unauthorized use and disposition.

- Internal controls must include segregation of duties, examining supporting documentation before making payment, reconciling bank statements promptly, and safeguarding the school district’s assets.

Segregation of duties is designed to cross-reference each other for accuracy. Giving a single person unquestioned authority over finances is not a wise business practice. Checks and balances help to eliminate the opportunity for fraud and abuse.

Additional prevention and detection techniques include:

- Know your district’s policies and procedures well and make them available and accessible to all employees at the school district.

- Set a strong tone from the top. This is a potent and cheap deterrent to implement. Communicate a policy of zero-tolerance through words and actions. Communicate to employees what constitutes fraud and how it impacts the district. If employees see upper-level management misconduct, they think it is okay for them.

- Establish a vendor code of conduct policy. Place limits on gifts to the school district. Require disclosure of any personal relationships. Ask vendors to sign annually.

- Know your vendor listing and keep it current. Be mindful of new vendors and long-term vendors. Disable all unused vendors.

- Perform walk-throughs of your procurement/payment system from the purchase requisition all the way to receipt of goods and payment to the vendor.

- Randomly select transactions throughout the year and verify all documentation and approvals for purchases are present. Mix up the selections from bids to small purchases and even recurring vendors.

- Implement a fraud hotline/website. Give your employees an outlet to communicate confidentially and reinforce an open-door policy.

- Think like an auditor – be skeptical of transactions! Perform unplanned internal audits on invoice support. Perform research on new vendors. Perform data analysis on your vendor listing.

If you have questions regarding fraud, how to strengthen internal controls, or internal audit procedures you can perform to prevent and detect vendor fraud, please contact your local Yeo & Yeo school district auditor.